- China

- /

- Semiconductors

- /

- SHSE:601908

Shaanxi Construction MachineryLtd And 2 Other Global Penny Stocks Worth Watching

Reviewed by Simply Wall St

As global markets continue to react to interest rate expectations and the ongoing AI boom, investors are exploring diverse opportunities across various sectors. Among these opportunities, penny stocks remain a compelling area for those looking to uncover potential value in smaller or newer companies. Though often seen as speculative, when backed by solid financials, these stocks can offer a blend of affordability and growth potential that larger firms might not provide.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.63 | HK$995.82M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$415.94M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.575 | MYR292.38M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.40 | MYR562.17M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.60 | $348.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.225 | £195.02M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.938 | €31.63M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,729 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Shaanxi Construction MachineryLtd (SHSE:600984)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shaanxi Construction Machinery Co., Ltd, along with its subsidiaries, is involved in the research and development, manufacturing, and leasing of machinery both in China and internationally, with a market cap of CN¥4.71 billion.

Operations: Shaanxi Construction Machinery Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥4.71B

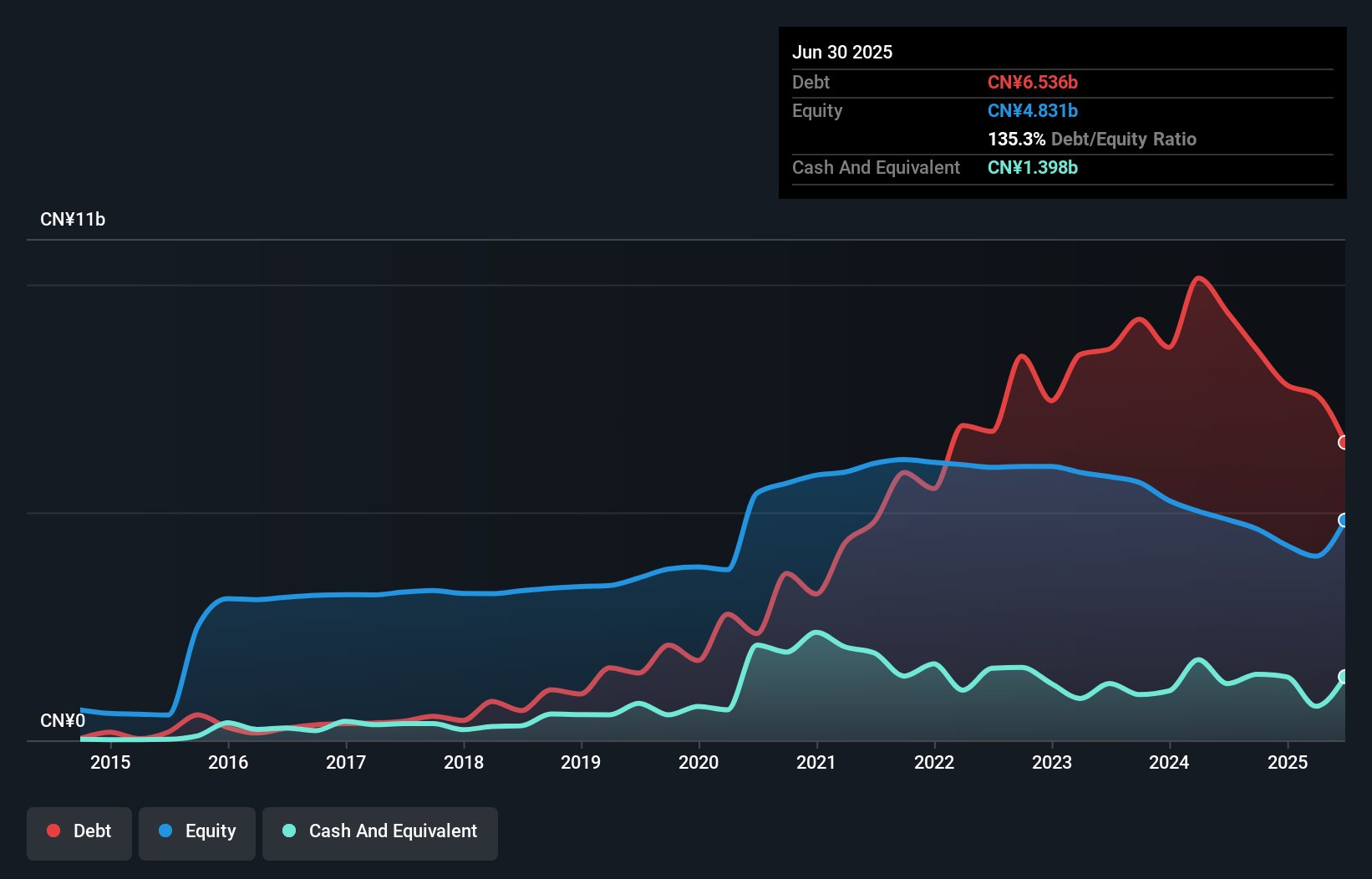

Shaanxi Construction Machinery Co., Ltd, with a market cap of CN¥4.71 billion, recently reported a net loss of CN¥447.44 million for the first half of 2025 despite generating revenue of CN¥1.12 billion. The company faces challenges with high debt levels, as indicated by a net debt to equity ratio exceeding 100%. However, it maintains stability in its short-term financial obligations, with assets surpassing liabilities and has an adequate cash runway for over three years due to positive free cash flow. Management and board experience are solid but profitability remains elusive amidst increasing losses over five years.

- Navigate through the intricacies of Shaanxi Construction MachineryLtd with our comprehensive balance sheet health report here.

- Gain insights into Shaanxi Construction MachineryLtd's future direction by reviewing our growth report.

Beijing Jingyuntong Technology (SHSE:601908)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Jingyuntong Technology Co., Ltd. and its subsidiaries focus on the research, development, production, and sale of monocrystalline silicon products both in China and internationally, with a market cap of CN¥10.26 billion.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥10.26B

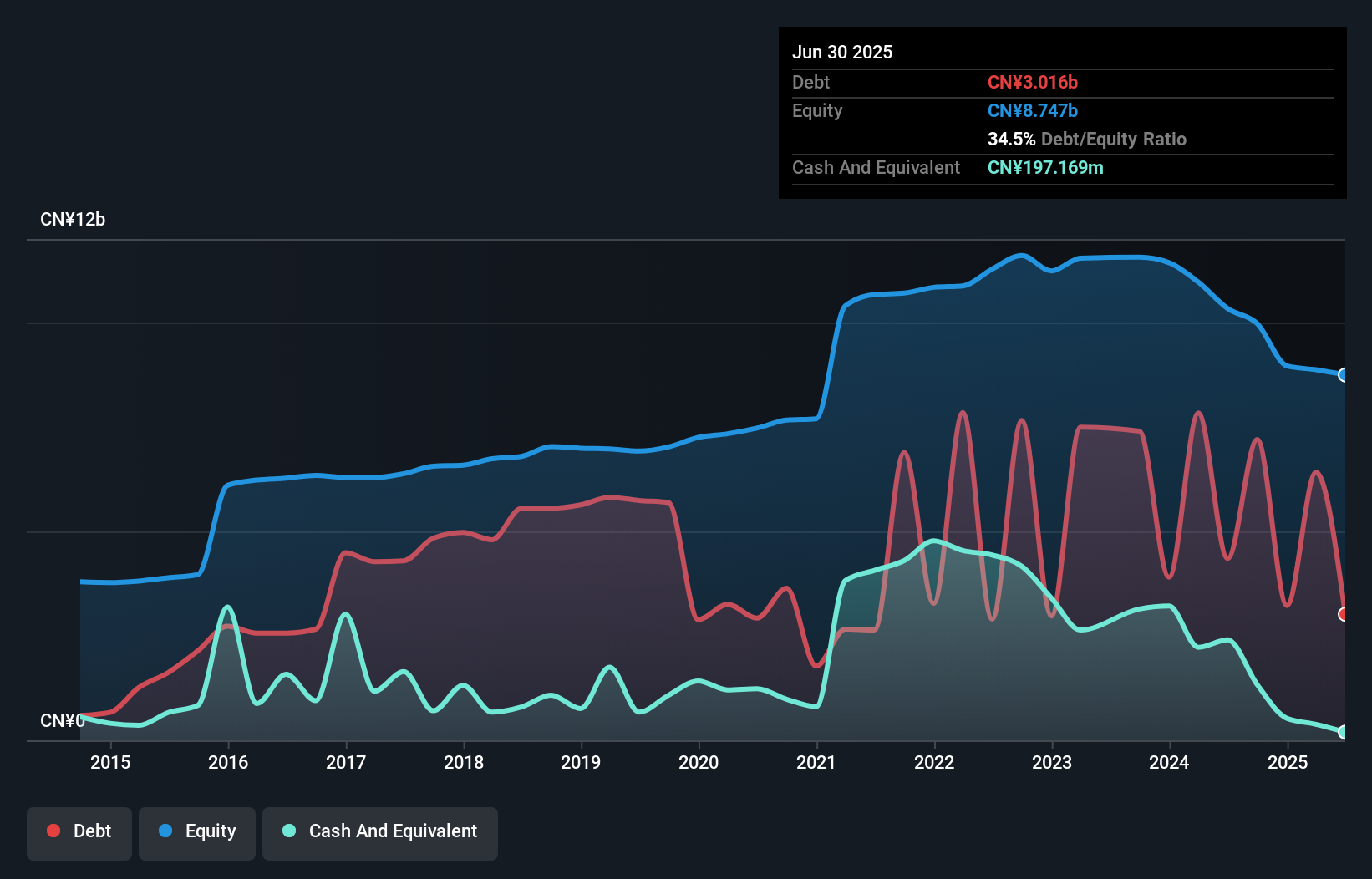

Beijing Jingyuntong Technology Co., Ltd. has a market cap of CN¥10.26 billion and recently reported a significant decrease in revenue to CN¥1,525.13 million for the first half of 2025, down from CN¥2,891.01 million the previous year, with net losses narrowing to CN¥212.01 million from CN¥1,084.78 million. Despite being unprofitable with a negative return on equity and increased losses over five years, its short-term assets exceed liabilities and debt is well covered by operating cash flow at 22%. The company's share price remains highly volatile but has not experienced meaningful shareholder dilution recently.

- Get an in-depth perspective on Beijing Jingyuntong Technology's performance by reading our balance sheet health report here.

- Learn about Beijing Jingyuntong Technology's historical performance here.

Jiangsu Baoli International Investment (SZSE:300135)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Baoli International Investment Co., Ltd. operates in various investment sectors and has a market capitalization of CN¥4.05 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥1.34 billion.

Market Cap: CN¥4.05B

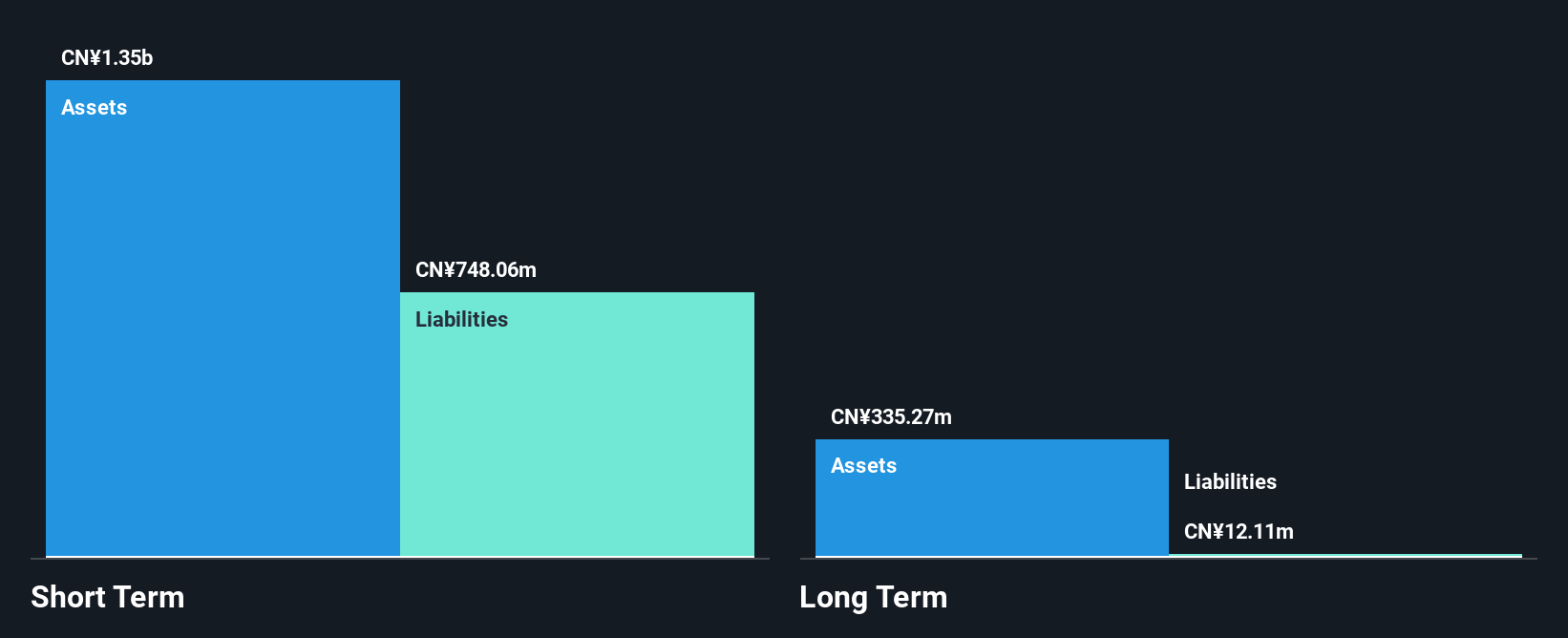

Jiangsu Baoli International Investment Co., Ltd. has a market cap of CN¥4.05 billion and reported a significant drop in revenue to CN¥519.35 million for the first half of 2025, compared to CN¥1.14 billion the previous year, resulting in a net loss of CN¥6.88 million. Despite this setback, the company has become profitable recently, though its return on equity remains low at 0.3%. The management and board are experienced with average tenures exceeding four years each, while short-term assets adequately cover both short- and long-term liabilities despite negative operating cash flow impacting debt coverage capabilities.

- Take a closer look at Jiangsu Baoli International Investment's potential here in our financial health report.

- Review our historical performance report to gain insights into Jiangsu Baoli International Investment's track record.

Next Steps

- Navigate through the entire inventory of 3,729 Global Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingyuntong Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601908

Beijing Jingyuntong Technology

Engages in the research, development, production, and sale of monocrystalline silicon products in China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives