- China

- /

- Trade Distributors

- /

- SHSE:600826

Optimistic Investors Push Dlg Exhibitions & Events Corporation Limited (SHSE:600826) Shares Up 26% But Growth Is Lacking

Those holding Dlg Exhibitions & Events Corporation Limited (SHSE:600826) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

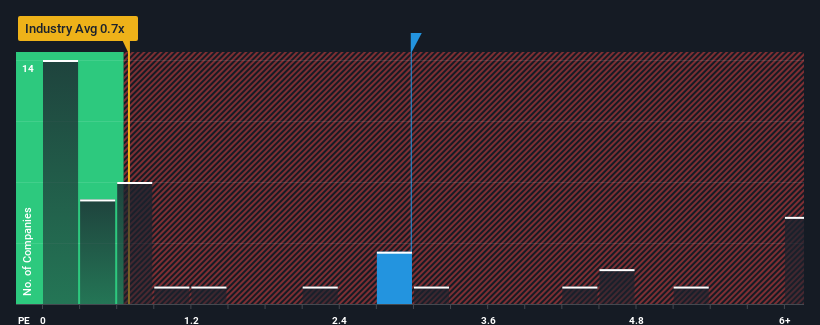

Since its price has surged higher, when almost half of the companies in China's Trade Distributors industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Dlg Exhibitions & Events as a stock not worth researching with its 3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Dlg Exhibitions & Events

How Dlg Exhibitions & Events Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Dlg Exhibitions & Events has been doing quite well of late. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dlg Exhibitions & Events.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Dlg Exhibitions & Events would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 183% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 17% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.0% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 17%, which is noticeably more attractive.

With this information, we find it concerning that Dlg Exhibitions & Events is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Dlg Exhibitions & Events' P/S?

Shares in Dlg Exhibitions & Events have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Dlg Exhibitions & Events trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 3 warning signs for Dlg Exhibitions & Events (1 shouldn't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Dlg Exhibitions & Events, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600826

Dlg Exhibitions & Events

Provides conference and exhibition services in China.

Excellent balance sheet average dividend payer.