- China

- /

- Aerospace & Defense

- /

- SHSE:600038

Investors three-year losses continue as Avicopter (SHSE:600038) dips a further 5.9% this week, earnings continue to decline

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Avicopter Plc (SHSE:600038) shareholders, since the share price is down 50% in the last three years, falling well short of the market decline of around 19%. The falls have accelerated recently, with the share price down 12% in the last three months.

Since Avicopter has shed CN¥1.9b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Avicopter

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

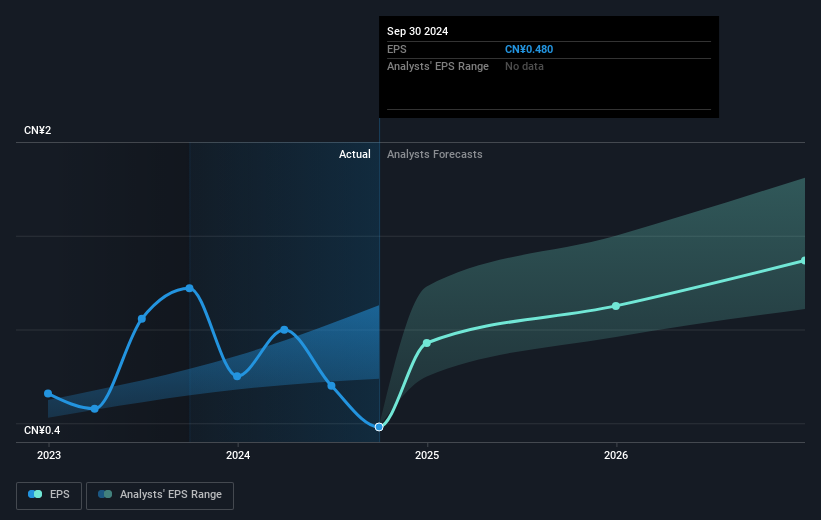

During the three years that the share price fell, Avicopter's earnings per share (EPS) dropped by 38% each year. In comparison the 20% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 103.76, it's fair to say the market sees a brighter future for the business.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Avicopter's key metrics by checking this interactive graph of Avicopter's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 6.1% in the last year, Avicopter shareholders lost 1.6% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 3% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Avicopter you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600038

Avicopter

Manufactures and sells helicopters in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives