Top Growth Companies With Strong Insider Ownership In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a mix of gains and setbacks, with major U.S. stock indexes showing moderate growth despite a dip in consumer confidence and manufacturing orders. Amidst these fluctuating conditions, growth companies with high insider ownership stand out as potentially resilient options, leveraging their internal stakeholder commitment to navigate market uncertainties effectively.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

JiangSu Zhenjiang New Energy Equipment (SHSE:603507)

Simply Wall St Growth Rating: ★★★★★☆

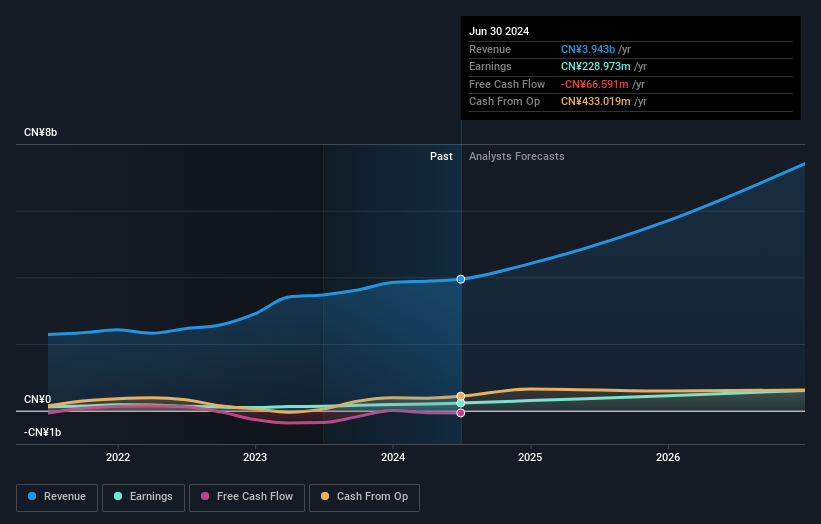

Overview: JiangSu Zhenjiang New Energy Equipment Co., Ltd. operates in the new energy sector, focusing on manufacturing equipment for renewable energy applications, with a market cap of CN¥4.24 billion.

Operations: Unfortunately, the provided text does not include specific revenue segments or amounts for JiangSu Zhenjiang New Energy Equipment Co., Ltd.

Insider Ownership: 29.1%

Earnings Growth Forecast: 38.7% p.a.

JiangSu Zhenjiang New Energy Equipment shows promising growth potential, with earnings expected to grow significantly at 38.7% annually over the next three years, outpacing the Chinese market. Revenue is also forecasted to increase by 26.5% per year. Despite a low return on equity forecast and a dividend not well-covered by free cash flows, the company trades at good value with a price-to-earnings ratio of 20.1x. Recent share buyback announcements aim to enhance employee incentives and long-term development strategies.

- Click here and access our complete growth analysis report to understand the dynamics of JiangSu Zhenjiang New Energy Equipment.

- Our valuation report here indicates JiangSu Zhenjiang New Energy Equipment may be undervalued.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Growth Rating: ★★★★☆☆

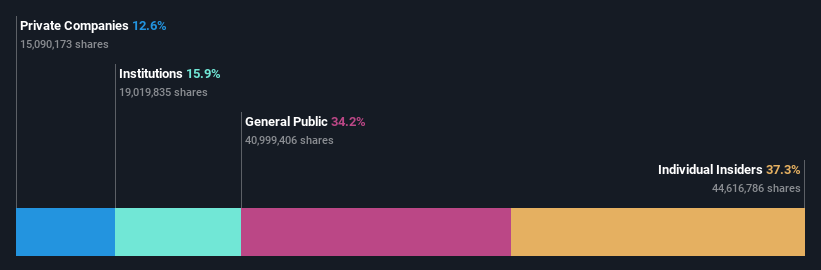

Overview: Hui Lyu Ecological Technology Groups Ltd (SZSE:001267) operates in the ecological technology sector and has a market cap of CN¥6.30 billion.

Operations: Unfortunately, the provided text for revenue segments does not contain specific information about the company's revenue breakdown. Therefore, I am unable to summarize the company's revenue segments into a sentence. If you have more detailed data on their revenue streams, feel free to share it so I can assist further.

Insider Ownership: 34.7%

Earnings Growth Forecast: 41.5% p.a.

Hui Lyu Ecological Technology Groups Ltd. is poised for significant earnings growth at 41.55% annually, surpassing the Chinese market's average. Despite revenue forecasts of 17.4% per year not reaching high-growth thresholds, the company trades below its estimated fair value by 19.4%. Recent board changes suggest strategic shifts, while stable net income growth amidst declining sales highlights operational resilience. However, a low return on equity forecast and an unstable dividend history may concern some investors.

- Delve into the full analysis future growth report here for a deeper understanding of Hui Lyu Ecological Technology GroupsLtd.

- Insights from our recent valuation report point to the potential overvaluation of Hui Lyu Ecological Technology GroupsLtd shares in the market.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acrobiosystems Co., Ltd. develops and manufactures recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of approximately CN¥5.15 billion.

Operations: The company's revenue primarily comes from its Research and Experimental Development segment, which generated CN¥583.70 million.

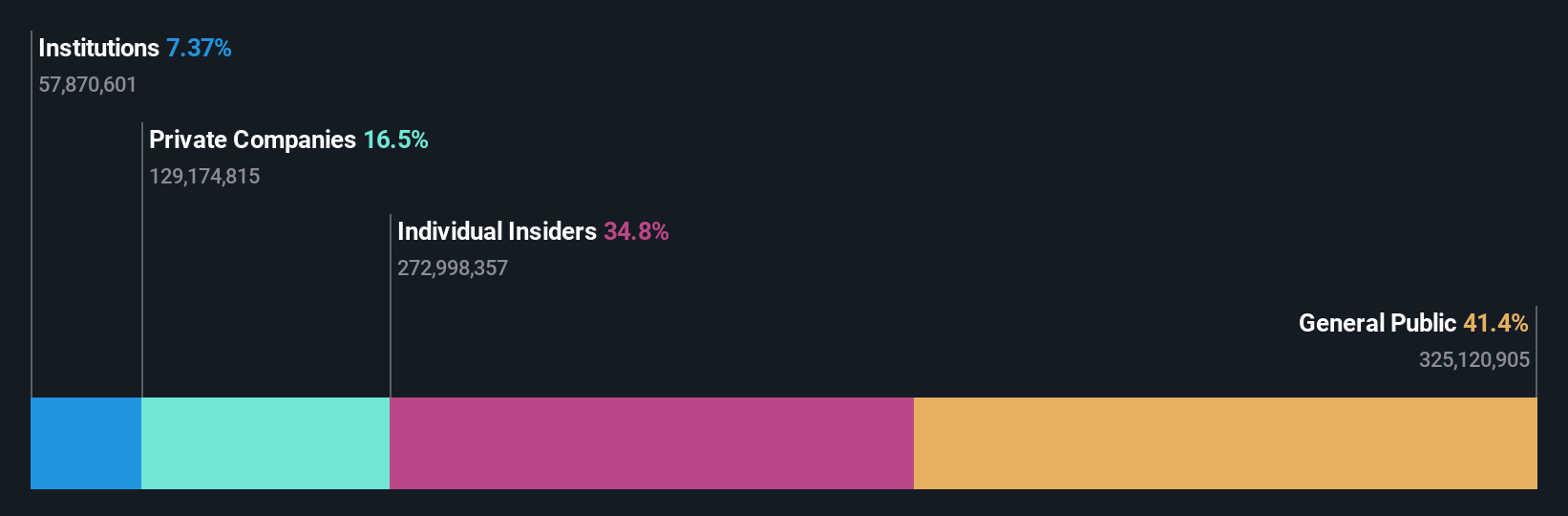

Insider Ownership: 37.3%

Earnings Growth Forecast: 29.6% p.a.

Acrobiosystems Ltd. demonstrates strong growth potential with earnings expected to rise 29.6% annually, outpacing the Chinese market average. Despite a decline in net profit margins from 31.1% to 18.3%, revenue is forecasted to grow at 18.5% per year, above the market rate of 13.7%. The company announced a share repurchase program worth up to CNY 40 million, reflecting confidence in its valuation and future prospects, though insider trading activity remains unreported recently.

- Take a closer look at AcrobiosystemsLtd's potential here in our earnings growth report.

- Our valuation report here indicates AcrobiosystemsLtd may be overvalued.

Seize The Opportunity

- Unlock our comprehensive list of 1510 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603507

JiangSu Zhenjiang New Energy Equipment

JiangSu Zhenjiang New Energy Equipment Co., Ltd.

High growth potential with solid track record.

Market Insights

Community Narratives