- China

- /

- Aerospace & Defense

- /

- SHSE:600316

Jiangxi Hongdu Aviation Industry Co., Ltd. (SHSE:600316) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Jiangxi Hongdu Aviation Industry Co., Ltd. (SHSE:600316) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

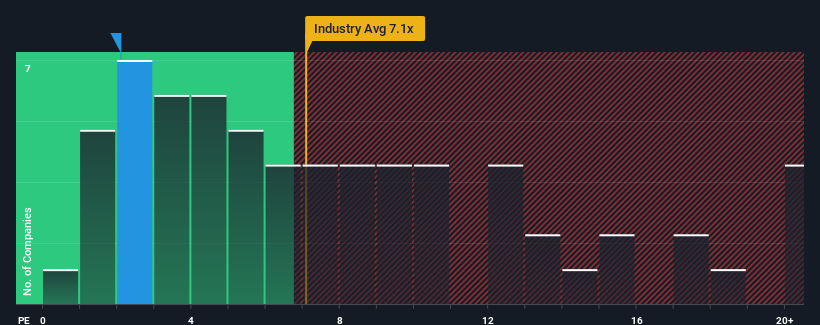

Even after such a large jump in price, Jiangxi Hongdu Aviation Industry may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.1x, considering almost half of all companies in the Aerospace & Defense industry in China have P/S ratios greater than 7.1x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Jiangxi Hongdu Aviation Industry

What Does Jiangxi Hongdu Aviation Industry's P/S Mean For Shareholders?

Jiangxi Hongdu Aviation Industry has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Jiangxi Hongdu Aviation Industry will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Jiangxi Hongdu Aviation Industry, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Jiangxi Hongdu Aviation Industry's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 48% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Jiangxi Hongdu Aviation Industry's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Jiangxi Hongdu Aviation Industry's P/S Mean For Investors?

Even after such a strong price move, Jiangxi Hongdu Aviation Industry's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Jiangxi Hongdu Aviation Industry confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Jiangxi Hongdu Aviation Industry that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600316

Jiangxi Hongdu Aviation Industry

Jiangxi Hongdu Aviation Industry Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives