Is Xiamen King Long Motor Group (SHSE:600686) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Xiamen King Long Motor Group Co., Ltd. (SHSE:600686) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Xiamen King Long Motor Group

How Much Debt Does Xiamen King Long Motor Group Carry?

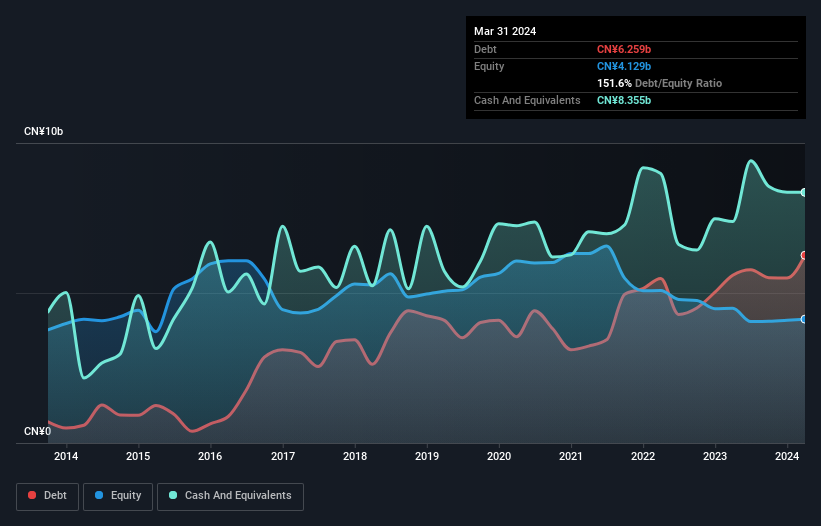

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Xiamen King Long Motor Group had CN¥6.26b of debt, an increase on CN¥5.59b, over one year. But it also has CN¥8.35b in cash to offset that, meaning it has CN¥2.10b net cash.

How Strong Is Xiamen King Long Motor Group's Balance Sheet?

We can see from the most recent balance sheet that Xiamen King Long Motor Group had liabilities of CN¥17.9b falling due within a year, and liabilities of CN¥5.07b due beyond that. On the other hand, it had cash of CN¥8.35b and CN¥5.28b worth of receivables due within a year. So its liabilities total CN¥9.38b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥5.74b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Xiamen King Long Motor Group would likely require a major re-capitalisation if it had to pay its creditors today. Given that Xiamen King Long Motor Group has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Xiamen King Long Motor Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Xiamen King Long Motor Group wasn't profitable at an EBIT level, but managed to grow its revenue by 3.0%, to CN¥20b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Xiamen King Long Motor Group?

While Xiamen King Long Motor Group lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of CN¥82m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Xiamen King Long Motor Group (of which 1 is concerning!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600686

Xiamen King Long Motor Group

Engages in the research and development, design, manufacturing, and sale of bus products in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives