- China

- /

- Trade Distributors

- /

- SHSE:600826

Even With A 46% Surge, Cautious Investors Are Not Rewarding Dlg Exhibitions & Events Corporation Limited's (SHSE:600826) Performance Completely

Despite an already strong run, Dlg Exhibitions & Events Corporation Limited (SHSE:600826) shares have been powering on, with a gain of 46% in the last thirty days. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

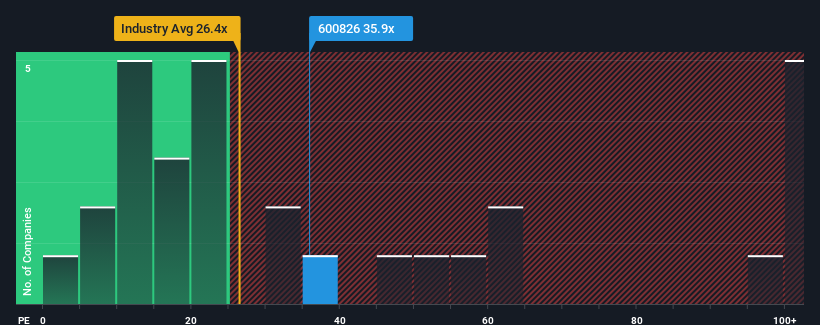

In spite of the firm bounce in price, it's still not a stretch to say that Dlg Exhibitions & Events' price-to-earnings (or "P/E") ratio of 35.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 36x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Dlg Exhibitions & Events as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Dlg Exhibitions & Events

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Dlg Exhibitions & Events' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 51% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 23% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 35% per annum over the next three years. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

With this information, we find it interesting that Dlg Exhibitions & Events is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Dlg Exhibitions & Events' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dlg Exhibitions & Events currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Dlg Exhibitions & Events (1 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Dlg Exhibitions & Events' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600826

Dlg Exhibitions & Events

Provides conference and exhibition services in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives