- China

- /

- Electrical

- /

- SHSE:603191

Is Chongqing Wangbian Electric (Group) (SHSE:603191) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Chongqing Wangbian Electric (Group) Corp., Ltd. (SHSE:603191) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Chongqing Wangbian Electric (Group)

How Much Debt Does Chongqing Wangbian Electric (Group) Carry?

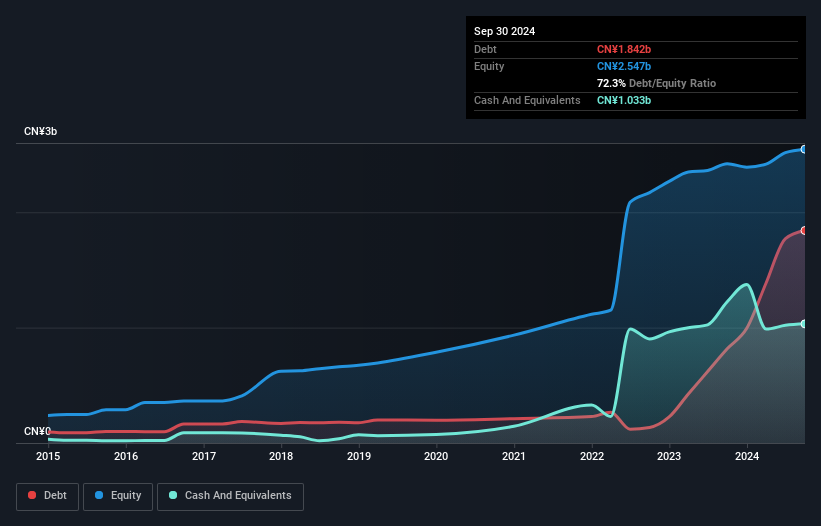

The image below, which you can click on for greater detail, shows that at September 2024 Chongqing Wangbian Electric (Group) had debt of CN¥1.84b, up from CN¥815.8m in one year. However, because it has a cash reserve of CN¥1.03b, its net debt is less, at about CN¥809.0m.

A Look At Chongqing Wangbian Electric (Group)'s Liabilities

The latest balance sheet data shows that Chongqing Wangbian Electric (Group) had liabilities of CN¥2.56b due within a year, and liabilities of CN¥1.32b falling due after that. Offsetting these obligations, it had cash of CN¥1.03b as well as receivables valued at CN¥2.05b due within 12 months. So its liabilities total CN¥793.0m more than the combination of its cash and short-term receivables.

Since publicly traded Chongqing Wangbian Electric (Group) shares are worth a total of CN¥4.79b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Chongqing Wangbian Electric (Group)'s net debt is 3.7 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 1k is very high, suggesting that the interest expense on the debt is currently quite low. Shareholders should be aware that Chongqing Wangbian Electric (Group)'s EBIT was down 65% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Chongqing Wangbian Electric (Group) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Chongqing Wangbian Electric (Group) saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Chongqing Wangbian Electric (Group)'s conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Chongqing Wangbian Electric (Group)'s debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Chongqing Wangbian Electric (Group) (1 shouldn't be ignored) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603191

Chongqing Wangbian Electric (Group)

Chongqing Wangbian Electric (Group) Corp., Ltd.

Adequate balance sheet low.

Market Insights

Community Narratives