Here's Why Taiyuan Heavy Industry (SHSE:600169) Is Weighed Down By Its Debt Load

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Taiyuan Heavy Industry Co., Ltd. (SHSE:600169) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Taiyuan Heavy Industry

What Is Taiyuan Heavy Industry's Net Debt?

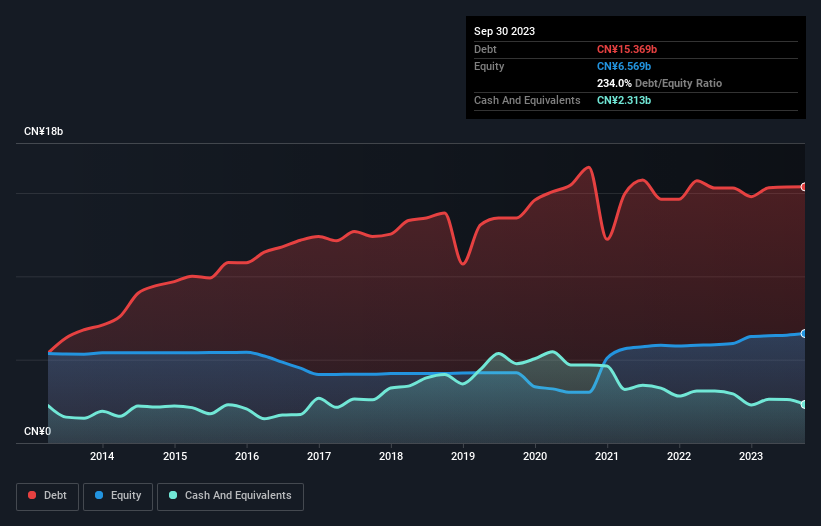

As you can see below, Taiyuan Heavy Industry had CN¥15.4b of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CN¥2.31b, its net debt is less, at about CN¥13.1b.

How Healthy Is Taiyuan Heavy Industry's Balance Sheet?

The latest balance sheet data shows that Taiyuan Heavy Industry had liabilities of CN¥15.6b due within a year, and liabilities of CN¥10.6b falling due after that. On the other hand, it had cash of CN¥2.31b and CN¥10.8b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥13.1b.

The deficiency here weighs heavily on the CN¥7.57b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Taiyuan Heavy Industry would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Taiyuan Heavy Industry shareholders face the double whammy of a high net debt to EBITDA ratio (13.9), and fairly weak interest coverage, since EBIT is just 1.9 times the interest expense. This means we'd consider it to have a heavy debt load. Even more troubling is the fact that Taiyuan Heavy Industry actually let its EBIT decrease by 5.0% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Taiyuan Heavy Industry's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Taiyuan Heavy Industry burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Taiyuan Heavy Industry's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. Considering all the factors previously mentioned, we think that Taiyuan Heavy Industry really is carrying too much debt. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Taiyuan Heavy Industry (1 is a bit concerning) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Taiyuan Heavy Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600169

Taiyuan Heavy Industry

Manufactures and sells heavy-duty machinery in China.

Mediocre balance sheet low.