- China

- /

- Trade Distributors

- /

- SHSE:600811

Swelling losses haven't held back gains for Orient Group Incorporation (SHSE:600811) shareholders since they're up 30% over 1 year

It's been a soft week for Orient Group Incorporation (SHSE:600811) shares, which are down 14%. But looking back over the last year, the returns have actually been rather pleasing! Looking at the full year, the company has easily bested an index fund by gaining 30%.

While the stock has fallen 14% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Orient Group Incorporation

Orient Group Incorporation isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Orient Group Incorporation saw its revenue shrink by 81%. Despite the lack of revenue growth, the stock has returned a solid 30% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

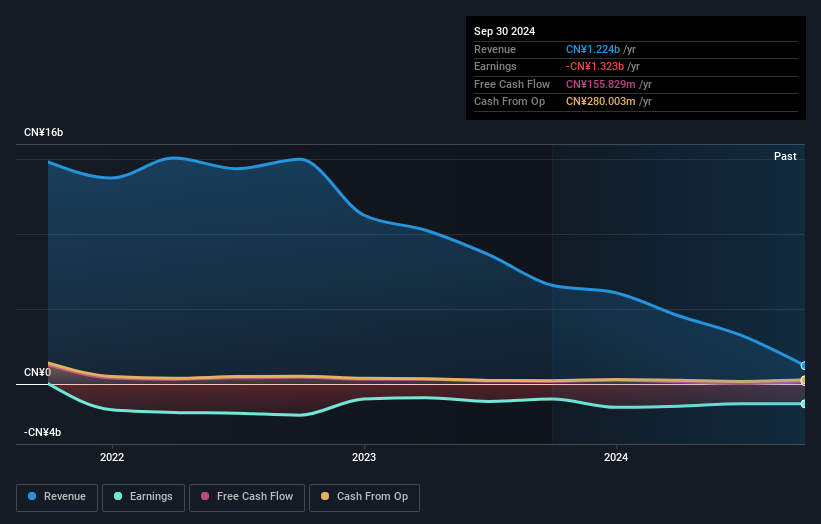

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Orient Group Incorporation has rewarded shareholders with a total shareholder return of 30% in the last twelve months. That certainly beats the loss of about 4% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Orient Group Incorporation you should be aware of.

Of course Orient Group Incorporation may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600811

Orient Group Incorporation

Engages in financial, agriculture and health food, urbanization and development, and port transportation businesses in China.

Low with imperfect balance sheet.