Ningbo Haitian Precision Machinery Co.,Ltd. (SHSE:601882) Looks Inexpensive But Perhaps Not Attractive Enough

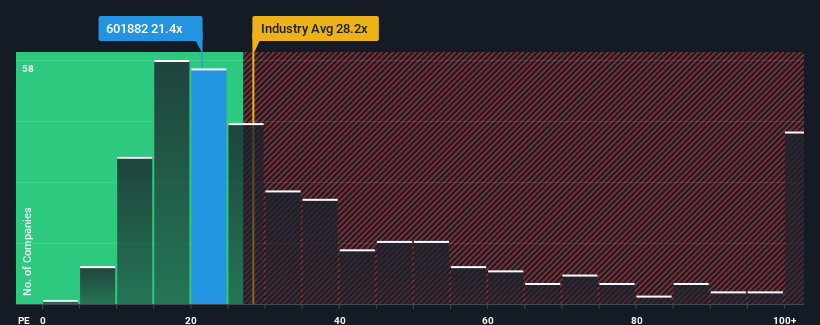

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Ningbo Haitian Precision Machinery Co.,Ltd. (SHSE:601882) as an attractive investment with its 21.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Ningbo Haitian Precision MachineryLtd has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Ningbo Haitian Precision MachineryLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Ningbo Haitian Precision MachineryLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen an excellent 226% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the six analysts watching the company. With the market predicted to deliver 25% growth per year, the company is positioned for a weaker earnings result.

With this information, we can see why Ningbo Haitian Precision MachineryLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ningbo Haitian Precision MachineryLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ningbo Haitian Precision MachineryLtd (1 is concerning) you should be aware of.

Of course, you might also be able to find a better stock than Ningbo Haitian Precision MachineryLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Haitian Precision MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601882

Ningbo Haitian Precision MachineryLtd

Ningbo Haitian Precision Machinery Co.,Ltd.

Flawless balance sheet and good value.