- China

- /

- Aerospace & Defense

- /

- SHSE:600118

A Piece Of The Puzzle Missing From China Spacesat Co.,Ltd.'s (SHSE:600118) Share Price

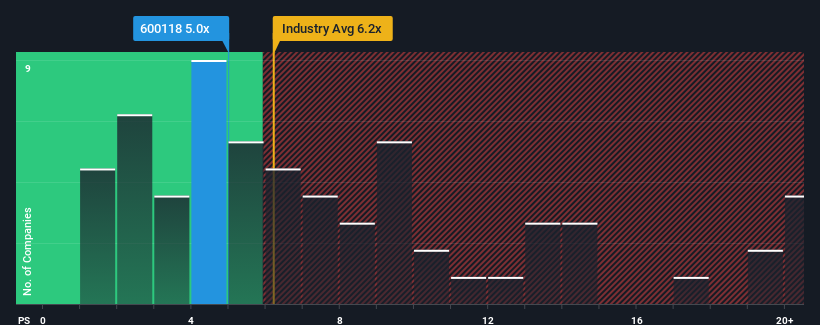

It's not a stretch to say that China Spacesat Co.,Ltd.'s (SHSE:600118) price-to-sales (or "P/S") ratio of 5x right now seems quite "middle-of-the-road" for companies in the Aerospace & Defense industry in China, where the median P/S ratio is around 6.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for China SpacesatLtd

How China SpacesatLtd Has Been Performing

China SpacesatLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China SpacesatLtd will help you uncover what's on the horizon.How Is China SpacesatLtd's Revenue Growth Trending?

In order to justify its P/S ratio, China SpacesatLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 26% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 59% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 39%, which is noticeably less attractive.

In light of this, it's curious that China SpacesatLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From China SpacesatLtd's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that China SpacesatLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware China SpacesatLtd is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600118

China SpacesatLtd

Engages in the research and development, design, manufacture, sale, and information servicing of aerospace technology applications and related products.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives