- China

- /

- Electrical

- /

- SHSE:601567

Ningbo Sanxing Medical Electric Co.,Ltd.'s (SHSE:601567) Shares Climb 25% But Its Business Is Yet to Catch Up

Despite an already strong run, Ningbo Sanxing Medical Electric Co.,Ltd. (SHSE:601567) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 184% in the last year.

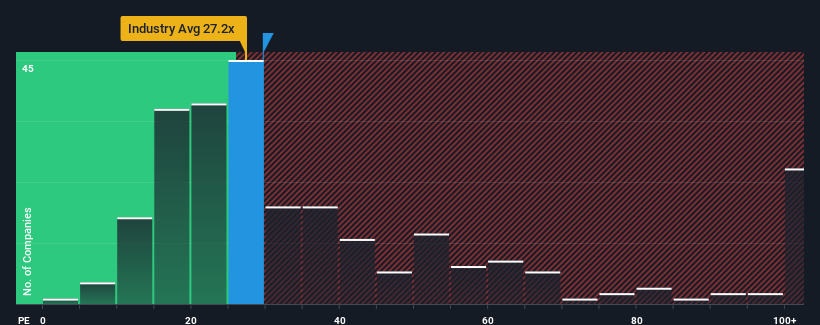

In spite of the firm bounce in price, it's still not a stretch to say that Ningbo Sanxing Medical ElectricLtd's price-to-earnings (or "P/E") ratio of 29.6x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 28x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Ningbo Sanxing Medical ElectricLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Ningbo Sanxing Medical ElectricLtd

Is There Some Growth For Ningbo Sanxing Medical ElectricLtd?

The only time you'd be comfortable seeing a P/E like Ningbo Sanxing Medical ElectricLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 133% gain to the company's bottom line. The latest three year period has also seen an excellent 76% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 26% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 36%, which is noticeably more attractive.

In light of this, it's curious that Ningbo Sanxing Medical ElectricLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Ningbo Sanxing Medical ElectricLtd's P/E?

Its shares have lifted substantially and now Ningbo Sanxing Medical ElectricLtd's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Ningbo Sanxing Medical ElectricLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Ningbo Sanxing Medical ElectricLtd.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sanxing Medical ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601567

Ningbo Sanxing Medical ElectricLtd

Manufactures and sells power distribution and utilization systems in China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.