Shanghai Highly (Group) (SHSE:600619) pulls back 3.2% this week, but still delivers shareholders decent 81% return over 1 year

Shanghai Highly (Group) Co., Ltd. (SHSE:600619) shareholders have seen the share price descend 16% over the month. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 81%.

Since the long term performance has been good but there's been a recent pullback of 3.2%, let's check if the fundamentals match the share price.

View our latest analysis for Shanghai Highly (Group)

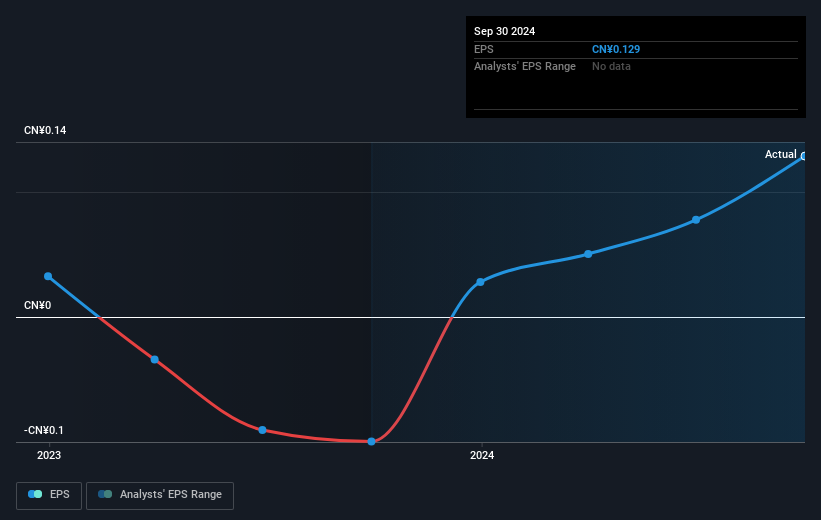

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Shanghai Highly (Group) went from making a loss to reporting a profit, in the last year.

While it's good to see positive EPS of CN¥0.13 this year, the loss wasn't too bad last year. But judging by the share price, the market is happy with the maiden profit. Inflection points like this can be a great time to take a closer look at a company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that Shanghai Highly (Group) shareholders have received a total shareholder return of 81% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Shanghai Highly (Group) better, we need to consider many other factors. For instance, we've identified 3 warning signs for Shanghai Highly (Group) (2 are potentially serious) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600619

Shanghai Highly (Group)

Researches, develops, manufactures, and sells components for white goods and energy vehicles in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives