Shang Gong Group Co., Ltd.'s (SHSE:600843) Shares Bounce 50% But Its Business Still Trails The Industry

The Shang Gong Group Co., Ltd. (SHSE:600843) share price has done very well over the last month, posting an excellent gain of 50%. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

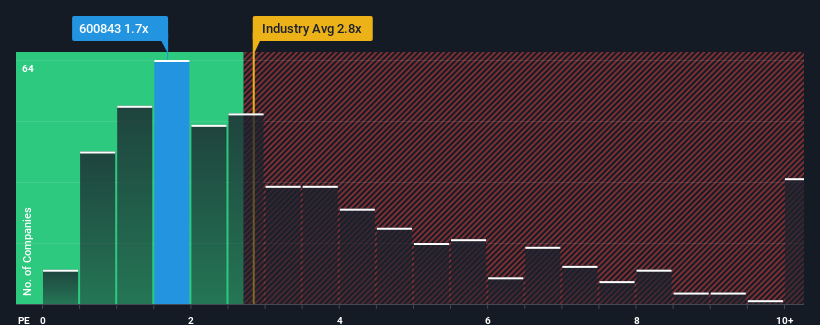

In spite of the firm bounce in price, Shang Gong Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shang Gong Group

How Has Shang Gong Group Performed Recently?

Revenue has risen firmly for Shang Gong Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shang Gong Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shang Gong Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 40% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Shang Gong Group's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Despite Shang Gong Group's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shang Gong Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Shang Gong Group (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Shang Gong Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600843

Shang Gong Group

Engages in research and development, production, and sale of industrial and household sewing machines in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives