- China

- /

- Construction

- /

- SHSE:601390

Lacklustre Performance Is Driving China Railway Group Limited's (SHSE:601390) Low P/E

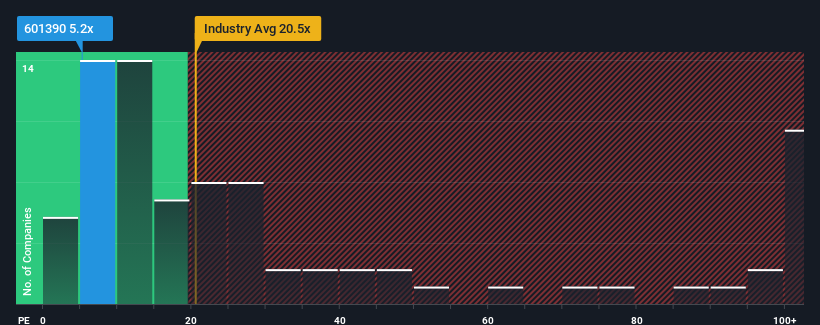

With a price-to-earnings (or "P/E") ratio of 5.2x China Railway Group Limited (SHSE:601390) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 65x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, China Railway Group has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for China Railway Group

Does Growth Match The Low P/E?

China Railway Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.1%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 14% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 14% during the coming year according to the five analysts following the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

In light of this, it's understandable that China Railway Group's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Railway Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for China Railway Group (1 is a bit concerning!) that you need to be mindful of.

Of course, you might also be able to find a better stock than China Railway Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601390

China Railway Group

Operates as a multi-functional integrated construction company in Mainland China and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives