Why We're Not Concerned About Jiangsu Hengli Hydraulic Co.,Ltd's (SHSE:601100) Share Price

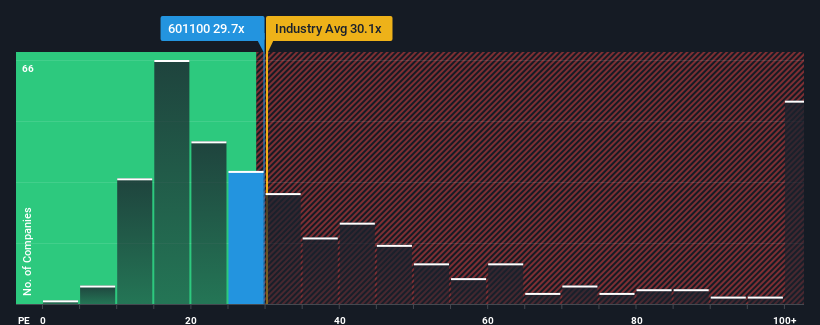

It's not a stretch to say that Jiangsu Hengli Hydraulic Co.,Ltd's (SHSE:601100) price-to-earnings (or "P/E") ratio of 29.7x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Jiangsu Hengli HydraulicLtd has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Jiangsu Hengli HydraulicLtd

How Is Jiangsu Hengli HydraulicLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like Jiangsu Hengli HydraulicLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 8.7% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

In light of this, it's understandable that Jiangsu Hengli HydraulicLtd's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Jiangsu Hengli HydraulicLtd's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Hengli HydraulicLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Jiangsu Hengli HydraulicLtd (including 1 which is concerning).

Of course, you might also be able to find a better stock than Jiangsu Hengli HydraulicLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601100

Jiangsu Hengli HydraulicLtd

Engages in manufacture and sale of hydraulic components and systems in China and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives