As global markets navigate a complex landscape marked by political shifts in Europe and mixed performances across major U.S. indices, investors are keenly observing the Federal Reserve's upcoming decisions on interest rates. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with consistent returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.86% | ★★★★★★ |

Click here to see the full list of 1926 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Yunnan Yuntianhua (SHSE:600096)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yunnan Yuntianhua Co., Ltd. operates in phosphate ore mining, chemical fertilizers, engineering materials, agriculture, and trade and logistics sectors in China with a market cap of CN¥40.47 billion.

Operations: Yunnan Yuntianhua Co., Ltd.'s revenue is derived from its operations in phosphate ore mining, chemical fertilizers, engineering materials, agriculture, and trade and logistics businesses.

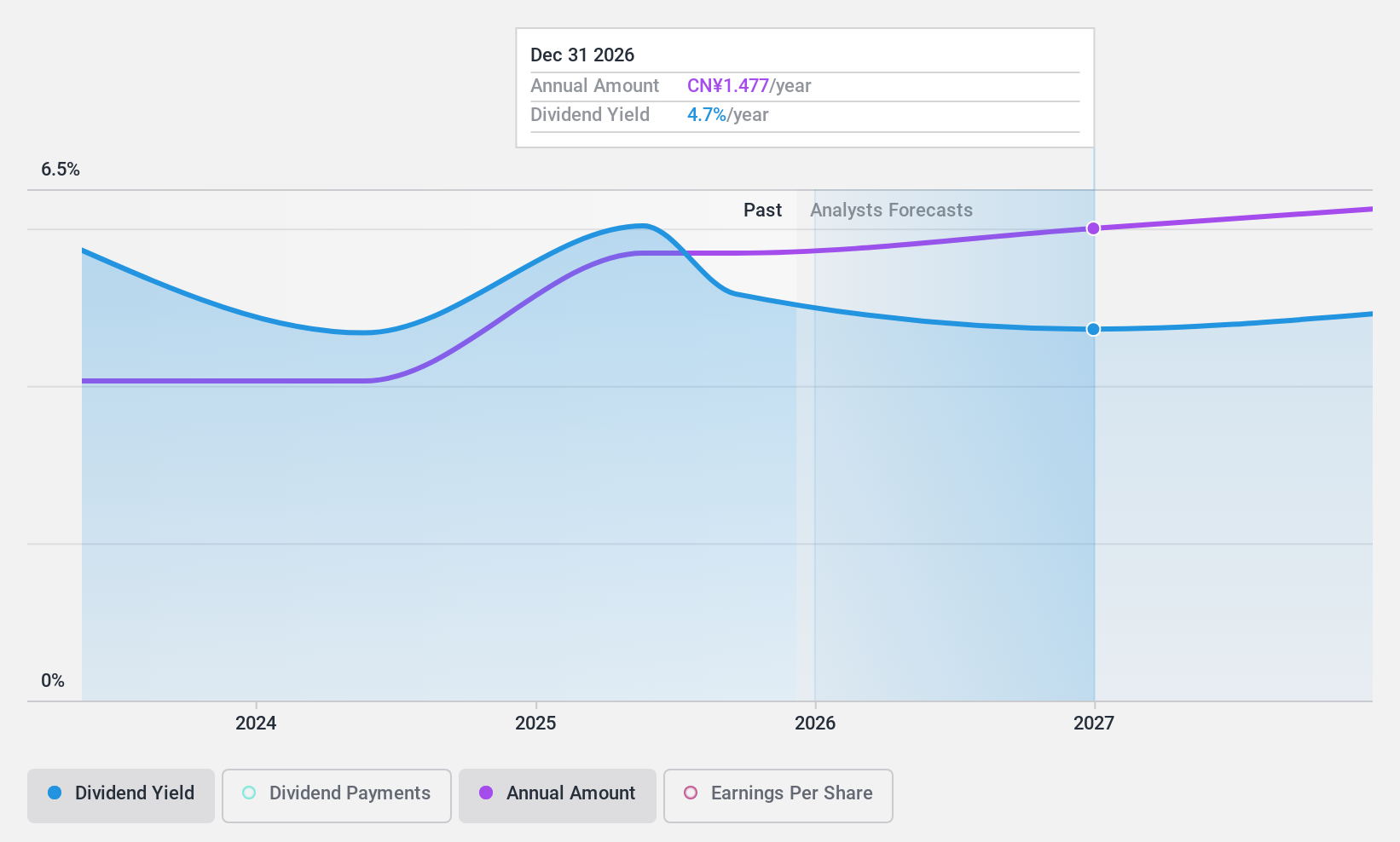

Dividend Yield: 4.4%

Yunnan Yuntianhua's dividend payments are well-supported by earnings, with a payout ratio of 34.9%, and cash flows, with a cash payout ratio of 21.8%. Despite recent revenue declines to CNY 46.72 billion for the first nine months of 2024, net income rose to CNY 4.42 billion, indicating improved profitability. However, its dividend history has been unstable over the past decade despite being in the top tier for yield in China at 4.45%.

- Unlock comprehensive insights into our analysis of Yunnan Yuntianhua stock in this dividend report.

- Our valuation report here indicates Yunnan Yuntianhua may be undervalued.

Xinjiang GuannongLtd (SHSE:600251)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Guannong Co., Ltd. is involved in the manufacturing, processing, trading, and selling of agricultural products in China with a market cap of CN¥6.19 billion.

Operations: Xinjiang Guannong Co., Ltd. generates revenue through its activities in the manufacturing, processing, trading, and sale of agricultural products within China.

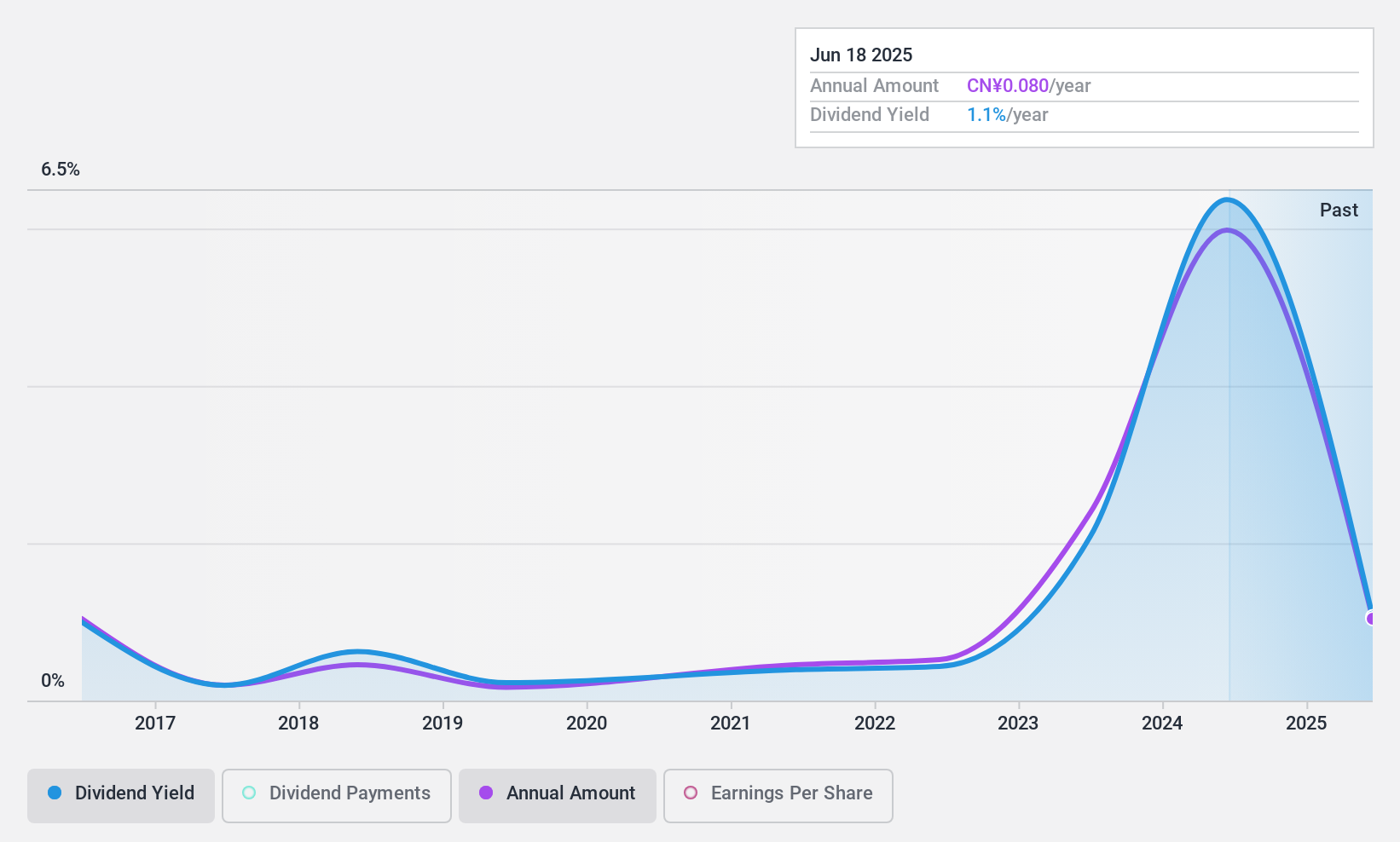

Dividend Yield: 5.7%

Xinjiang Guannong's dividend yield of 5.66% ranks among the top 25% in China, but its sustainability is questionable due to a high cash payout ratio of 577.1%, indicating dividends are not well-covered by cash flows. The company's earnings have declined, with net income dropping to CNY 331.87 million for the first nine months of 2024 from CNY 628.46 million a year ago, and profit margins have decreased significantly from last year’s levels.

- Navigate through the intricacies of Xinjiang GuannongLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Xinjiang GuannongLtd shares in the market.

Bank of Jiangsu (SHSE:600919)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Jiangsu Co., Ltd. offers a range of banking products and services in China and has a market capitalization of approximately CN¥168.28 billion.

Operations: Bank of Jiangsu Co., Ltd. generates revenue through various segments, including corporate banking, personal banking, treasury operations, and other financial services in China.

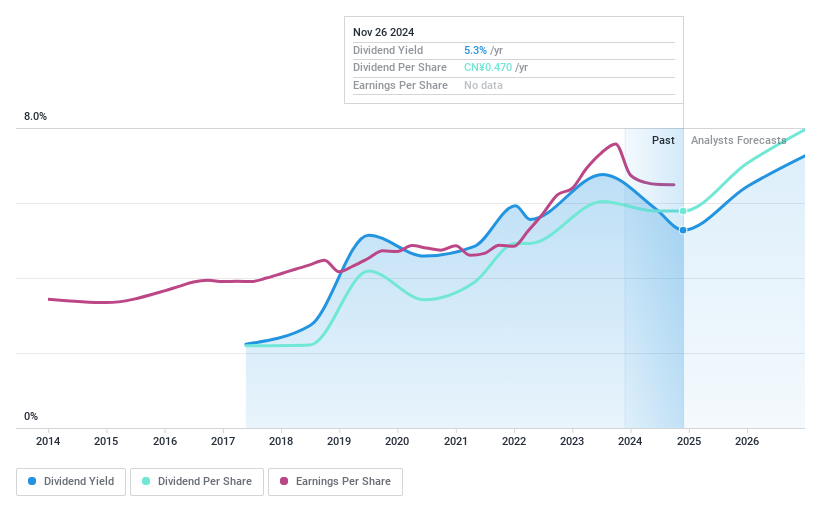

Dividend Yield: 5%

Bank of Jiangsu offers a compelling dividend profile with a yield of 5.04%, placing it among the top 25% in China's market. Its dividends are well-covered by earnings, evidenced by a low payout ratio of 29%. Despite only eight years of dividend history, payments have been stable and growing. Recent earnings reports show net income growth to CNY 28.23 billion for the first nine months of 2024, supporting its dividend sustainability.

- Take a closer look at Bank of Jiangsu's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Bank of Jiangsu is trading behind its estimated value.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1923 more companies for you to explore.Click here to unveil our expertly curated list of 1926 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600096

Yunnan Yuntianhua

Engages in the phosphate ore mining, chemical fertilizers, engineering materials, agriculture, and trade and logistics businesses in China.

Very undervalued with flawless balance sheet and pays a dividend.