- China

- /

- Electronic Equipment and Components

- /

- SZSE:301013

Top 3 Insider-Favored Growth Stocks To Watch

Reviewed by Simply Wall St

As global markets edge toward record highs, with U.S. growth stocks outperforming their value counterparts and inflation data influencing interest rate expectations, investors are keenly watching the landscape for promising opportunities. In this environment, companies with strong insider ownership often stand out as they suggest confidence from those who know the business best; such alignment of interests can be particularly appealing when seeking growth potential amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 128.7% |

Here we highlight a subset of our preferred stocks from the screener.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★☆☆

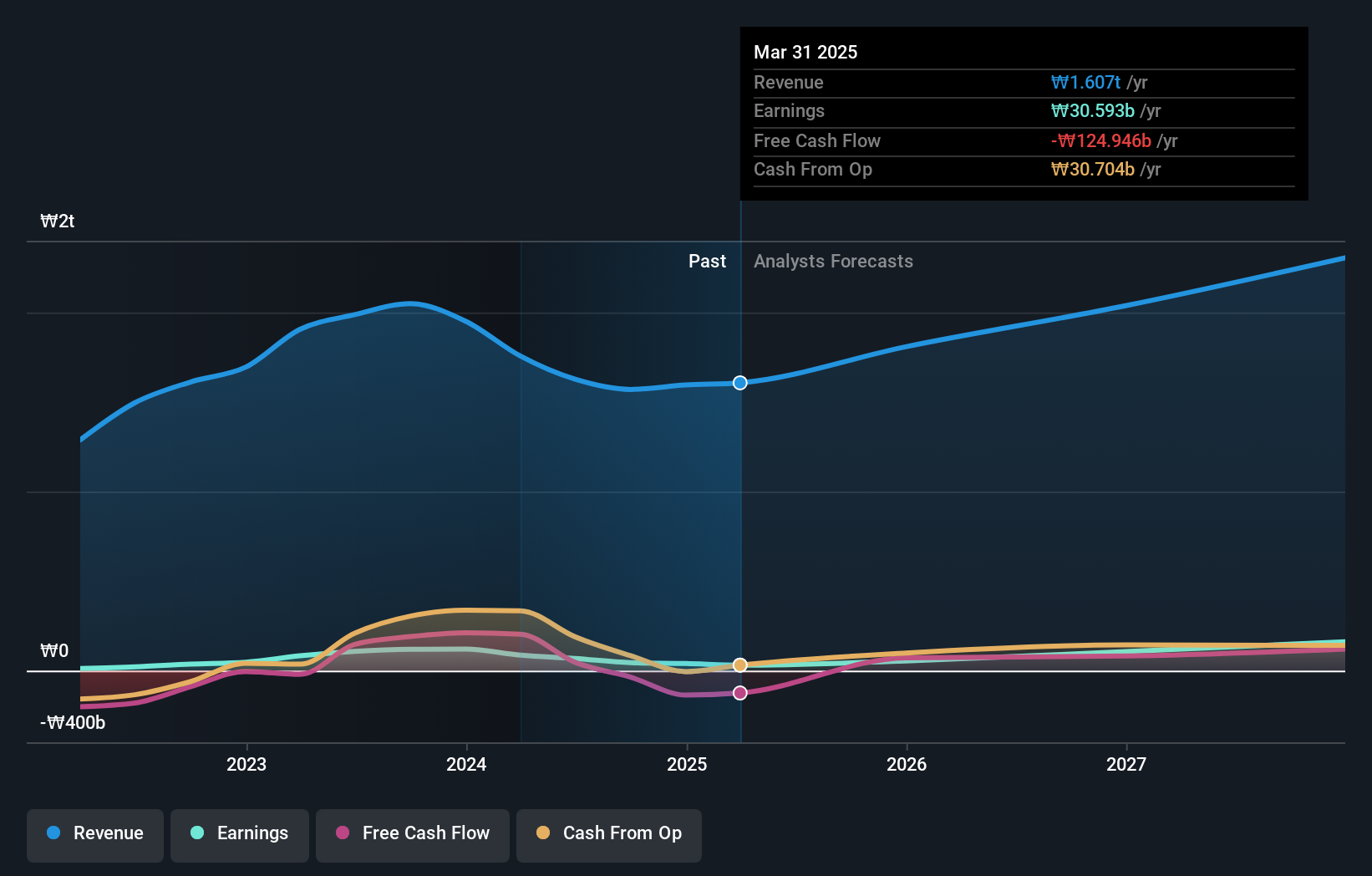

Overview: Solum Co., Ltd. is a company that produces and sells power modules, digital tuners, and electronic shelf labels both in South Korea and internationally, with a market capitalization of approximately ₩905.92 billion.

Operations: Solum generates revenue from two primary segments: the ICT Business, contributing approximately ₩432.21 million, and the Electronic Components Division, which accounts for around ₩1.14 billion.

Insider Ownership: 16.8%

Revenue Growth Forecast: 14.3% p.a.

Solum is poised for significant growth with earnings expected to increase by 47.9% annually, outpacing the KR market's 26% forecast. Despite a high debt level and declining profit margins from 5.8% to 2.8%, it trades at a substantial discount, nearly 58.4% below its estimated fair value. Recent innovations in AI-enhanced display solutions showcase potential in the $156 billion retail media network market, enhancing Solum's growth prospects amidst evolving privacy regulations and data utilization trends.

- Navigate through the intricacies of Solum with our comprehensive analyst estimates report here.

- The analysis detailed in our Solum valuation report hints at an deflated share price compared to its estimated value.

Quick Intelligent EquipmentLtd (SHSE:603203)

Simply Wall St Growth Rating: ★★★★★★

Overview: Quick Intelligent Equipment Co., Ltd. focuses on the research, development, manufacturing, and sale of precision assembly technology for electronics both in China and internationally, with a market cap of CN¥6.13 billion.

Operations: The company's revenue primarily comes from the Special Equipment Manufacturing Industry, amounting to CN¥882.38 million.

Insider Ownership: 34.2%

Revenue Growth Forecast: 27% p.a.

Quick Intelligent Equipment Ltd. demonstrates robust growth potential, with earnings projected to rise 35.6% annually, surpassing the CN market's 25% forecast. Revenue is also expected to grow significantly at 27% per year, outpacing the market average of 13.3%. Despite a Price-To-Earnings ratio of 31.7x being below the market average, its dividend yield of 2.4% is not well covered by free cash flows. The company benefits from high-quality earnings and a strong Return on Equity forecasted at 21.1%.

- Get an in-depth perspective on Quick Intelligent EquipmentLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Quick Intelligent EquipmentLtd valuation report hints at an inflated share price compared to its estimated value.

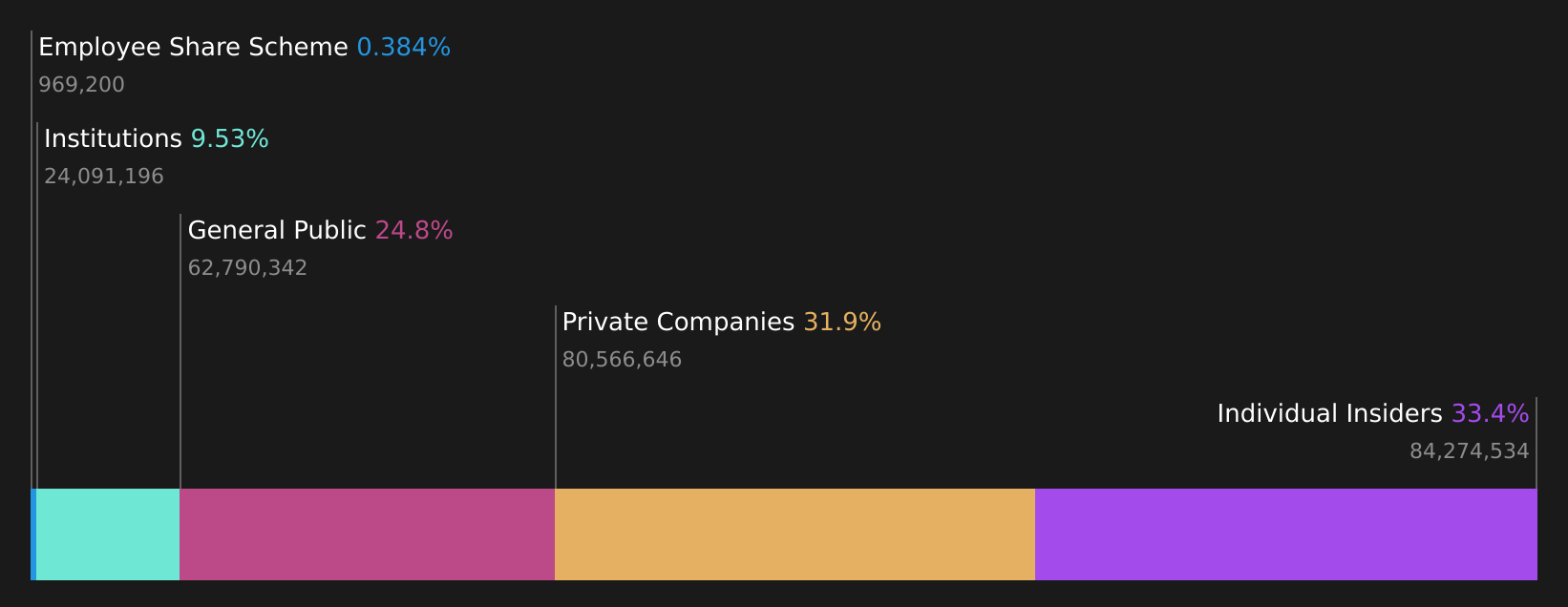

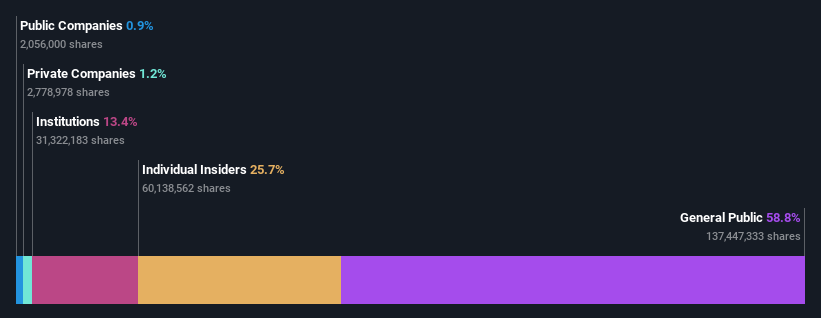

Shenzhen LihexingLtd (SZSE:301013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Lihexing Co., Ltd. focuses on the research, development, production, and sale of automation and intelligent equipment for the information and communication technology industry in China, with a market cap of CN¥2.83 billion.

Operations: The company generates revenue from the research, development, production, and sale of automation and intelligent equipment within China's information and communication technology sector.

Insider Ownership: 25.7%

Revenue Growth Forecast: 33.6% p.a.

Shenzhen Lihexing Ltd. exhibits strong growth prospects, with revenue anticipated to increase by 33.6% annually, significantly outpacing the CN market's 13.3%. Earnings are projected to grow at a robust 67.56% per year, and profitability is expected within three years, surpassing average market growth rates. However, its Return on Equity is forecasted to be relatively low at 13.2%, and operating cash flow does not adequately cover debt obligations.

- Unlock comprehensive insights into our analysis of Shenzhen LihexingLtd stock in this growth report.

- The valuation report we've compiled suggests that Shenzhen LihexingLtd's current price could be inflated.

Taking Advantage

- Investigate our full lineup of 1454 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301013

Shenzhen LihexingLtd

Engages in the research and development, production, and sale of automation and intelligent equipment for information and communication technology industry in China.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives