- China

- /

- Trade Distributors

- /

- SHSE:600083

Jiangsu Boxin Investing&Holdings Co.,Ltd.'s (SHSE:600083) Stock Retreats 50% But Revenues Haven't Escaped The Attention Of Investors

Jiangsu Boxin Investing&Holdings Co.,Ltd. (SHSE:600083) shares have had a horrible month, losing 50% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

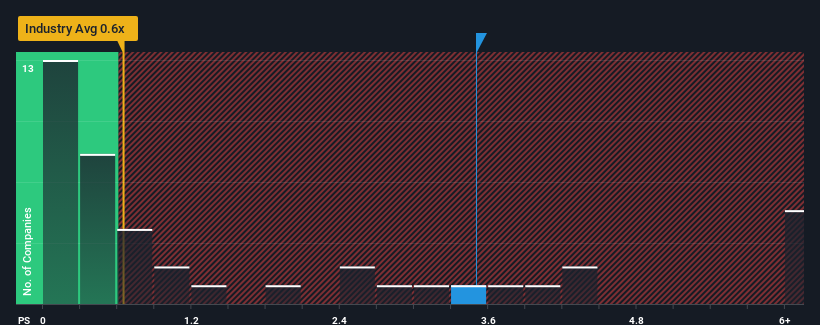

Although its price has dipped substantially, you could still be forgiven for thinking Jiangsu Boxin Investing&HoldingsLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in China's Trade Distributors industry have P/S ratios below 0.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiangsu Boxin Investing&HoldingsLtd

How Jiangsu Boxin Investing&HoldingsLtd Has Been Performing

For instance, Jiangsu Boxin Investing&HoldingsLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Boxin Investing&HoldingsLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Jiangsu Boxin Investing&HoldingsLtd's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Jiangsu Boxin Investing&HoldingsLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Jiangsu Boxin Investing&HoldingsLtd's P/S?

Even after such a strong price drop, Jiangsu Boxin Investing&HoldingsLtd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Jiangsu Boxin Investing&HoldingsLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Jiangsu Boxin Investing&HoldingsLtd is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600083

Jiangsu Boxin Investing&HoldingsLtd

Jiangsu Boxin Investing&Holdings Co.,Ltd.

Adequate balance sheet very low.