- Philippines

- /

- Banks

- /

- PSE:BPI

3 Dividend Stocks Offering Yields Up To 4.7%

Reviewed by Simply Wall St

In the current global market landscape, characterized by geopolitical tensions and consumer spending concerns, investors are navigating a volatile environment where major indices have experienced fluctuations. Amidst these challenges, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

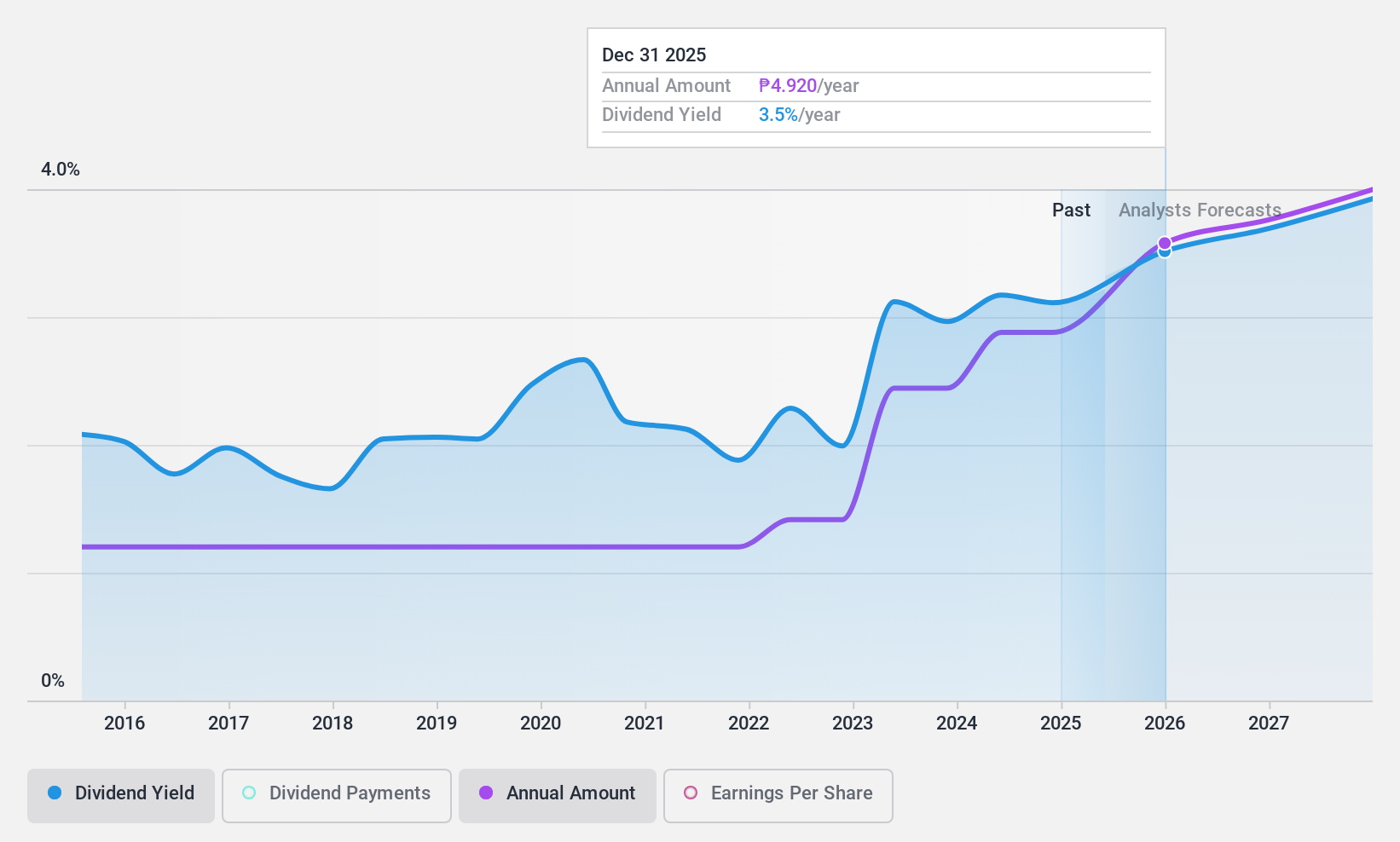

Bank of the Philippine Islands (PSE:BPI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of the Philippine Islands, along with its subsidiaries, offers a range of financial products and services to retail and corporate clients in the Philippines, with a market cap of approximately ₱675.36 billion.

Operations: Bank of the Philippine Islands generates its revenue through various financial services and products tailored for both retail and corporate clients in the Philippines.

Dividend Yield: 3%

Bank of the Philippine Islands offers a stable dividend with a 3.03% yield, supported by a low payout ratio of 33.6%, indicating dividends are well covered by earnings. The bank's dividends have been reliable and growing over the past decade, though its yield is below the top quartile in the Philippine market. Recent earnings growth and leadership changes, such as Luis Geminiano E. Cruz's appointment as Head of Institutional Banking, may influence future performance positively.

- Delve into the full analysis dividend report here for a deeper understanding of Bank of the Philippine Islands.

- According our valuation report, there's an indication that Bank of the Philippine Islands' share price might be on the expensive side.

Tiandi Science & TechnologyLtd (SHSE:600582)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tiandi Science & Technology Co. Ltd operates in mine safety, smart equipment, design and construction, green development, and clean low-carbon sectors in China with a market cap of CN¥24.33 billion.

Operations: Tiandi Science & Technology Co. Ltd generates revenue from its operations in mine safety, smart equipment, design and construction, green development, and clean low-carbon sectors within China.

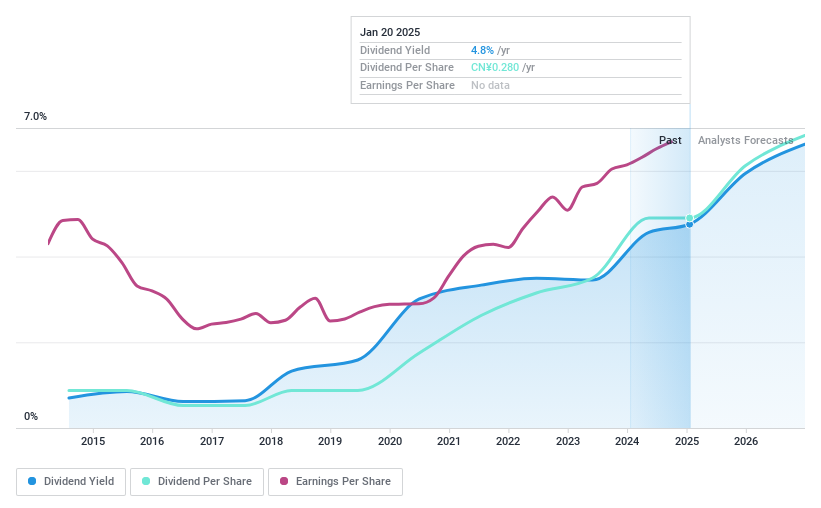

Dividend Yield: 4.7%

Tiandi Science & Technology Ltd. provides a compelling dividend yield of 4.72%, placing it in the top 25% of dividend payers in China, supported by a manageable payout ratio of 45.2%. The company's dividends are covered by both earnings and cash flows, though their history is marked by volatility and unreliability over the past decade. Despite this instability, dividend payments have grown over ten years, with the stock currently trading at a significant discount to its estimated fair value.

- Dive into the specifics of Tiandi Science & TechnologyLtd here with our thorough dividend report.

- Our valuation report here indicates Tiandi Science & TechnologyLtd may be undervalued.

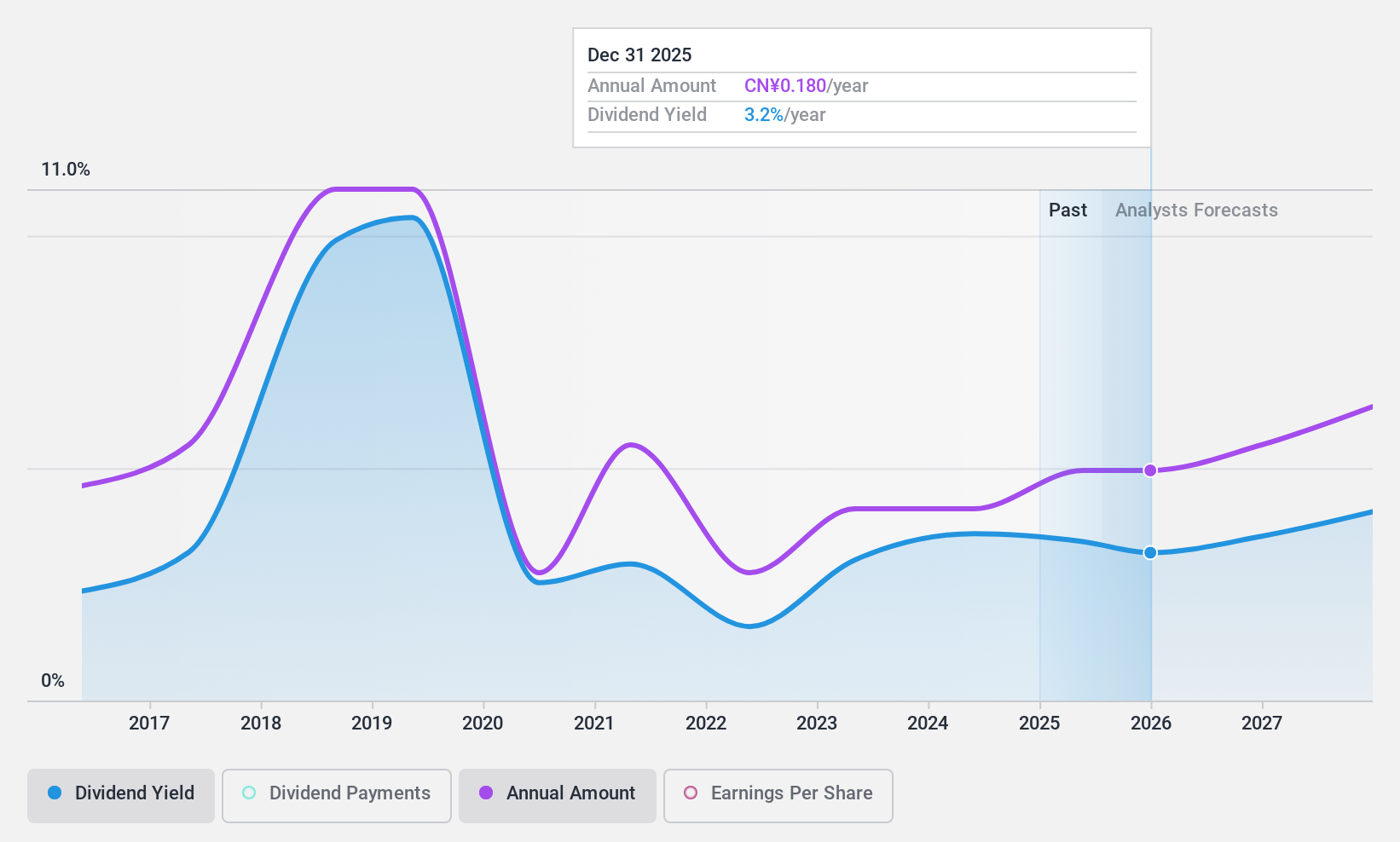

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd operates in the research, development, production, and sales of chemical fibers, textile materials, and rubber and plastic products both domestically and internationally with a market cap of CN¥5.02 billion.

Operations: Zhejiang Hailide New Material Co., Ltd's revenue is derived from its activities in chemical fibers, textile materials, and rubber and plastic products within China and on an international scale.

Dividend Yield: 3.4%

Zhejiang Hailide New Material Ltd. offers a dividend yield of 3.42%, ranking it among the top 25% of dividend payers in China, with a payout ratio of 45.4% and cash payout ratio of 41.6%, ensuring dividends are covered by earnings and cash flows. Despite past volatility, dividends have grown over ten years. The company announced a CNY 300 million share buyback program, enhancing shareholder value while trading at an attractive P/E ratio of 13.7x compared to the market's average.

- Click to explore a detailed breakdown of our findings in Zhejiang Hailide New MaterialLtd's dividend report.

- According our valuation report, there's an indication that Zhejiang Hailide New MaterialLtd's share price might be on the cheaper side.

Seize The Opportunity

- Embark on your investment journey to our 2010 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of the Philippine Islands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:BPI

Bank of the Philippine Islands

Provides various financial products and services to retail and corporate clients in the Philippines.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives