- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8240

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

In the midst of a bustling week for global markets, characterized by mixed earnings reports and economic signals, investors are navigating a landscape where growth stocks have lagged behind value shares, and small-caps have shown resilience compared to their larger counterparts. As major indices like the Nasdaq Composite and S&P MidCap 400 experience fluctuations amidst macroeconomic uncertainties, dividend stocks present an appealing option for those seeking stability and income in their portfolios. In such volatile times, a good dividend stock is often one that offers consistent payouts backed by strong fundamentals, providing investors with both potential income and some measure of security against market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.86 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue primarily from Finished Drugs, amounting to CN¥1.04 billion, and Intermediates and Bulk Medicines, totaling CN¥130.31 million.

Dividend Yield: 5.9%

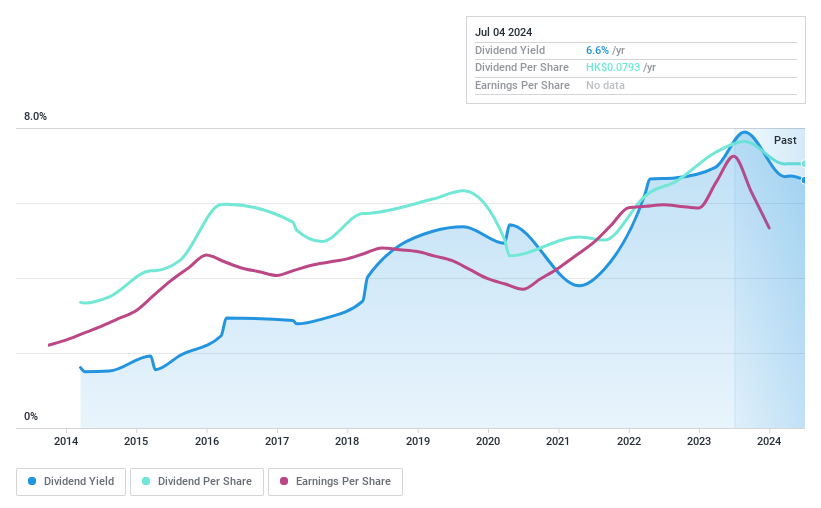

Dawnrays Pharmaceutical's dividend payments have been volatile over the past decade, with a recent interim dividend of HK$0.015 per share. Although its payout ratio of 19.4% indicates dividends are well covered by earnings, the cash payout ratio is higher at 86.3%. The company has shown earnings growth with net income rising significantly recently, but its dividend yield of 5.94% remains below top-tier levels in Hong Kong.

- Click here to discover the nuances of Dawnrays Pharmaceutical (Holdings) with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Dawnrays Pharmaceutical (Holdings) shares in the market.

Bank of Changsha (SHSE:601577)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Changsha Co., Ltd. offers a range of commercial banking products and services to individual and business clients in China, with a market capitalization of CN¥34.91 billion.

Operations: Bank of Changsha Co., Ltd. generates revenue through its diverse range of commercial banking products and services tailored for both individual and business clients in China.

Dividend Yield: 4.4%

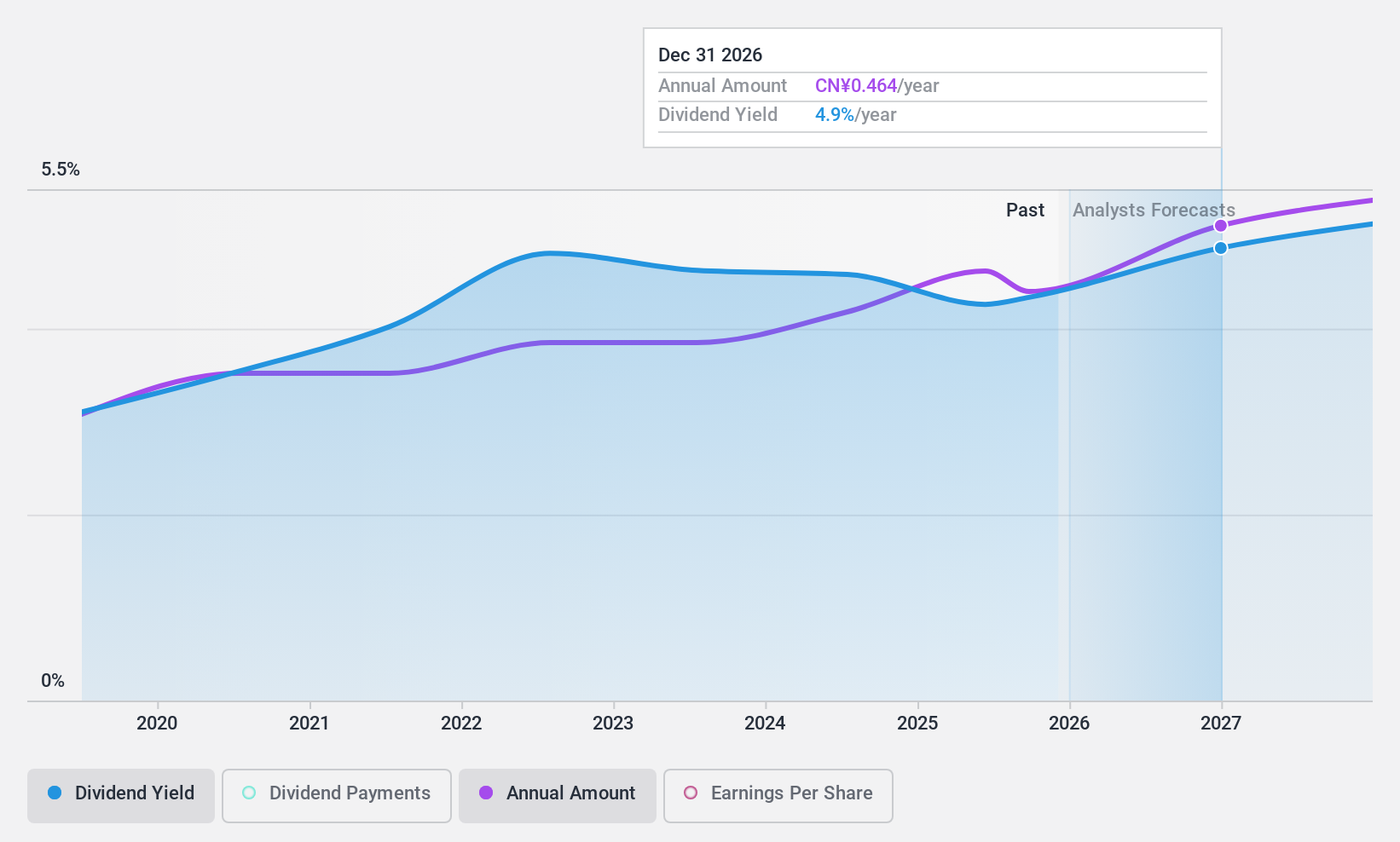

Bank of Changsha's dividends, although stable and reliable, have been paid for less than 10 years. The current payout ratio is low at 19.5%, indicating dividends are well covered by earnings, with future forecasts maintaining coverage at 23%. Despite a short dividend history, the company trades at a good value compared to peers and industry standards. Recent earnings growth of 6.9% supports its ability to sustain dividend payments moving forward.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Changsha.

- In light of our recent valuation report, it seems possible that Bank of Changsha is trading behind its estimated value.

Wah Hong Industrial (TPEX:8240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Hong Industrial Corp. develops, produces, and sells composite materials and advanced plastic compounds in Taiwan and internationally, with a market cap of NT$4.48 billion.

Operations: Wah Hong Industrial Corp.'s revenue segments are comprised of NT$3.79 billion from Taiwan, NT$4.17 billion from East China, and NT$1.46 billion from South China.

Dividend Yield: 3.3%

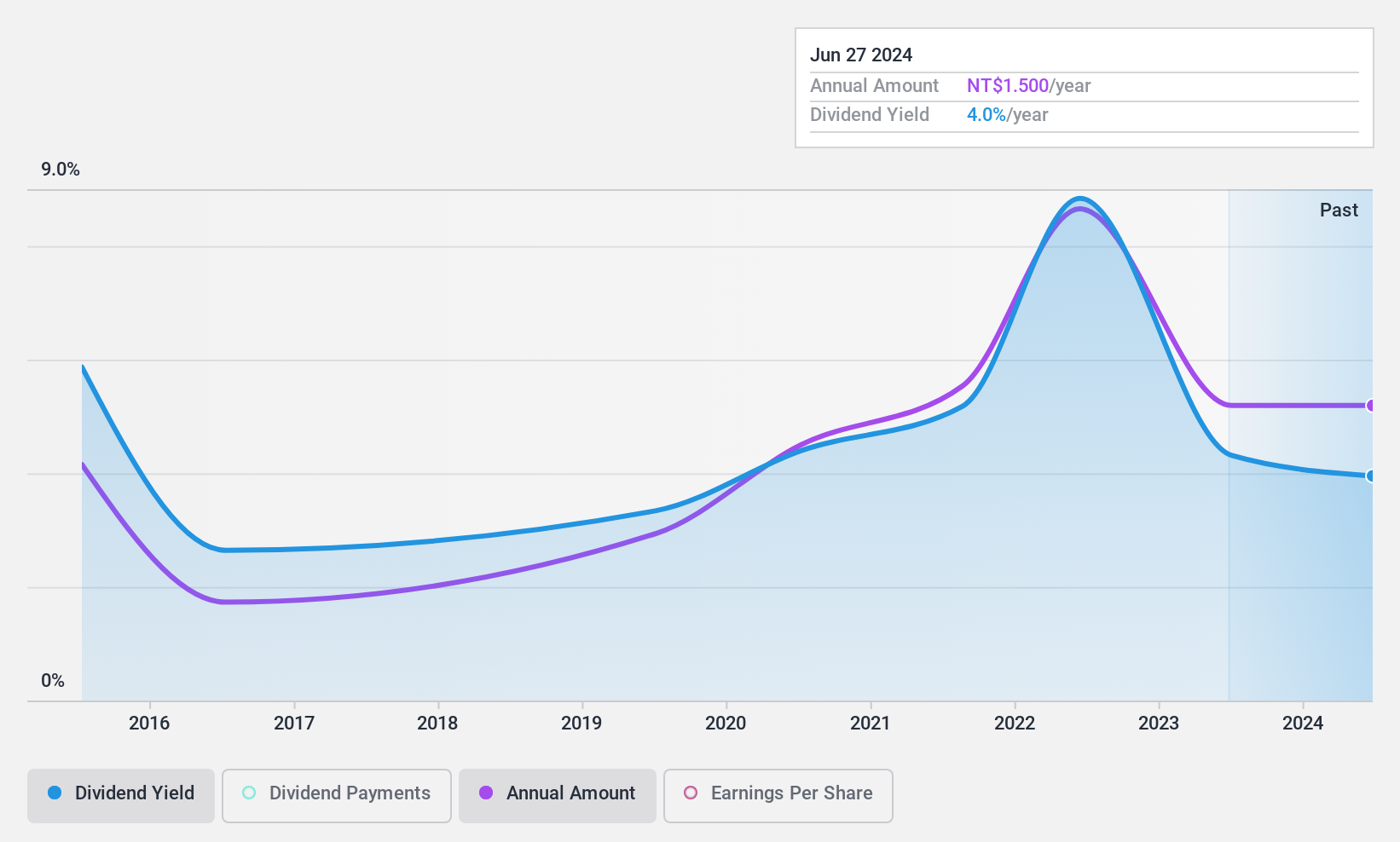

Wah Hong Industrial's dividends are covered by earnings with a payout ratio of 70.7% and cash flows at 34%, but the dividend yield is below top-tier levels in the TW market. Despite an unstable dividend track record, payments have increased over the past decade. The company's price-to-earnings ratio of 21.5x is favorable compared to industry averages. Recent earnings show a decline in quarterly net income, but six-month figures indicate slight growth year-over-year, suggesting some resilience amidst challenges.

- Click to explore a detailed breakdown of our findings in Wah Hong Industrial's dividend report.

- In light of our recent valuation report, it seems possible that Wah Hong Industrial is trading beyond its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 2032 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wah Hong Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8240

Wah Hong Industrial

Engages in the development, production, and sale of composite materials and advanced plastic compounds in Taiwan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives