- Taiwan

- /

- Real Estate

- /

- TWSE:2520

Jingjin Equipment And 2 Other Noteworthy Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, marked by fluctuating consumer confidence and varied regional performances, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In this environment, selecting stocks with consistent dividend payouts can offer a buffer against market volatility while contributing to long-term portfolio growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

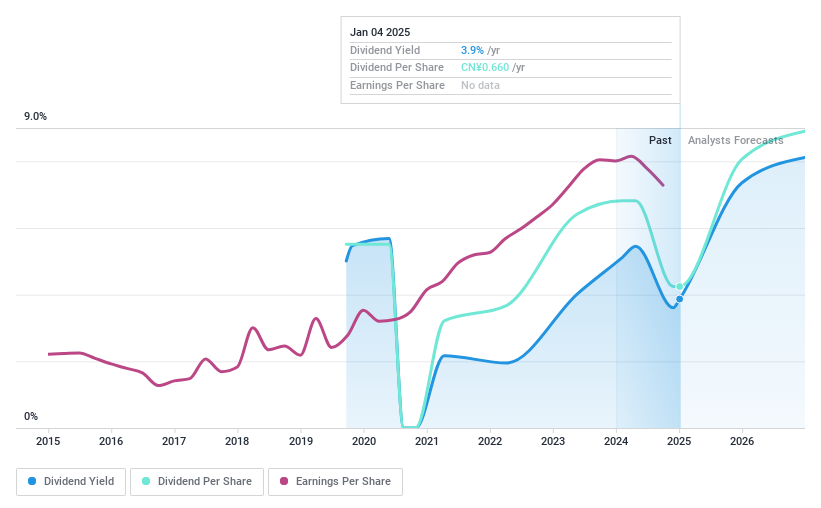

Jingjin Equipment (SHSE:603279)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jingjin Equipment Inc. provides environmental protection products and services in China and has a market cap of CN¥10.29 billion.

Operations: Jingjin Equipment Inc. generates revenue from its General Equipment Manufacturing segment, amounting to CN¥6.31 billion.

Dividend Yield: 3.6%

Jingjin Equipment's dividend yield of 3.62% places it among the top 25% of dividend payers in China, supported by a low payout ratio of 40.8%, indicating dividends are well-covered by earnings and cash flows (65.7%). However, its dividend history is less stable, with payments being volatile and declining over the past five years. Despite this, the stock trades at a favorable price-to-earnings ratio of 11.1x compared to the market average.

- Unlock comprehensive insights into our analysis of Jingjin Equipment stock in this dividend report.

- According our valuation report, there's an indication that Jingjin Equipment's share price might be on the cheaper side.

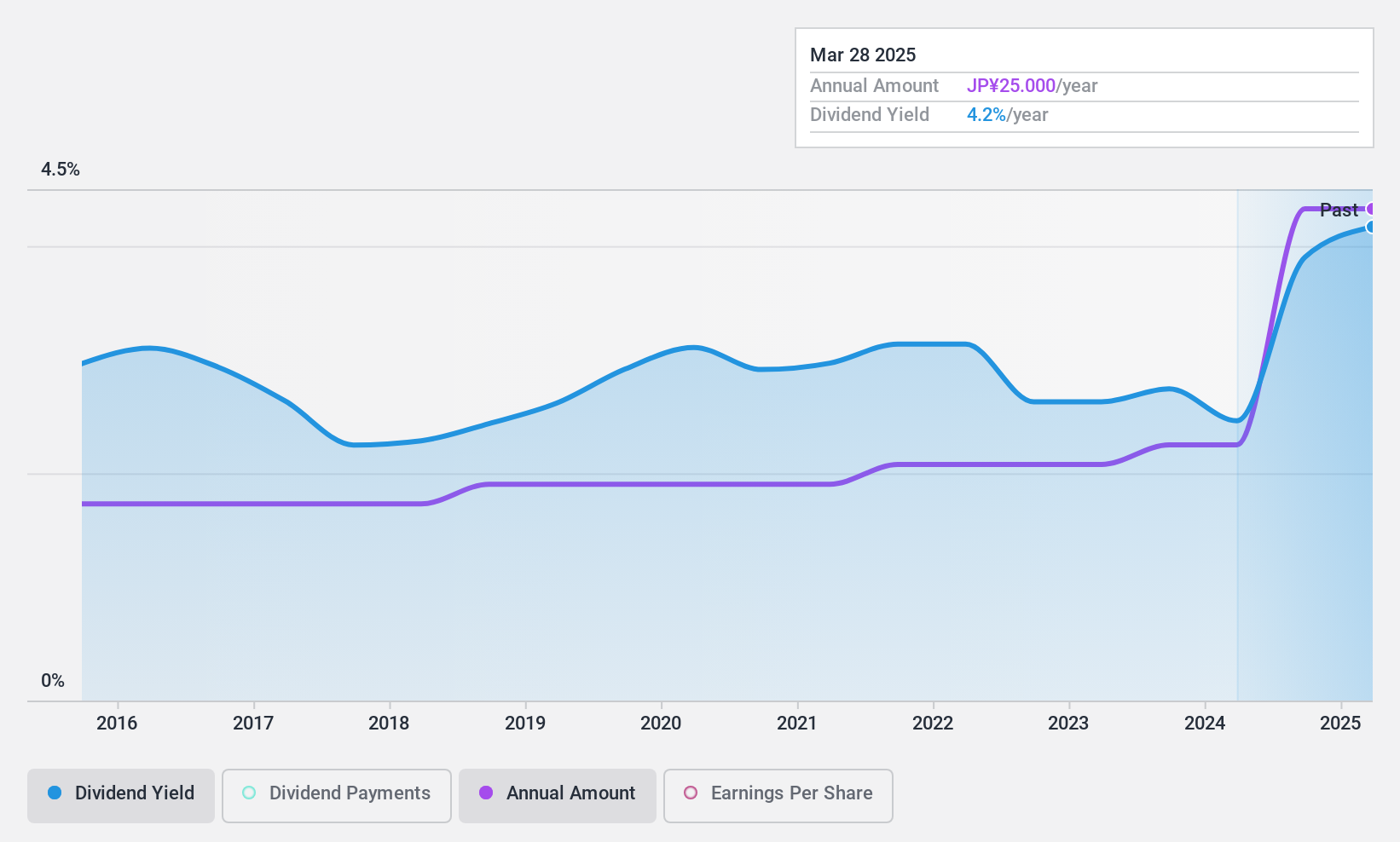

Japan Pulp and Paper (TSE:8032)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Pulp and Paper Company Limited operates in the manufacture, import, export, distribution, wholesale, and sale of papers, paperboards, pulp, and paper-related products across Japan and internationally with a market cap of ¥83.65 billion.

Operations: Japan Pulp and Paper Company Limited's revenue segments include Paper Processing at ¥56.13 billion, Domestic Wholesale at ¥207.04 billion, Overseas Wholesale at ¥265.27 billion, Real Estate Rental at ¥4.24 billion, and Environmental Raw Materials at ¥29.68 billion.

Dividend Yield: 3.6%

Japan Pulp and Paper's dividend payments have been consistently reliable over the past decade, with recent affirmations indicating a significant increase to JPY 125.00 per share from JPY 65.00 last year. The current yield of 3.65% is slightly below the top tier in Japan, but dividends are well-sustained by earnings (payout ratio: 22%) and cash flows (cash payout ratio: 10.2%). Despite high debt levels, the stock trades significantly below estimated fair value, enhancing its appeal for value-focused investors.

- Click here to discover the nuances of Japan Pulp and Paper with our detailed analytical dividend report.

- Our expertly prepared valuation report Japan Pulp and Paper implies its share price may be lower than expected.

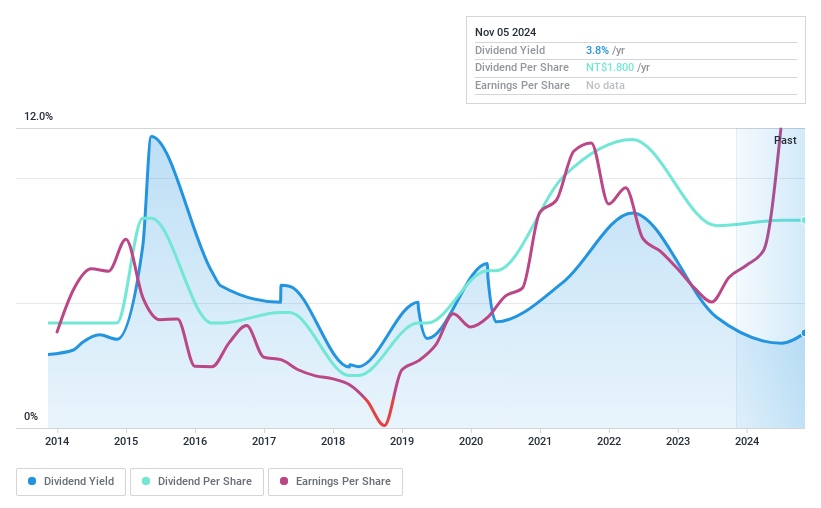

Kindom Development (TWSE:2520)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kindom Development Co., Ltd. and its subsidiaries are engaged in the construction, development, and sale of real estate properties in Taiwan, with a market capitalization of NT$27.61 billion.

Operations: Kindom Development Co., Ltd.'s revenue is primarily derived from its Manufacturing segment at NT$15.39 billion, Construction Segments at NT$13.98 billion, and Department Store operations contributing NT$1.76 billion.

Dividend Yield: 3.4%

Kindom Development's dividend yield of 3.44% is below the top 25% in Taiwan, and its dividends have been volatile over the past decade despite recent growth. However, dividends are well-covered by earnings (payout ratio: 17.9%) and cash flows (cash payout ratio: 9.6%). Recent earnings show strong growth with net income reaching TWD 4.49 billion for nine months, enhancing potential for future stability in dividend payments amidst ongoing business expansions like the New Taipei MRT project.

- Click to explore a detailed breakdown of our findings in Kindom Development's dividend report.

- The analysis detailed in our Kindom Development valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click this link to deep-dive into the 1949 companies within our Top Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindom Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2520

Kindom Development

Kindom Development Co., Ltd., together with its subsidiaries, constructs, develops, and sells real estate properties in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives