Discover February 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets edge toward record highs, small-cap stocks have lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 Index by a notable margin. In this environment of heightened inflation and cautious monetary policy, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities in overlooked segments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

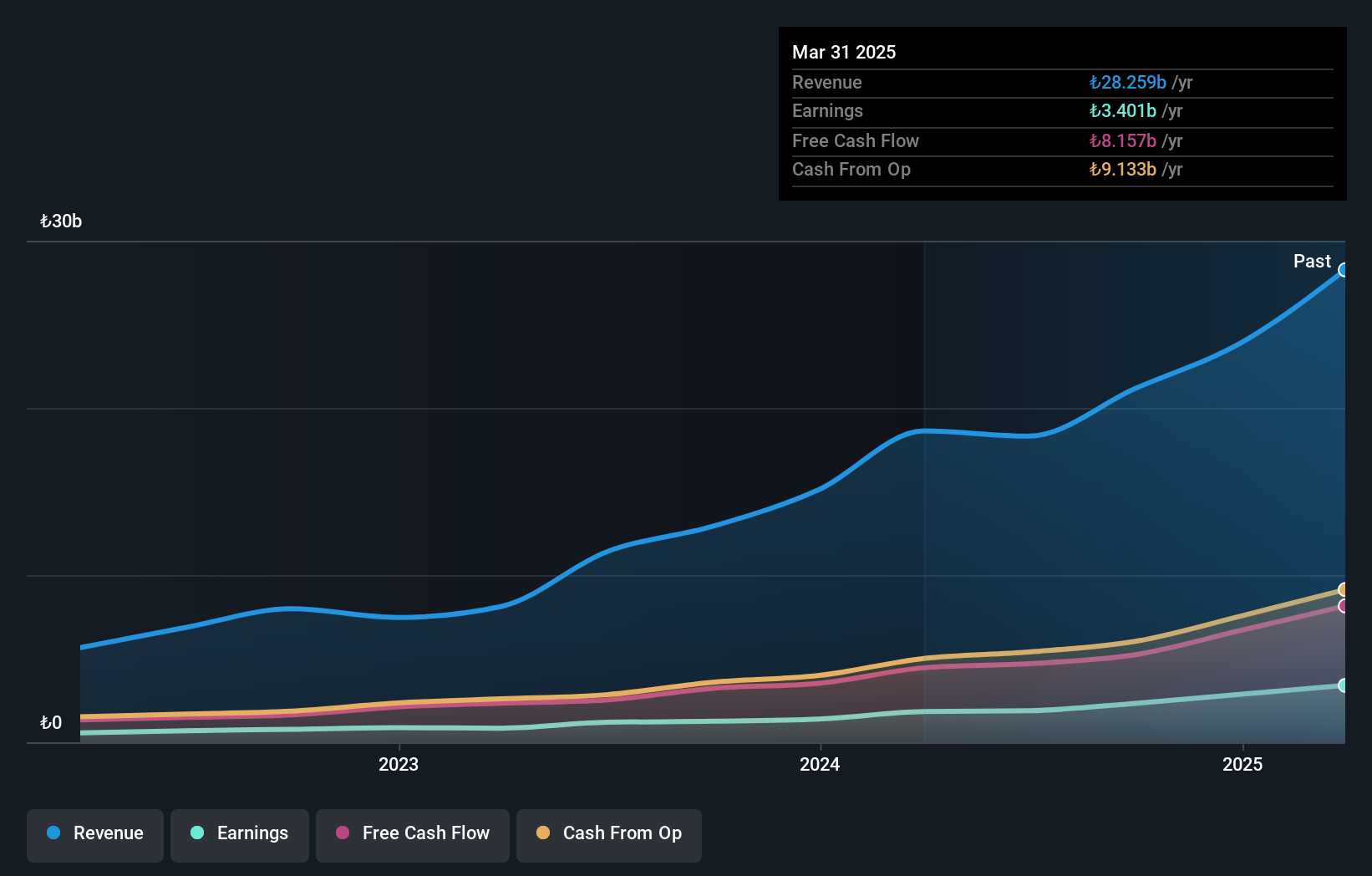

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sectors mainly in Turkey, with a market capitalization of TRY25.38 billion.

Operations: AgeSA generates revenue primarily from its Life Insurance - Pension and Life Insurance - Retirement segments, contributing TRY3.65 billion and TRY3.14 billion, respectively. The company also reports a notable adjustment segment of TRY1.34 billion, while the Life Insurance - Cumulative Life segment shows a negative contribution of TRY741.43 million.

AgeSA Hayat ve Emeklilik Anonim Sirketi, a smaller player in the insurance industry, showcases impressive financial health with no debt and high-quality earnings. Its earnings surged by 88% over the past year, outpacing the broader insurance sector's growth of 84.4%. This growth is supported by a favorable price-to-earnings ratio of 10.7x compared to the TR market average of 15.7x, suggesting potential undervaluation. The company also boasts positive free cash flow and has remained profitable over time, highlighting its robust operational efficiency and strong market positioning within its niche segment.

Tianjin Benefo Tejing Electric (SHSE:600468)

Simply Wall St Value Rating: ★★★★★☆

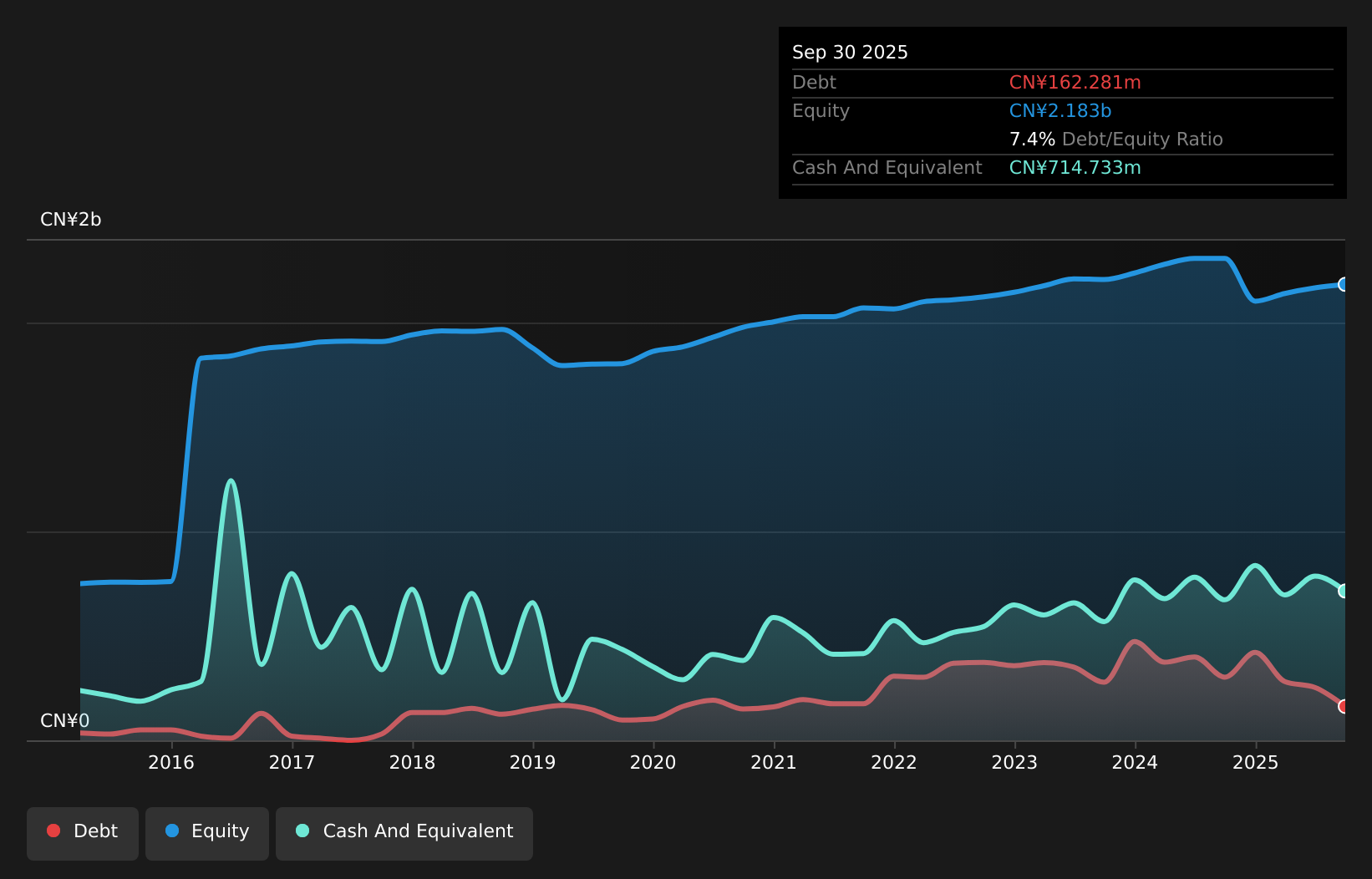

Overview: Tianjin Benefo Tejing Electric Co., Ltd. operates in the power equipment industry both in China and internationally, with a market cap of CN¥5.03 billion.

Operations: Tianjin Benefo Tejing Electric generates revenue primarily from its power equipment segment. The company's cost structure includes significant expenses related to production and distribution within this sector. Notably, the gross profit margin has shown interesting trends over recent periods, reflecting changes in operational efficiency and market conditions.

Tianjin Benefo Tejing Electric, a smaller player in the machinery sector, has shown promising signs with earnings growth of 4.8% over the past year, outpacing the industry average of -0.06%. The company is financially robust, boasting more cash than its total debt and maintaining a positive free cash flow. However, its debt to equity ratio has risen from 5.4% to 13.1% over five years, which might warrant attention despite not affecting interest payment coverage due to sufficient earnings quality. An upcoming shareholders meeting on January 6 could provide further insights into strategic directions and future prospects for this dynamic entity in Tianjin's economic landscape.

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Value Rating: ★★★★★★

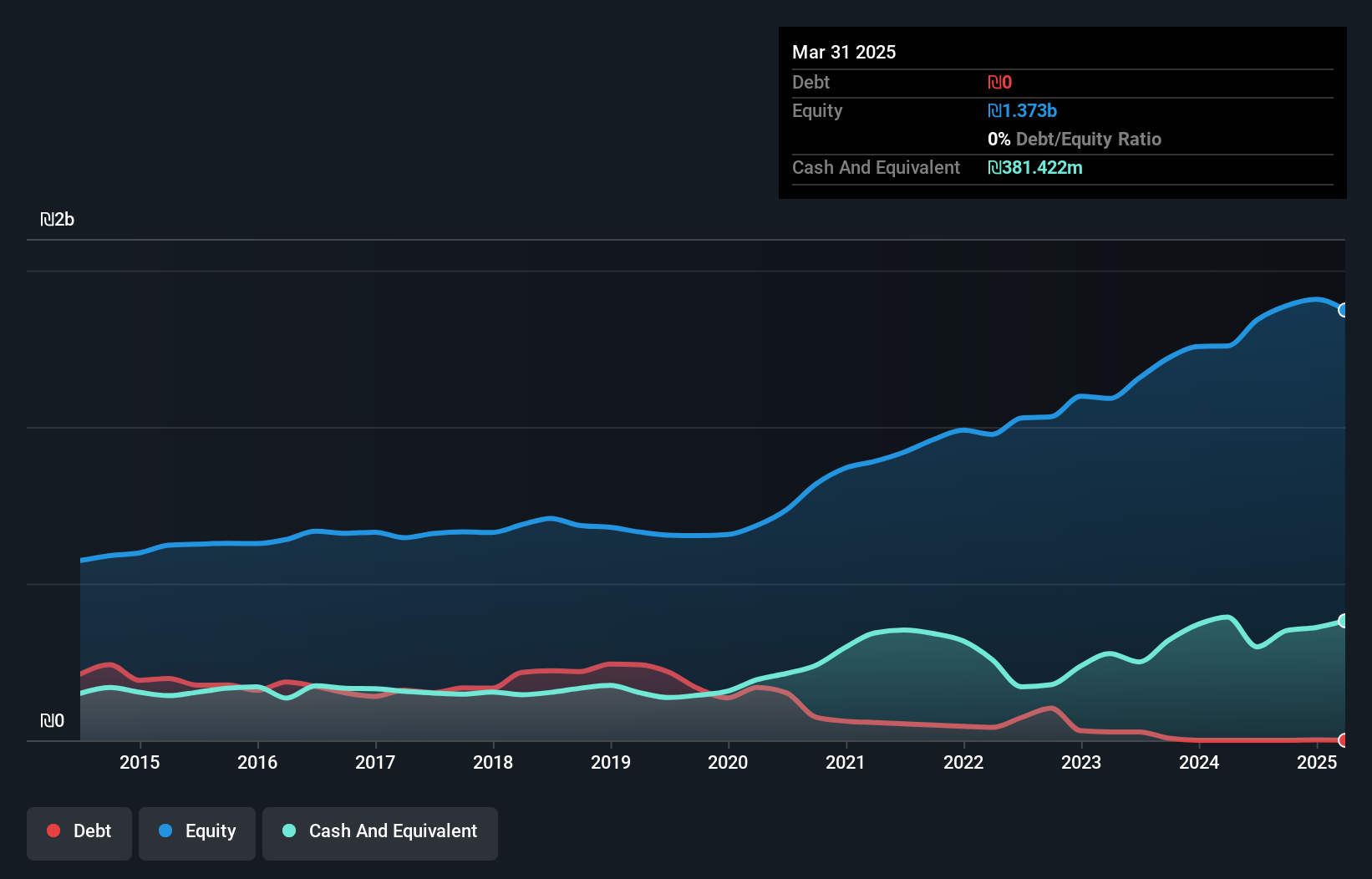

Overview: Palram Industries (1990) Ltd specializes in manufacturing and selling thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪2.60 billion.

Operations: Palram generates revenue primarily through its Polycarbonate Sector, contributing ₪965.66 million, followed by the PVC and Canopia Sectors with revenues of ₪436.67 million and ₪265.80 million, respectively. The Pur-U Sector adds another ₪197.89 million to the company's revenue streams.

Palram Industries, a nimble player in the market, has shown impressive financial resilience and growth. Over the past year, its earnings surged by 42%, outpacing the Chemicals industry's 9.7% growth rate. This performance is supported by a debt-free balance sheet, contrasting with a debt-to-equity ratio of 25% five years ago. The company reported third-quarter sales of ILS 490 million and net income of ILS 62 million, reflecting solid profitability with basic earnings per share at ILS 2.42 from continuing operations. With a price-to-earnings ratio of 10.9x below the IL market average, Palram appears attractively valued for investors seeking opportunities in this segment.

- Click to explore a detailed breakdown of our findings in Palram Industries (1990)'s health report.

Learn about Palram Industries (1990)'s historical performance.

Next Steps

- Click this link to deep-dive into the 4733 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AGESA

AgeSA Hayat ve Emeklilik Anonim Sirketi

Engages in the pension and life insurance business primarily in Turkey.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives