- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

3 Promising Penny Stocks With Market Caps Under US$3B

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, major indexes like the S&P 500 have reached record highs, fueled by optimism around trade policies and AI investments. In such a vibrant market landscape, investors often seek opportunities in lesser-known areas that promise potential growth. Despite its outdated ring, the term "penny stock" still signifies smaller or newer companies with promising prospects. By focusing on those with strong financial foundations and growth potential, investors can uncover valuable opportunities among these stocks.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dubai Investments PJSC, with a market cap of AED9.31 billion, operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally.

Operations: The company's revenue is segmented into Property (AED2.21 billion), Manufacturing, Contracting and Services (AED1.24 billion), and Investments (AED330.77 million).

Market Cap: AED9.31B

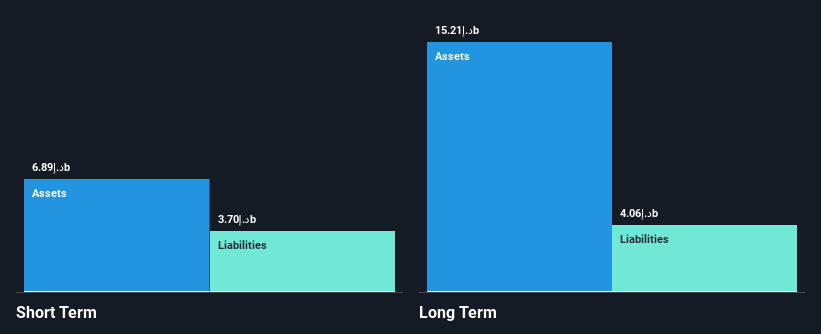

Dubai Investments PJSC, with a market cap of AED9.31 billion, operates across various sectors including property and manufacturing. Recent earnings for the third quarter showed sales of AED349.02 million with a net income of AED241.31 million, reflecting steady growth despite lower annual revenue and profit margins compared to last year. The company's debt is satisfactorily managed with short-term assets exceeding liabilities, but interest payments are not well covered by EBIT. Although its earnings growth has slowed recently to 3% from a five-year average of 22.5%, it remains above industry averages, supported by an experienced management team and board.

- Jump into the full analysis health report here for a deeper understanding of Dubai Investments PJSC.

- Gain insights into Dubai Investments PJSC's outlook and expected performance with our report on the company's earnings estimates.

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. focuses on the research, development, manufacture, and sale of nylon filaments primarily in China, with a market cap of CN¥4.53 billion.

Operations: Yiwu Huading Nylon Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.53B

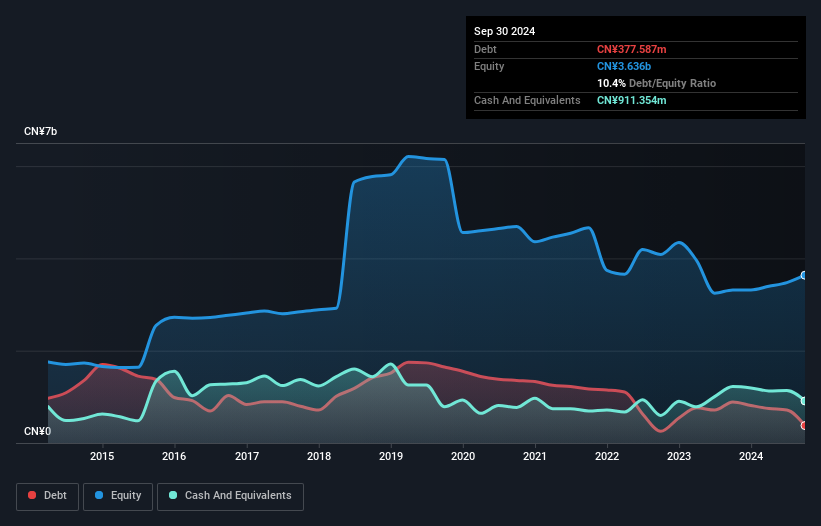

Yiwu Huading Nylon Co., Ltd., with a market cap of CN¥4.53 billion, has shown significant earnings growth, with net income rising to CN¥324.27 million for the first nine months of 2024 from CN¥165.23 million the previous year. Despite a slight decline in sales, the company maintains strong financial health, as evidenced by its well-covered debt and short-term assets exceeding both short- and long-term liabilities. Recent developments include a private placement agreement to raise CN¥707.5 million through share issuance, subject to regulatory approvals and shareholder consent, indicating strategic capital management efforts amidst evolving market conditions.

- Click to explore a detailed breakdown of our findings in Yiwu Huading NylonLtd's financial health report.

- Assess Yiwu Huading NylonLtd's previous results with our detailed historical performance reports.

Shanghai Guangdian Electric Group (SHSE:601616)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Guangdian Electric Group Co., Ltd. operates in the electrical equipment industry and has a market capitalization of approximately CN¥3.65 billion.

Operations: The company generates revenue primarily from its Transmission and Distribution and Control Equipment Manufacturing segment, amounting to CN¥935.54 million.

Market Cap: CN¥3.65B

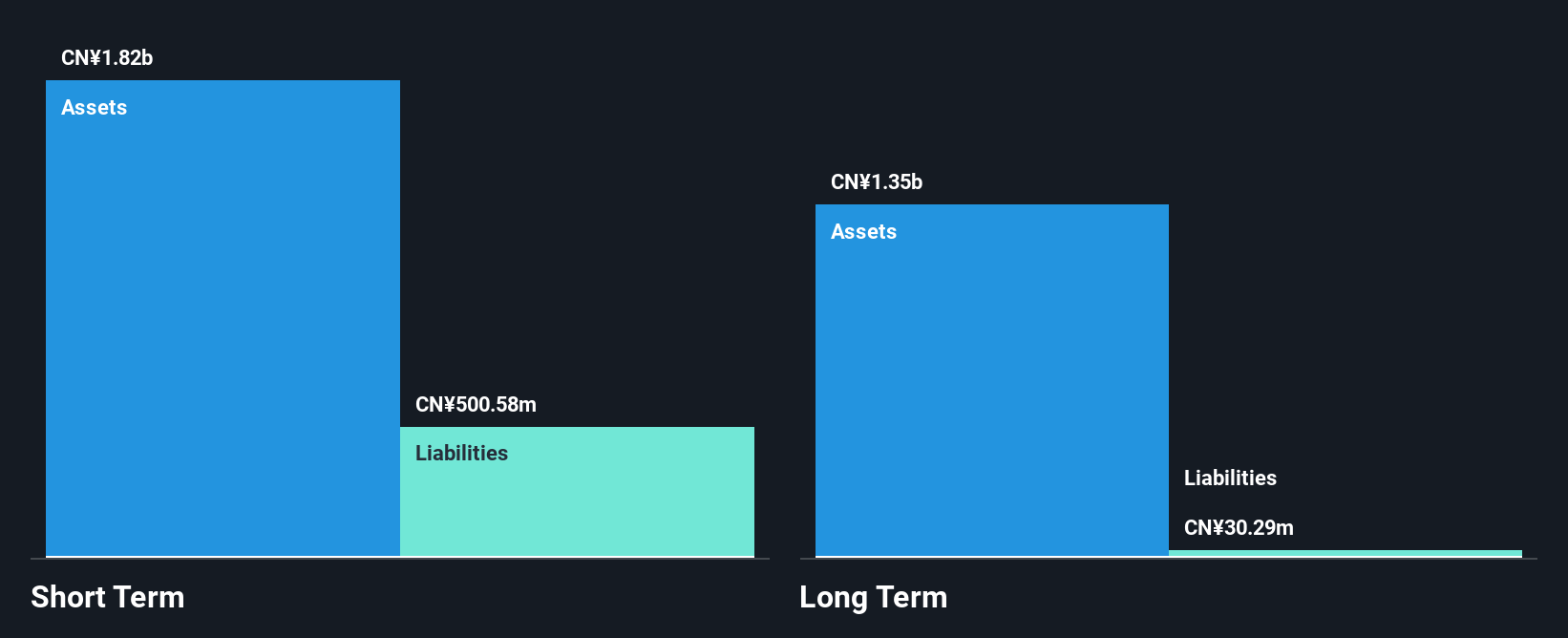

Shanghai Guangdian Electric Group Co., Ltd. operates with a market capitalization of CN¥3.65 billion, showing robust financial health and notable earnings growth. For the nine months ending September 2024, sales increased to CN¥736.19 million from CN¥557.48 million the previous year, while net income rose significantly to CN¥47.95 million from CN¥16.11 million, aided by a large one-off gain of CN¥15.6 million. The company benefits from being debt-free with short-term assets of CN¥1.7 billion covering both short- and long-term liabilities comfortably, though its return on equity remains low at 2.7%.

- Click here to discover the nuances of Shanghai Guangdian Electric Group with our detailed analytical financial health report.

- Gain insights into Shanghai Guangdian Electric Group's past trends and performance with our report on the company's historical track record.

Next Steps

- Take a closer look at our Penny Stocks list of 5,708 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Adequate balance sheet average dividend payer.