JDM JingDaMachine (Ningbo) Co.Ltd (SHSE:603088) Soars 31% But It's A Story Of Risk Vs Reward

Despite an already strong run, JDM JingDaMachine (Ningbo) Co.Ltd (SHSE:603088) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 27%.

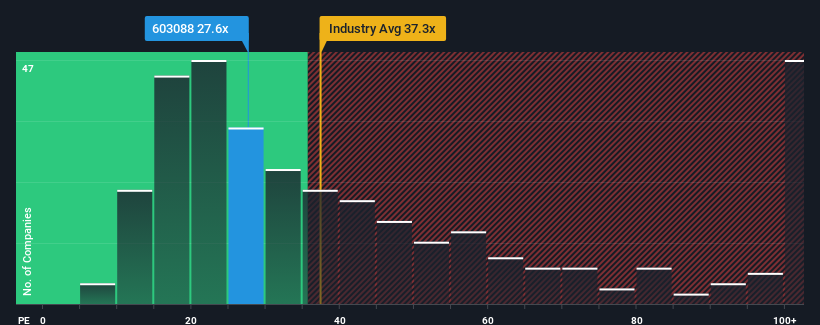

Even after such a large jump in price, JDM JingDaMachine (Ningbo)Ltd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.6x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 74x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

JDM JingDaMachine (Ningbo)Ltd's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for JDM JingDaMachine (Ningbo)Ltd

How Is JDM JingDaMachine (Ningbo)Ltd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as JDM JingDaMachine (Ningbo)Ltd's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. Even so, admirably EPS has lifted 87% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 69% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 39%, which is noticeably less attractive.

In light of this, it's peculiar that JDM JingDaMachine (Ningbo)Ltd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On JDM JingDaMachine (Ningbo)Ltd's P/E

Despite JDM JingDaMachine (Ningbo)Ltd's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of JDM JingDaMachine (Ningbo)Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for JDM JingDaMachine (Ningbo)Ltd that you need to be mindful of.

If these risks are making you reconsider your opinion on JDM JingDaMachine (Ningbo)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.