- China

- /

- Electronic Equipment and Components

- /

- SZSE:300319

Undiscovered Gems on None for January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are buoyed by cooling inflation and robust bank earnings, with major U.S. stock indexes rebounding after recent volatility. This environment has seen value stocks outshine growth shares, particularly within the energy sector, as investors navigate the shifting economic landscape. In such a dynamic market, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth amidst these broader trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Junhe Pumps HoldingLtd (SHSE:603617)

Simply Wall St Value Rating: ★★★★★☆

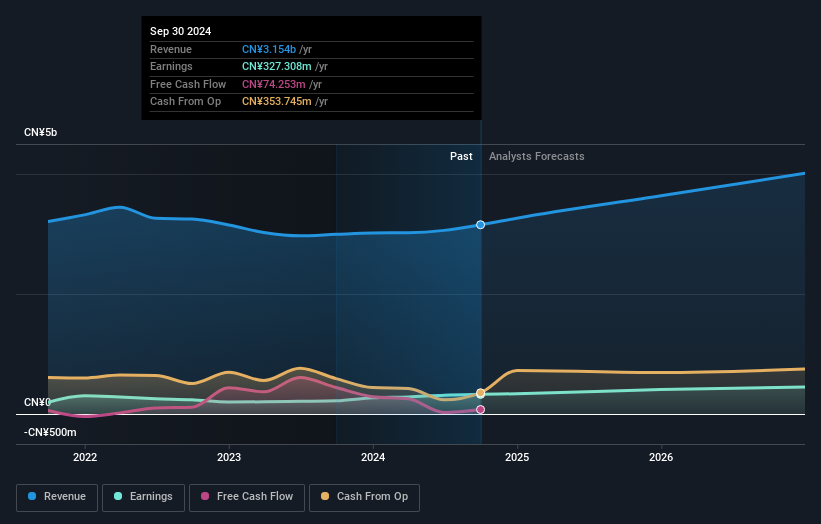

Overview: Junhe Pumps Holding Co., Ltd specializes in the production and sale of household water pumps within China, with a market capitalization of approximately CN¥3.01 billion.

Operations: Junhe Pumps Holding Co., Ltd generates revenue primarily from its machinery segment, specifically household water pumps, totaling approximately CN¥1.07 billion. The company's financial performance is reflected in its market capitalization of about CN¥3.01 billion.

Junhe Pumps, a relatively small player in the industry, has shown impressive earnings growth of 45.5% over the past year, outpacing its sector's -0.2%. The company reported a revenue increase to CNY 847.93 million for the first nine months of 2024 from CNY 492.46 million last year, with net income rising to CNY 61.81 million from CNY 41.31 million. Despite a volatile share price recently and an increased debt-to-equity ratio from 25% to 32% over five years, Junhe possesses more cash than total debt and maintains high-quality earnings with no concern over interest coverage.

- Navigate through the intricacies of Junhe Pumps HoldingLtd with our comprehensive health report here.

Explore historical data to track Junhe Pumps HoldingLtd's performance over time in our Past section.

Shenzhen Microgate Technology (SZSE:300319)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Microgate Technology Co., Ltd. specializes in the production of passive electronic components and has a market capitalization of CN¥10.81 billion.

Operations: Microgate Technology generates revenue primarily from the electronics manufacturing industry, amounting to CN¥3.15 billion.

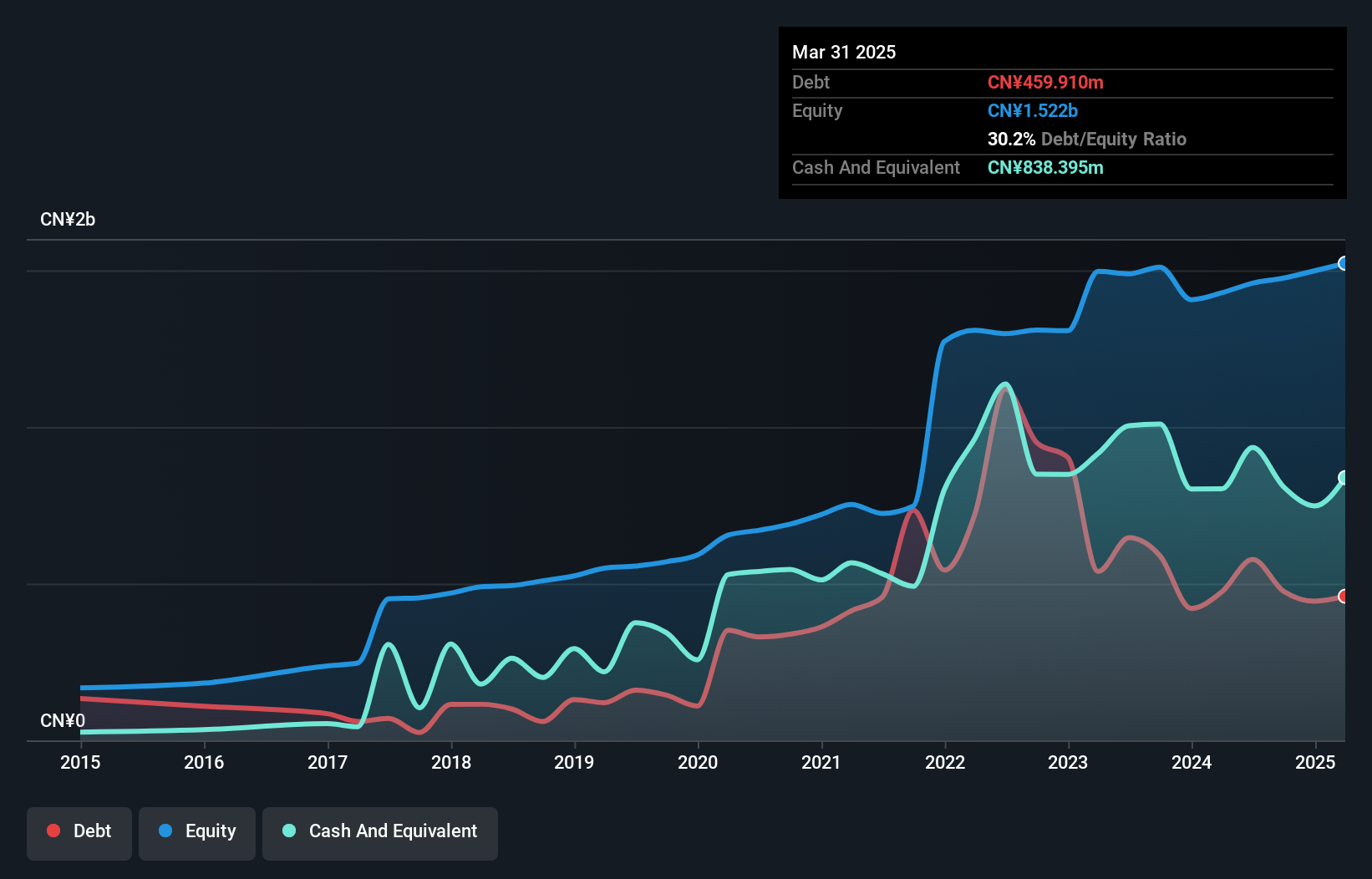

Shenzhen Microgate Technology, a relatively smaller player in the market, has shown promising growth with earnings up by 49% over the past year, outpacing the electronic industry average of 2.3%. The company's debt-to-equity ratio has improved significantly from 22.5% to 6.5% in five years, indicating prudent financial management. Despite a price-to-earnings ratio of 33x being slightly below the CN market average of 34.8x, it suggests potential value for investors seeking growth opportunities. Recent earnings reports highlight net income rising to CNY 241 million from CNY 184 million last year, reflecting ongoing profitability and operational efficiency improvements.

Ningbo BaoSi Energy Equipment (SZSE:300441)

Simply Wall St Value Rating: ★★★★★☆

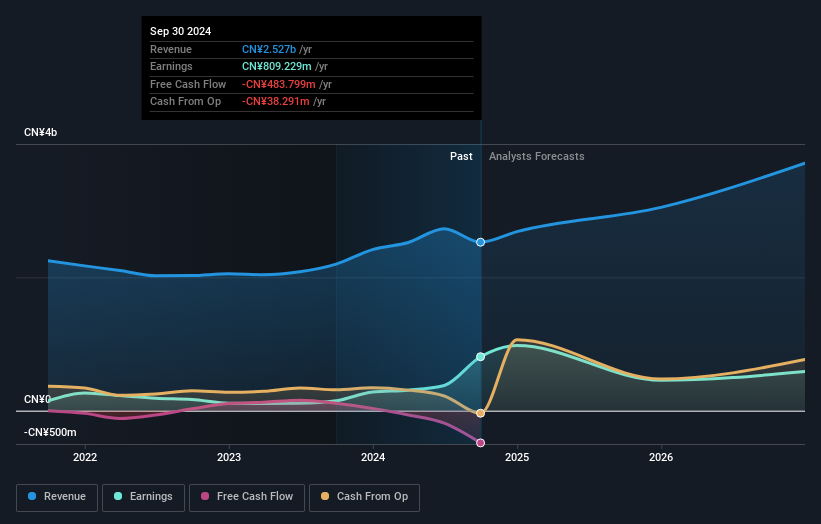

Overview: Ningbo BaoSi Energy Equipment Co., Ltd. focuses on the research, development, production, and sale of high-end precision mechanical parts and equipment both in China and internationally, with a market capitalization of approximately CN¥5.83 billion.

Operations: The company's revenue primarily comes from its Screw Compressor Division, which generated CN¥1.46 billion. The gross profit margin for the company is not provided, but it is crucial to analyze this metric to understand profitability trends over time.

Ningbo BaoSi Energy Equipment showcases robust financial health, with its earnings surging by 449% in the past year, significantly outpacing the machinery industry's -0.2%. The company's price-to-earnings ratio stands attractively at 7.2x, well below China's market average of 34.8x, suggesting a good relative value. Over five years, debt to equity has impressively decreased from 40.2% to just 4.8%, indicating prudent financial management. Recent earnings announcements reveal net income for nine months at CNY 703 million compared to CNY 174 million previously, with basic EPS rising from CNY 0.27 to CNY 1.08, reflecting strong profitability improvements despite forecasts of future earnings declines by an average of 23% annually over three years.

- Click here to discover the nuances of Ningbo BaoSi Energy Equipment with our detailed analytical health report.

Understand Ningbo BaoSi Energy Equipment's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 4657 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300319

Flawless balance sheet with solid track record.