- China

- /

- Electrical

- /

- SHSE:603662

Keli Sensing Technology (Ningbo) Co.,Ltd. (SHSE:603662) Doing What It Can To Lift Shares

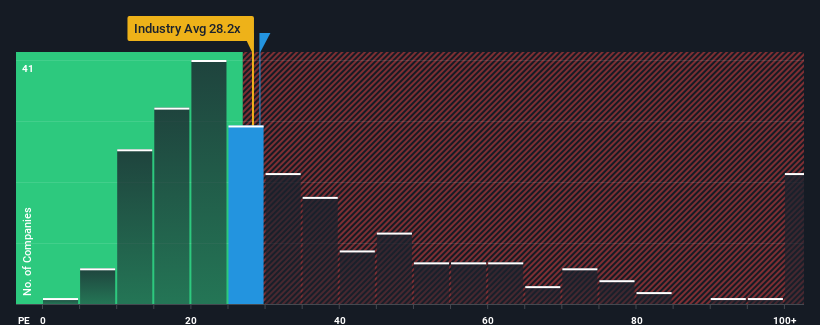

There wouldn't be many who think Keli Sensing Technology (Ningbo) Co.,Ltd.'s (SHSE:603662) price-to-earnings (or "P/E") ratio of 29.2x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Keli Sensing Technology (Ningbo)Ltd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Keli Sensing Technology (Ningbo)Ltd

What Are Growth Metrics Telling Us About The P/E?

Keli Sensing Technology (Ningbo)Ltd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.7% last year. The solid recent performance means it was also able to grow EPS by 6.2% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 51% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

In light of this, it's curious that Keli Sensing Technology (Ningbo)Ltd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Keli Sensing Technology (Ningbo)Ltd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Keli Sensing Technology (Ningbo)Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Keli Sensing Technology (Ningbo)Ltd is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Keli Sensing Technology (Ningbo)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603662

Keli Sensing Technology (Ningbo)Ltd

Engages in the research and development, manufacture, and sale of various types of sensors, weighing indicators, electronic weighing systems, system integration and health scales in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives