- China

- /

- Electrical

- /

- SHSE:600241

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are keenly observing the performance of small-cap stocks within indices like the S&P 600. Despite recent volatility, this environment presents opportunities to uncover lesser-known companies that may offer unique value propositions. In such conditions, identifying stocks with strong fundamentals and growth potential can be key to enhancing a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

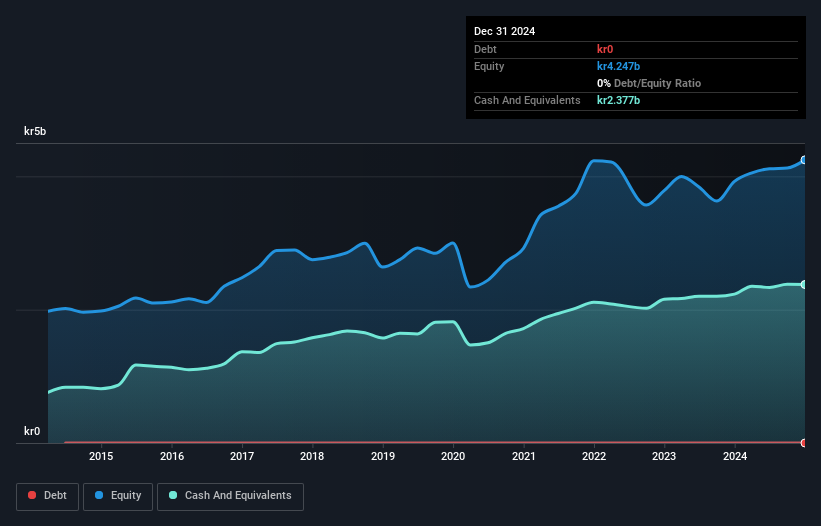

AB Traction (OM:TRAC B)

Simply Wall St Value Rating: ★★★★★★

Overview: AB Traction is a private equity firm that focuses on distressed, middle market, later stage, mature, bridge, recapitalization, buyouts and PIPES investments with a market cap of SEK3.93 billion.

Operations: The company's revenue streams include SEK79.30 million from unlisted holdings, SEK275.60 million from active listed holdings, and SEK309.80 million from financial investments.

AB Traction, a smaller player in the market, has shown impressive financial resilience. The company reported a net income of SEK 10.7 million for Q3 2024, bouncing back from a SEK 210 million loss the previous year. For the nine months ending September 2024, net income reached SEK 354.4 million compared to a loss of SEK 25.3 million last year. Trading at about 12% below its estimated fair value and boasting earnings growth of over 241%, it outpaces industry averages significantly. With no debt on its books for five years and high-quality non-cash earnings, AB Traction presents an intriguing opportunity for investors seeking undervalued stocks with robust fundamentals.

- Take a closer look at AB Traction's potential here in our health report.

Understand AB Traction's track record by examining our Past report.

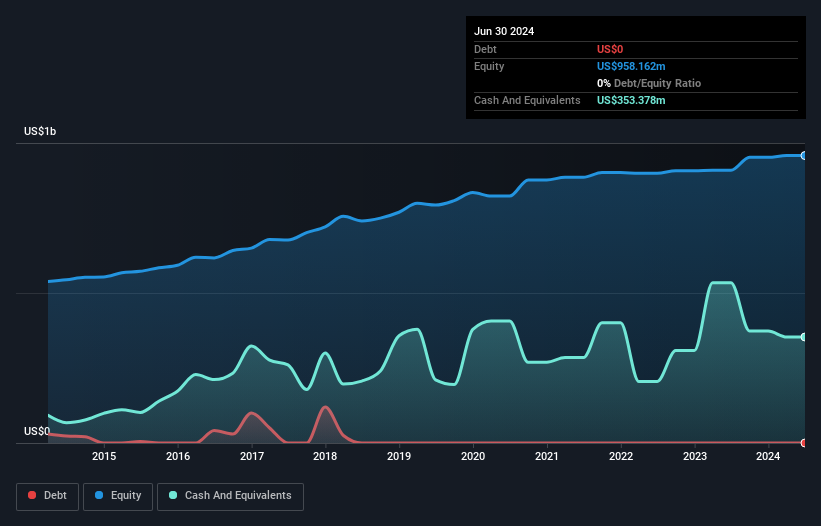

China Aviation Oil (Singapore) (SGX:G92)

Simply Wall St Value Rating: ★★★★★★

Overview: China Aviation Oil (Singapore) Corporation Ltd is engaged in the trading and supply of jet fuel and other petroleum products to the global civil aviation industry, with a market capitalization of SGD791.37 million.

Operations: The company's primary revenue streams are from Middle Distillates, generating $10.53 billion, and Other Oil Products, contributing $5.16 billion.

China Aviation Oil, known for its strategic role in the aviation fuel supply chain, is a small player that has shown remarkable earnings growth of 143% over the past year. This performance surpasses the broader oil and gas industry growth of 14.5%, highlighting its competitive edge. Trading at 61.6% below estimated fair value, it offers an attractive entry point compared to peers. Despite not being free cash flow positive recently, the company remains debt-free with high-quality non-cash earnings, suggesting a sturdy financial footing and potential room for future growth within its sector dynamics.

- Delve into the full analysis health report here for a deeper understanding of China Aviation Oil (Singapore).

Learn about China Aviation Oil (Singapore)'s historical performance.

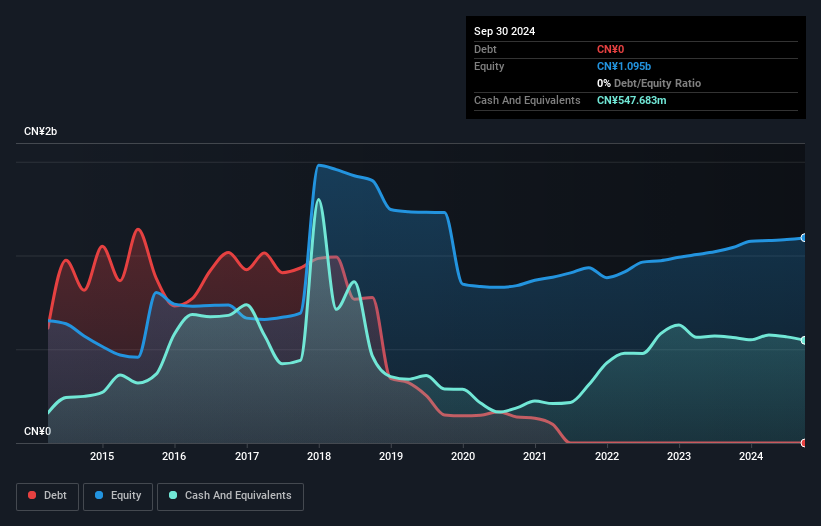

Liaoning Shidai WanhengLtd (SHSE:600241)

Simply Wall St Value Rating: ★★★★★★

Overview: Liaoning Shidai Wanheng Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and sale of energy batteries and has a market cap of CN¥2.07 billion.

Operations: Liaoning Shidai Wanheng Ltd generates revenue primarily through the production and sale of energy batteries. The company has a market cap of CN¥2.07 billion, indicating its valuation in the financial markets.

Liaoning Shidai Wanheng, a player in the electrical industry, has demonstrated high-quality earnings despite facing challenges. Its debt-free status marks a significant improvement from five years ago when the debt to equity ratio was 12.2%. Earnings growth of 6.8% outpaced the industry average of 1.1%, highlighting its competitive edge. However, recent financials show sales at CNY 298 million for nine months ending September 2024, down from CNY 514 million in the previous year, with net income dropping to CNY 18.81 million from CNY 44.42 million. This suggests potential operational hurdles impacting revenue and profitability recently.

Next Steps

- Embark on your investment journey to our 4645 Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600241

Liaoning Shidai WanhengLtd

Engages in the research, development, production, and sale of energy batteries.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives