Investors Still Waiting For A Pull Back In China Shipbuilding Industry Group Power Co., Ltd. (SHSE:600482)

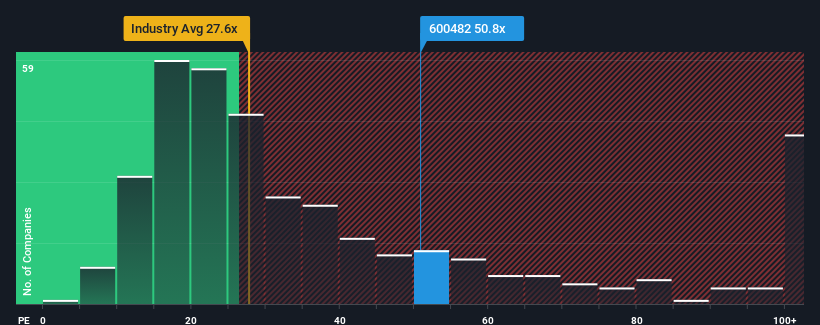

China Shipbuilding Industry Group Power Co., Ltd.'s (SHSE:600482) price-to-earnings (or "P/E") ratio of 50.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for China Shipbuilding Industry Group Power as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for China Shipbuilding Industry Group Power

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as China Shipbuilding Industry Group Power's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 175% gain to the company's bottom line. EPS has also lifted 7.1% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 103% over the next year. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we can see why China Shipbuilding Industry Group Power is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Shipbuilding Industry Group Power's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for China Shipbuilding Industry Group Power with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600482

China Shipbuilding Industry Group Power

China Shipbuilding Industry Group Power Co., Ltd.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives