- China

- /

- Aerospace & Defense

- /

- SHSE:600893

Analyst Estimates: Here's What Brokers Think Of AECC Aviation Power Co.,Ltd (SHSE:600893) After Its Full-Year Report

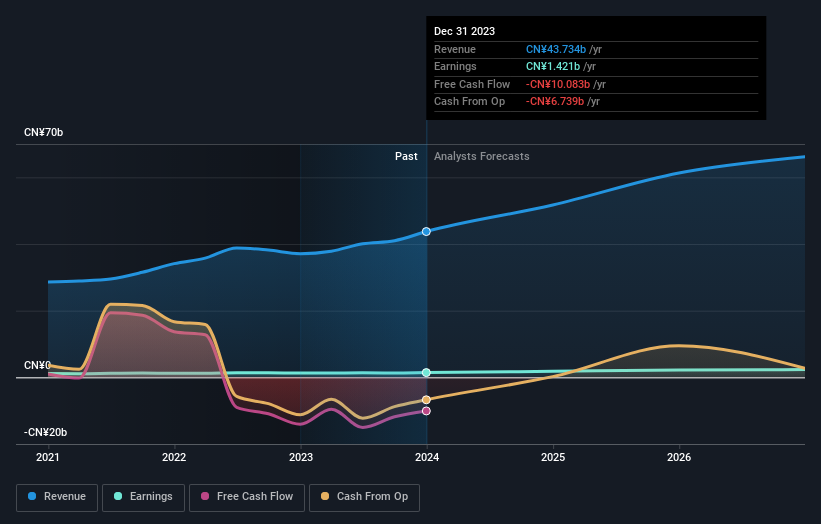

AECC Aviation Power Co.,Ltd (SHSE:600893) last week reported its latest yearly results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. It looks like the results were a bit of a negative overall. While revenues of CN¥44b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 3.9% to hit CN¥0.53 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for AECC Aviation PowerLtd

After the latest results, the ten analysts covering AECC Aviation PowerLtd are now predicting revenues of CN¥51.7b in 2024. If met, this would reflect a meaningful 18% improvement in revenue compared to the last 12 months. Per-share earnings are expected to leap 28% to CN¥0.68. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥51.4b and earnings per share (EPS) of CN¥0.68 in 2024. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at CN¥46.33. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic AECC Aviation PowerLtd analyst has a price target of CN¥50.00 per share, while the most pessimistic values it at CN¥42.16. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the AECC Aviation PowerLtd's past performance and to peers in the same industry. The analysts are definitely expecting AECC Aviation PowerLtd's growth to accelerate, with the forecast 18% annualised growth to the end of 2024 ranking favourably alongside historical growth of 14% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 22% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that AECC Aviation PowerLtd is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple AECC Aviation PowerLtd analysts - going out to 2026, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with AECC Aviation PowerLtd , and understanding it should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600893

AECC Aviation PowerLtd

Researches, develops, manufactures, and sells large and medium-sized aircraft engines and gas turbine power units in China.

Reasonable growth potential second-rate dividend payer.