These 4 Measures Indicate That Nanjing Kangni Mechanical & ElectricalLtd (SHSE:603111) Is Using Debt Safely

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Nanjing Kangni Mechanical & Electrical Co.,Ltd (SHSE:603111) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nanjing Kangni Mechanical & ElectricalLtd

What Is Nanjing Kangni Mechanical & ElectricalLtd's Debt?

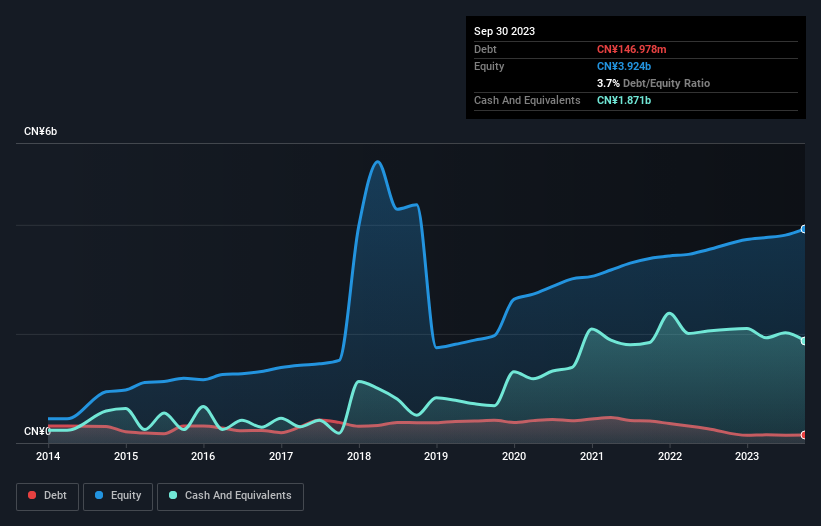

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Nanjing Kangni Mechanical & ElectricalLtd had CN¥147.0m of debt, an increase on CN¥140.1m, over one year. But on the other hand it also has CN¥1.87b in cash, leading to a CN¥1.72b net cash position.

How Healthy Is Nanjing Kangni Mechanical & ElectricalLtd's Balance Sheet?

According to the last reported balance sheet, Nanjing Kangni Mechanical & ElectricalLtd had liabilities of CN¥1.74b due within 12 months, and liabilities of CN¥194.7m due beyond 12 months. On the other hand, it had cash of CN¥1.87b and CN¥2.70b worth of receivables due within a year. So it can boast CN¥2.63b more liquid assets than total liabilities.

This surplus strongly suggests that Nanjing Kangni Mechanical & ElectricalLtd has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, Nanjing Kangni Mechanical & ElectricalLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

Fortunately, Nanjing Kangni Mechanical & ElectricalLtd grew its EBIT by 5.4% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is Nanjing Kangni Mechanical & ElectricalLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Nanjing Kangni Mechanical & ElectricalLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Nanjing Kangni Mechanical & ElectricalLtd generated free cash flow amounting to a very robust 88% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Nanjing Kangni Mechanical & ElectricalLtd has net cash of CN¥1.72b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of CN¥176m, being 88% of its EBIT. So is Nanjing Kangni Mechanical & ElectricalLtd's debt a risk? It doesn't seem so to us. Over time, share prices tend to follow earnings per share, so if you're interested in Nanjing Kangni Mechanical & ElectricalLtd, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Nanjing Kangni Mechanical & ElectricalLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nanjing Kangni Mechanical & ElectricalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603111

Nanjing Kangni Mechanical & ElectricalLtd

Engages in the research and development, manufacture, sale, and maintenance of railway vehicle door systems.

Flawless balance sheet with solid track record and pays a dividend.