China Shenhua Energy And 2 Other Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, with U.S. stocks reaching record highs amid AI enthusiasm and potential trade deal optimism, investors are keenly observing how these dynamics influence market sectors. In this context, dividend stocks like China Shenhua Energy offer a unique opportunity for those looking to balance growth potential with income generation, particularly in a climate where manufacturing activity shows signs of rebounding and consumer sentiment faces challenges.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Shenhua Energy (SEHK:1088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shenhua Energy Company Limited operates in the production and sale of coal and power, as well as railway, port, and shipping transportation services both in China and internationally, with a market cap of HK$814.64 billion.

Operations: China Shenhua Energy's revenue is primarily derived from coal (CN¥274.49 billion), power (CN¥94.73 billion), railway (CN¥42.65 billion), port (CN¥6.90 billion), shipping (CN¥4.98 billion), and coal chemical operations (CN¥5.65 billion).

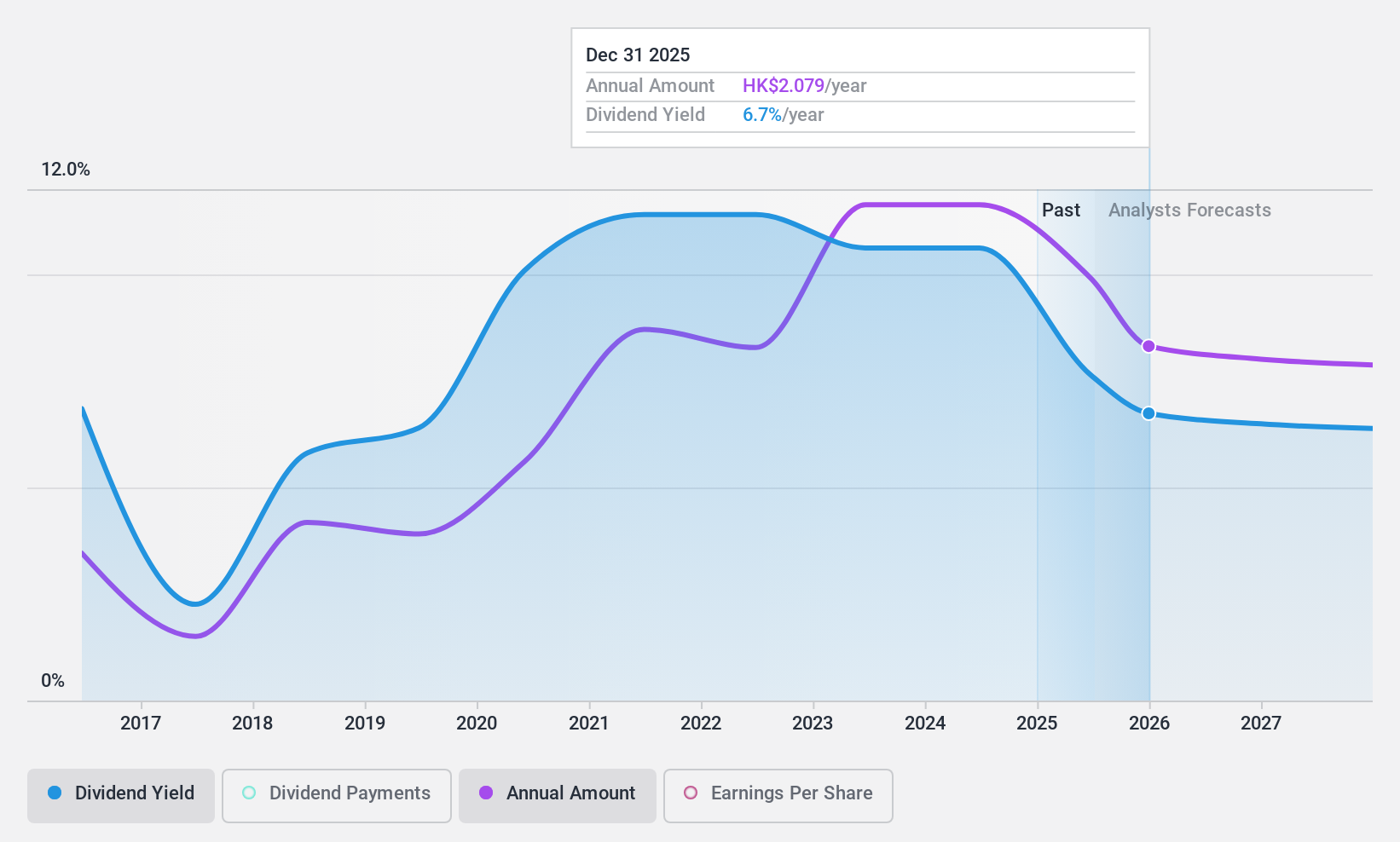

Dividend Yield: 7.8%

China Shenhua Energy's dividend payments are covered by cash flows, with a cash payout ratio of 68%, and earnings, with a payout ratio of 77.7%. Despite an increase in dividends over the past decade, the track record remains volatile. Trading at 42.9% below estimated fair value, its yield is slightly lower than top-tier Hong Kong payers. Recent guidance indicates a profit decline due to lower coal prices and asset impairments but stable production levels were maintained.

- Unlock comprehensive insights into our analysis of China Shenhua Energy stock in this dividend report.

- The valuation report we've compiled suggests that China Shenhua Energy's current price could be inflated.

Jingjin Equipment (SHSE:603279)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jingjin Equipment Inc. provides environmental protection products and services in China with a market cap of CN¥9.55 billion.

Operations: Jingjin Equipment Inc. generates revenue from its General Equipment Manufacturing segment, amounting to CN¥6.31 billion.

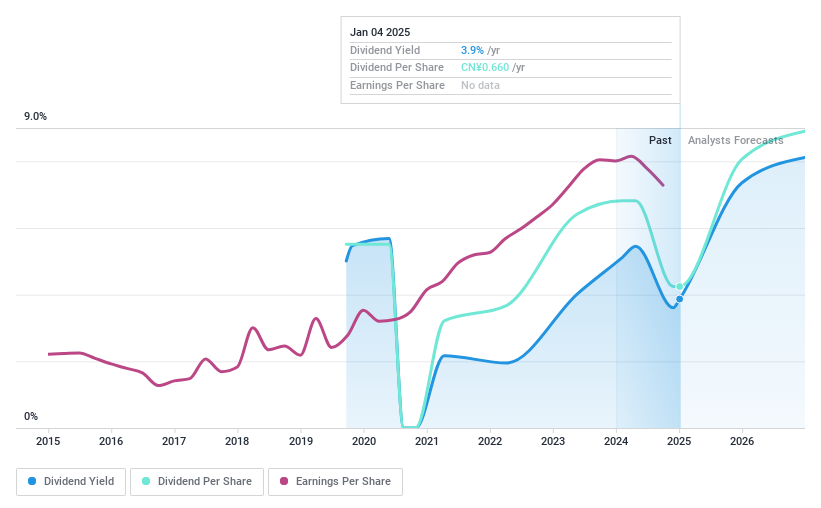

Dividend Yield: 3.9%

Jingjin Equipment's dividend yield of 3.93% ranks in the top 25% within the Chinese market, supported by a low payout ratio of 40.8%, indicating coverage by earnings and cash flows (65.7% cash payout). However, its five-year dividend history is marked by volatility and declining payments, raising concerns about reliability. The stock trades at a favorable price-to-earnings ratio of 10.2x compared to the market average, suggesting good relative value despite its unstable dividend track record.

- Get an in-depth perspective on Jingjin Equipment's performance by reading our dividend report here.

- According our valuation report, there's an indication that Jingjin Equipment's share price might be on the cheaper side.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Persol Holdings Co., Ltd. is a global provider of human resource services operating under the PERSOL brand, with a market cap of ¥521.40 billion.

Operations: Persol Holdings Co., Ltd.'s revenue segments include Staffing (Excluding BPO) at ¥589.29 billion, Asia Pacific at ¥446.91 billion, Career at ¥137.78 billion, Technology at ¥107.70 billion, and BPO at ¥111.25 billion.

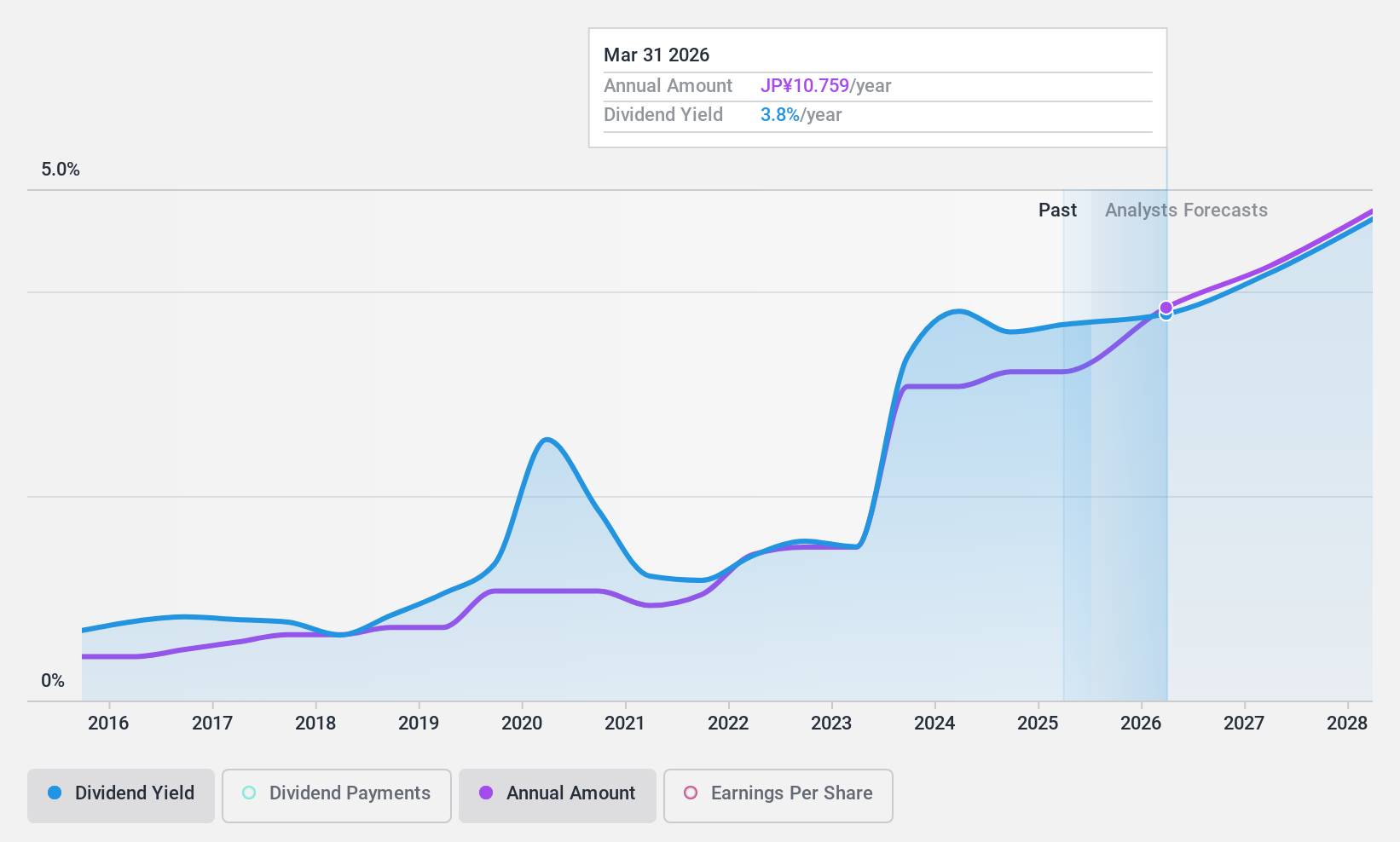

Dividend Yield: 3.8%

Persol Holdings' dividend yield of 3.83% ranks in the top 25% of the Japanese market, with dividends covered by earnings (57.4% payout ratio) and cash flows (49.8% cash payout). Despite a history of volatility, recent increases in interim dividends to ¥4.5 per share suggest potential growth. The company revised its FY2024 earnings forecast upward, indicating stronger financial performance and possibly enhancing dividend sustainability despite past inconsistencies.

- Delve into the full analysis dividend report here for a deeper understanding of Persol HoldingsLtd.

- Our expertly prepared valuation report Persol HoldingsLtd implies its share price may be lower than expected.

Make It Happen

- Explore the 1949 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603279

Jingjin Equipment

Offers environmental protection products and services in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives