In a week marked by mixed performances across major global indices, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reaching record highs while growth stocks outpaced value stocks significantly, dividend stocks continue to attract investors seeking reliable income streams amid market volatility. As the economic landscape evolves with fluctuating job growth and interest rate expectations, identifying solid dividend-paying companies like Djurslands Bank can provide stability and potential income in an investor's portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.86% | ★★★★★★ |

Click here to see the full list of 1926 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Djurslands Bank (CPSE:DJUR)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Djurslands Bank A/S offers a range of banking products and services in Denmark, with a market capitalization of DKK1.42 billion.

Operations: Djurslands Bank A/S generates revenue of DKK675.27 million from its banking segment in Denmark.

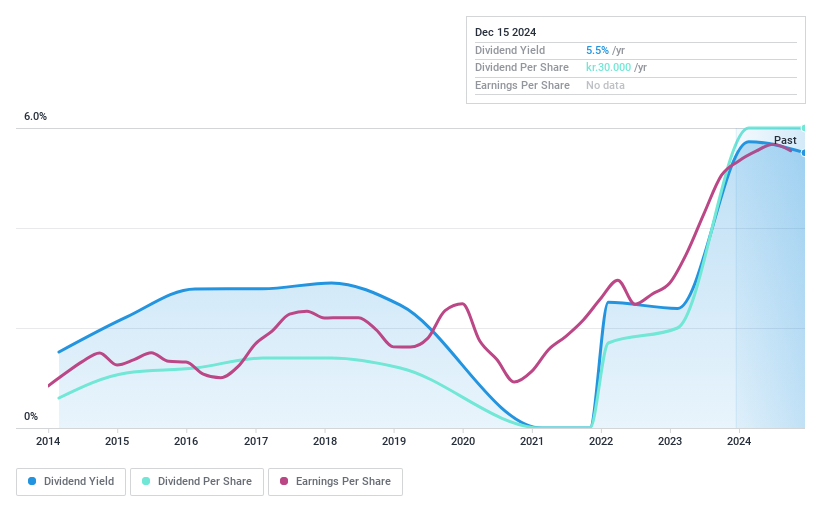

Dividend Yield: 5.5%

Djurslands Bank's dividend payments have been volatile over the past decade, with periods of instability and unreliable growth. Despite this, recent earnings show improvement, with net interest income rising to DKK 326.98 million and net income reaching DKK 189.25 million for the first nine months of 2024. The bank maintains a low payout ratio of 32.5%, suggesting current dividends are well-covered by earnings, though future sustainability remains uncertain due to insufficient data on long-term coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Djurslands Bank.

- According our valuation report, there's an indication that Djurslands Bank's share price might be on the cheaper side.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China with a market capitalization of approximately HK$45.59 billion.

Operations: Bosideng International Holdings Limited's revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

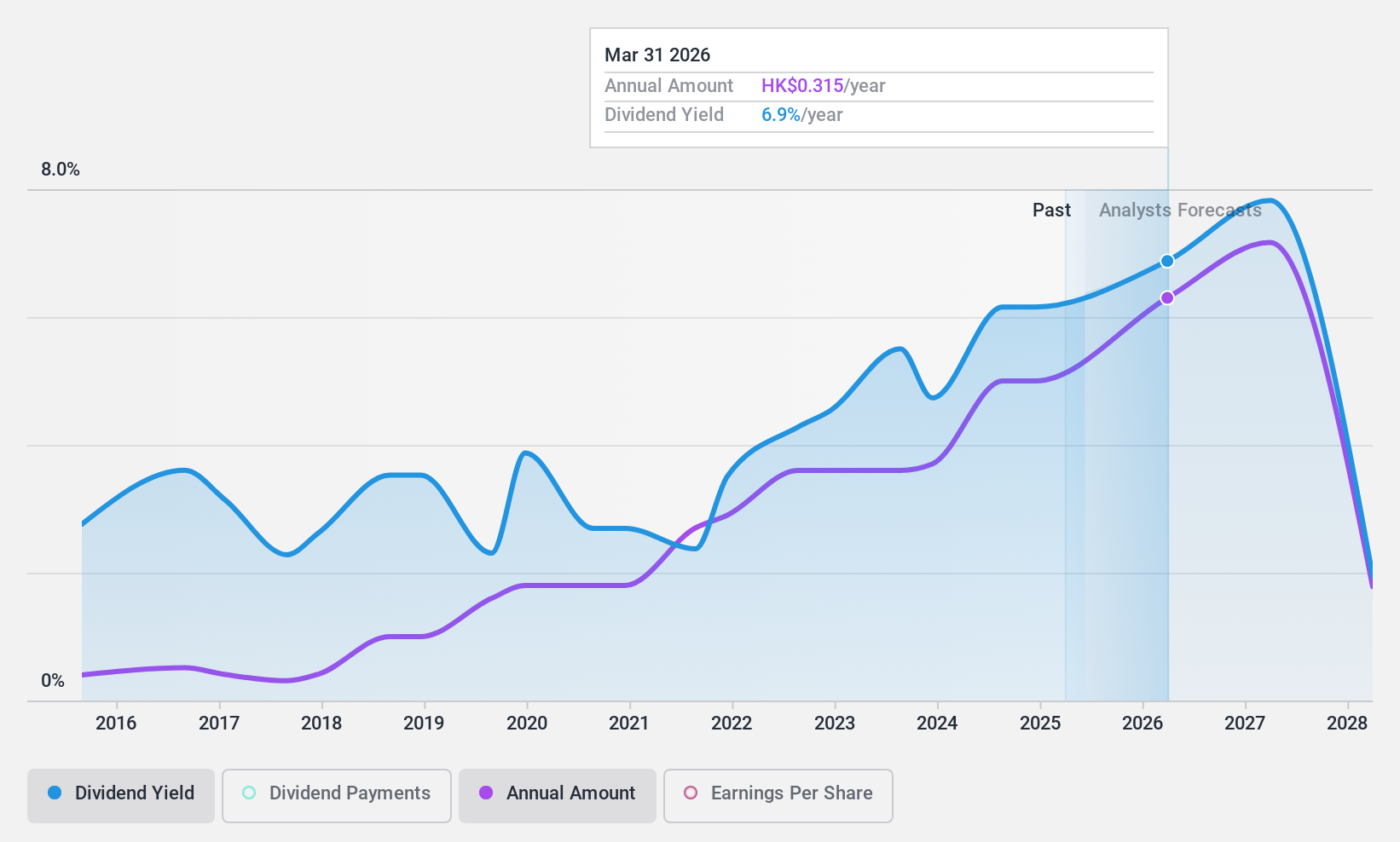

Dividend Yield: 5.8%

Bosideng International Holdings' recent interim dividend of HKD 0.06 per share reflects its commitment to shareholder returns, backed by a robust earnings report showing a rise in sales to CNY 8.80 billion and net income to CNY 1.13 billion for the half year ended September 2024. Despite past volatility, dividends are currently well-covered by earnings (payout ratio: 78.3%) and cash flows (cash payout ratio: 36.6%), though sustainability concerns persist due to an unstable track record.

- Unlock comprehensive insights into our analysis of Bosideng International Holdings stock in this dividend report.

- Upon reviewing our latest valuation report, Bosideng International Holdings' share price might be too pessimistic.

Jangho Group (SHSE:601886)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jangho Group Co., Ltd. operates in the architectural decoration business across Mainland China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of CN¥6.74 billion.

Operations: Jangho Group Co., Ltd.'s revenue segments include architectural decoration services across various regions, including Mainland China, Hong Kong, Macau, Taiwan, and international markets.

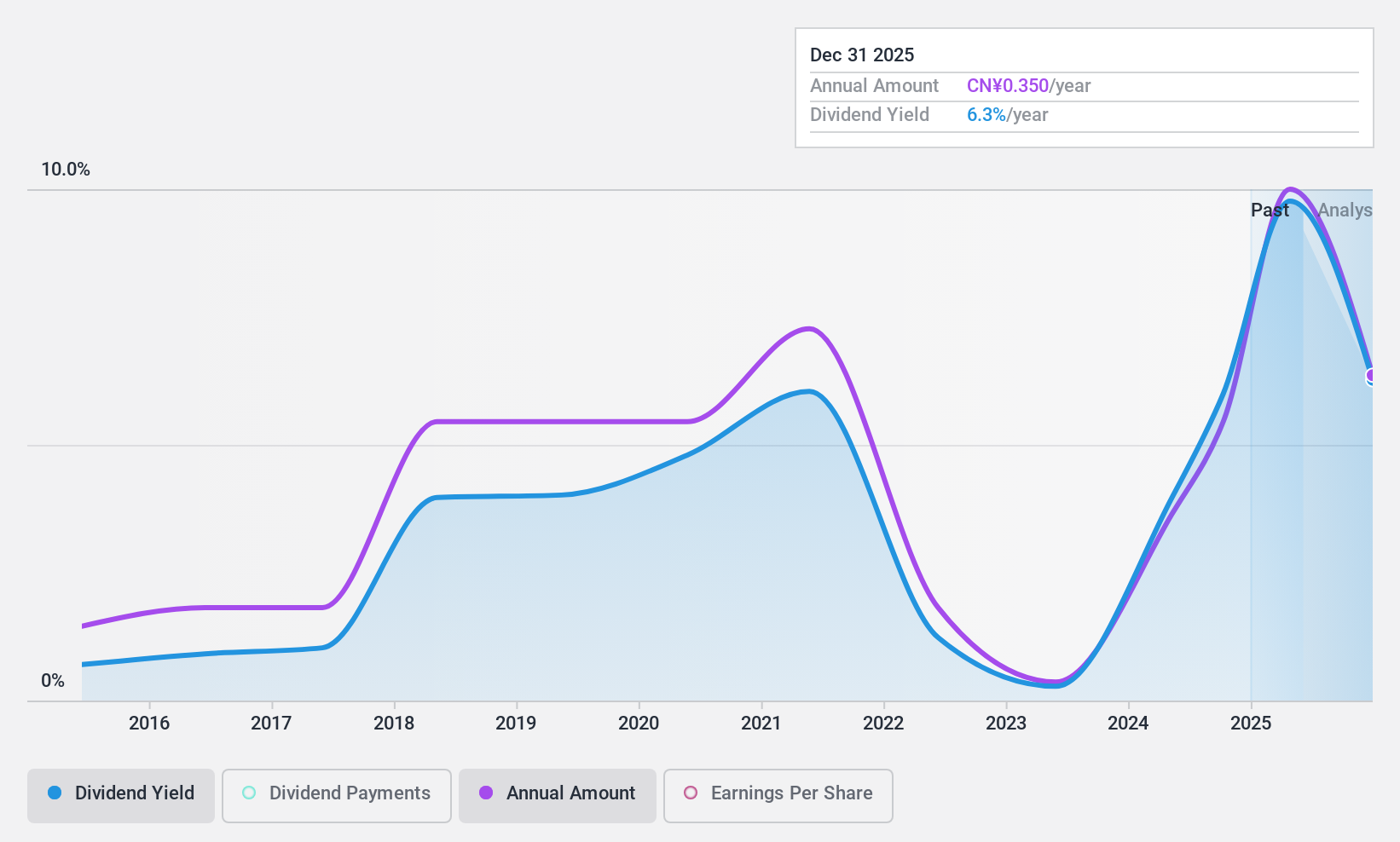

Dividend Yield: 5%

Jangho Group's dividend yield is among the top 25% in China, yet its track record shows volatility and unreliability over the past decade. Despite these concerns, dividends are well-covered by earnings (payout ratio: 56.4%) and cash flows (cash payout ratio: 23.9%). The company reported a rise in sales to CNY 15.42 billion and net income to CNY 433.06 million for the nine months ended September 2024, indicating strong financial performance despite large one-off items affecting results.

- Click to explore a detailed breakdown of our findings in Jangho Group's dividend report.

- Our valuation report here indicates Jangho Group may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1926 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DJUR

Djurslands Bank

Provides various banking products and services in Denmark.

Good value with adequate balance sheet.