Yantai Eddie Precision Machinery Co., Ltd.'s (SHSE:603638) Share Price Not Quite Adding Up

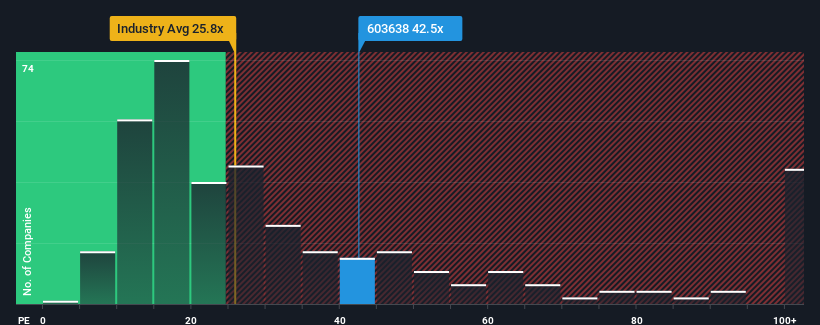

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 25x, you may consider Yantai Eddie Precision Machinery Co., Ltd. (SHSE:603638) as a stock to avoid entirely with its 42.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Yantai Eddie Precision Machinery as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Yantai Eddie Precision Machinery

How Is Yantai Eddie Precision Machinery's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Yantai Eddie Precision Machinery's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 55% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 14% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 23% per annum growth forecast for the broader market.

In light of this, it's alarming that Yantai Eddie Precision Machinery's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Yantai Eddie Precision Machinery's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with Yantai Eddie Precision Machinery.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603638

Yantai Eddie Precision Machinery

Engages in the development, production, and sale of attachments for construction machinery and marines in China.

Adequate balance sheet with acceptable track record.