- Hong Kong

- /

- Capital Markets

- /

- SEHK:245

Discovering Opportunities: 3 Penny Stocks With Over US$50M Market Cap

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices showing varied performances and economic indicators like the Chicago PMI reflecting ongoing challenges, investors are keenly observing potential opportunities. The term 'penny stocks' may seem outdated, yet these smaller or newer companies continue to offer intriguing possibilities for those looking beyond established market giants. In this article, we explore three penny stocks that stand out due to their robust financial foundations and growth potential, providing a glimpse into the hidden value they might hold.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £471.86M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Bosideng International Holdings (SEHK:3998) | HK$3.57 | HK$39.31B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.44 | £182.11M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.18M | ★★★★☆☆ |

Click here to see the full list of 5,852 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services across Hong Kong, Mainland China, Japan, and Canada with a market cap of approximately HK$1.56 billion.

Operations: The company's revenue is primarily derived from Investment Holding at HK$58.71 million, followed by Asset Management at HK$16.56 million, and Securities Brokerage including Investment Banking at HK$9.04 million.

Market Cap: HK$1.56B

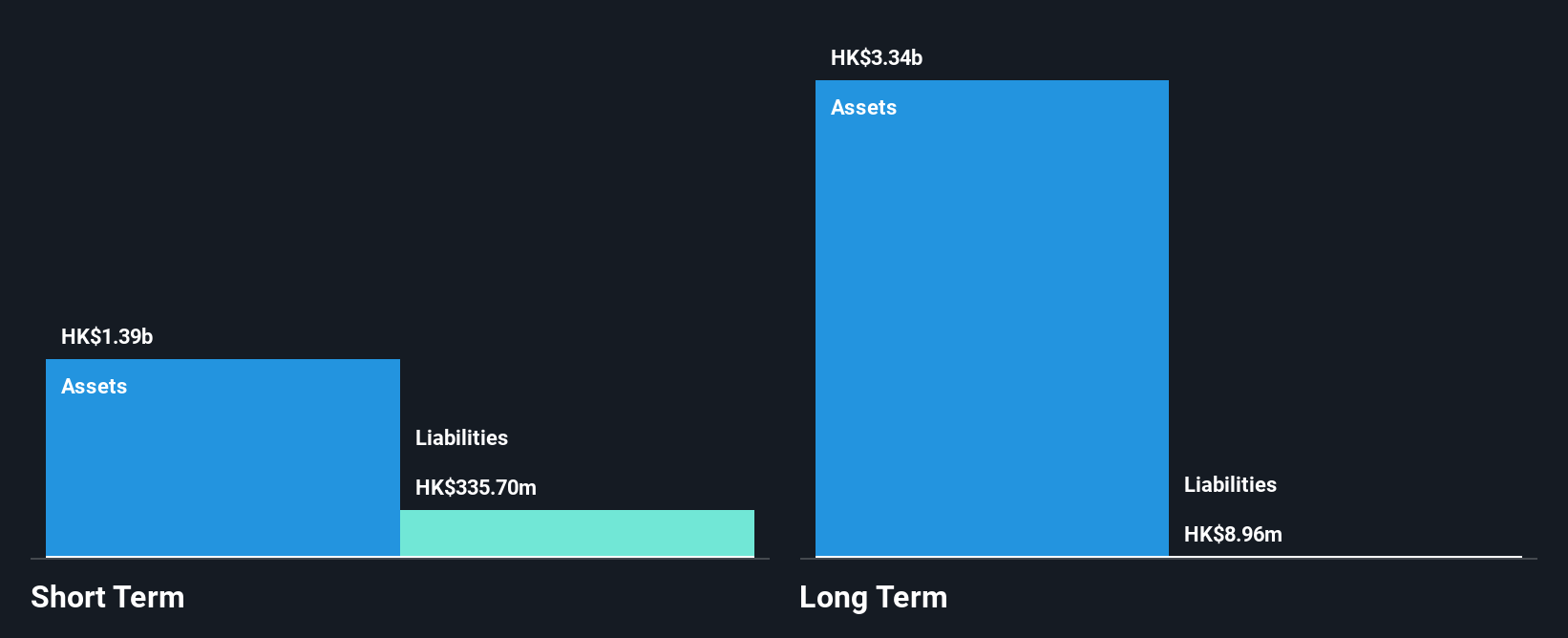

China Vered Financial Holding Corporation Limited, with a market cap of HK$1.56 billion, operates in asset management and securities services across multiple regions. Despite being unprofitable and having a negative return on equity of -0.19%, the company is debt-free and has sufficient cash runway for over three years based on current free cash flow trends. Recent executive changes include the appointment of Ms. Cao Jianmei as an executive director, bringing extensive finance experience to the team. Shareholders have faced dilution with shares outstanding increasing by 7.1% last year, reflecting potential challenges in capital management strategies.

- Unlock comprehensive insights into our analysis of China Vered Financial Holding stock in this financial health report.

- Gain insights into China Vered Financial Holding's historical outcomes by reviewing our past performance report.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Huading Industrial Co., Ltd. focuses on the research and development, production, and sale of CNC machine tools and elevator accessories in China, with a market cap of approximately CN¥1.55 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥269.85 million.

Market Cap: CN¥1.55B

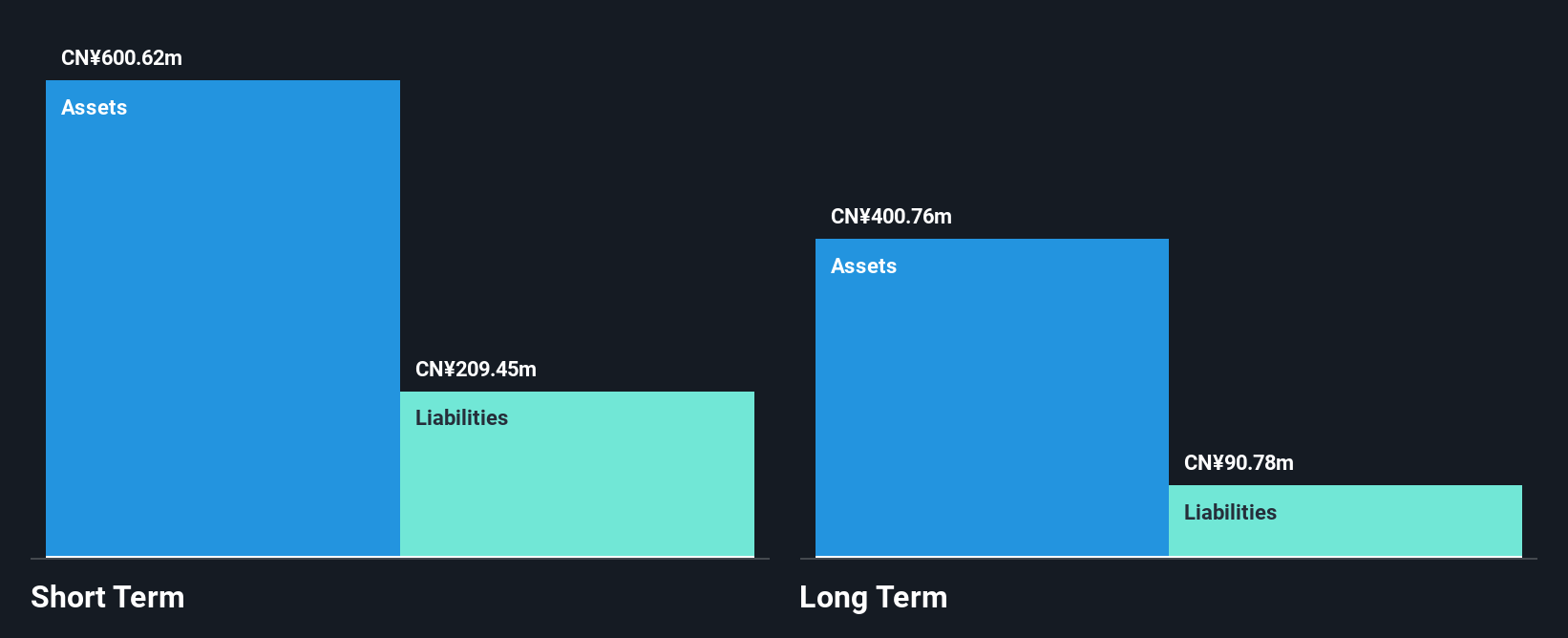

Qinghai Huading Industrial, with a market cap of CN¥1.55 billion, is focused on CNC machine tools and elevator accessories in China. The company remains unprofitable but has reduced losses by 15.8% annually over five years, indicating potential progress toward profitability. Its short-term assets of CN¥552.9 million comfortably cover both short-term and long-term liabilities, suggesting solid financial management despite a negative return on equity of -21.92%. Recent earnings show sales decreased to CN¥185.37 million for the first nine months of 2024 from CN¥271.56 million the previous year, yet net loss narrowed from CN¥28.37 million to CN¥17.62 million.

- Dive into the specifics of Qinghai Huading Industrial here with our thorough balance sheet health report.

- Learn about Qinghai Huading Industrial's historical performance here.

3U Holding (XTRA:UUU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3U Holding AG, with a market cap of €53.99 million, operates through its subsidiaries to offer telecommunication and information technology services both in Germany and internationally.

Operations: The company's revenue is primarily derived from its Sanitary, Heating and Air Conditioning (SHAC) segment at €48.66 million, followed by Information and Telecommunications Technology (ITC) at €20.49 million, and Renewable Energies excluding SHAC at €5.81 million.

Market Cap: €53.99M

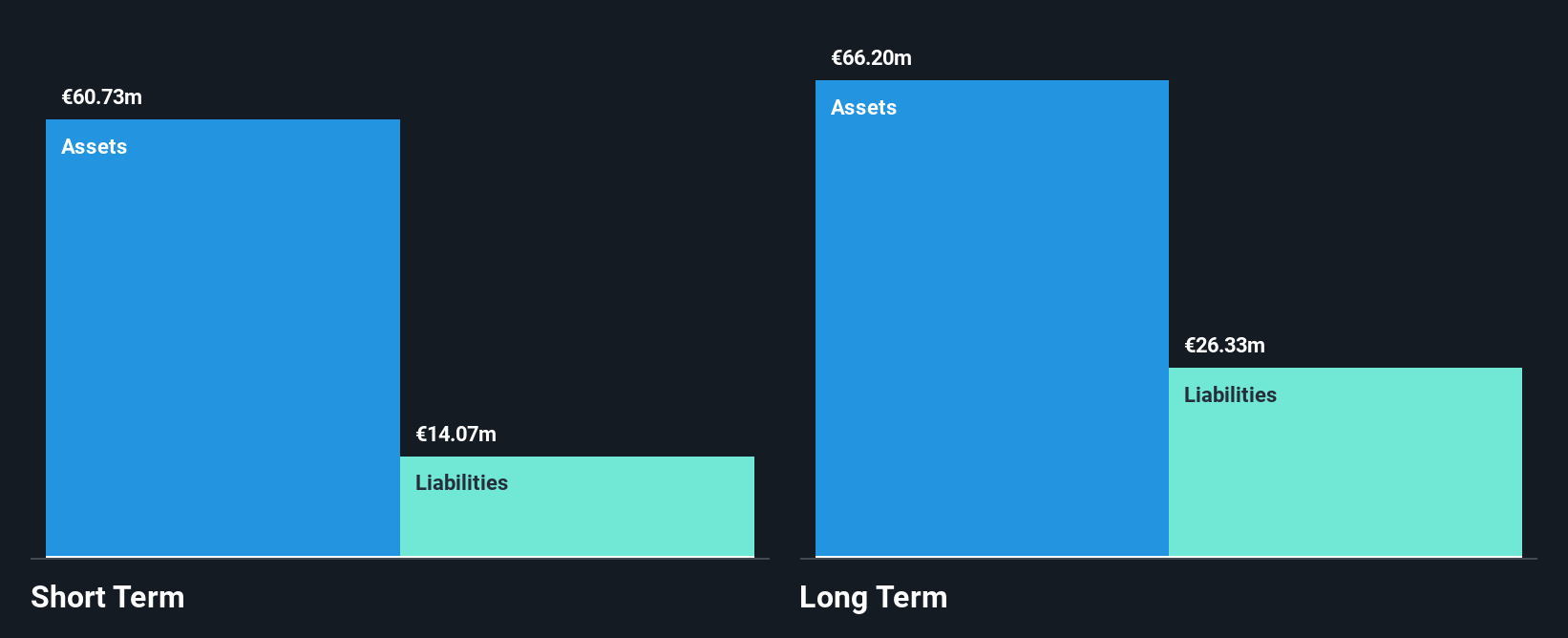

3U Holding AG, with a market cap of €53.99 million, has faced challenges as its earnings have declined by 12.1% annually over the past five years. Despite this, the company maintains high-quality earnings and has reduced its debt-to-equity ratio from 50.5% to 21.5%. Short-term assets of €60.2 million exceed both short-term and long-term liabilities, indicating strong liquidity management. However, recent guidance suggests lower-than-expected group sales for 2024 at a minimum of €55 million compared to previous forecasts. Although analysts predict a potential stock price increase of 62.2%, profitability remains under pressure with low return on equity at 2.2%.

- Navigate through the intricacies of 3U Holding with our comprehensive balance sheet health report here.

- Examine 3U Holding's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Investigate our full lineup of 5,852 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:245

China Vered Financial Holding

An investment holding company, provides asset management, consultancy, financing, and securities advisory and brokerage services in Hong Kong, Mainland China, Japan, and Canada.

Flawless balance sheet minimal.

Market Insights

Community Narratives