3 Growth Companies With High Insider Ownership Growing Earnings Up To 38%

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the AI sector, global markets have been navigating a complex landscape with mixed performances across major indices. While the U.S. Federal Reserve held interest rates steady amid solid economic activity, concerns over AI competition and tariff risks have introduced new dynamics into market sentiment. Amid these conditions, growth companies with high insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Underneath we present a selection of stocks filtered out by our screen.

Darbond Technology (SHSE:688035)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Darbond Technology Co., Ltd focuses on the research, development, production, and sale of polymer engineering and interface materials in China with a market cap of CN¥5.24 billion.

Operations: Darbond Technology generates its revenue from the research, development, production, and sale of polymer engineering and interface materials within China.

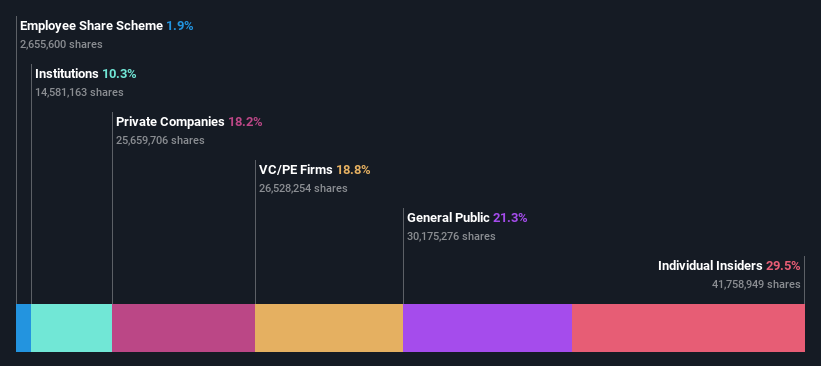

Insider Ownership: 29.6%

Earnings Growth Forecast: 38.1% p.a.

Darbond Technology's earnings are forecast to grow significantly at 38.1% annually, outpacing the Chinese market. However, profit margins have decreased from 13.1% to 7.5%. Despite a volatile share price recently, no substantial insider trading activity has been reported in the past three months. The company completed a buyback of shares worth CNY 54.06 million by December 2024, reflecting strategic financial maneuvers amidst ongoing growth prospects.

- Take a closer look at Darbond Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report Darbond Technology implies its share price may be too high.

Shenzhen VMAX New Energy (SHSE:688612)

Simply Wall St Growth Rating: ★★★★★☆

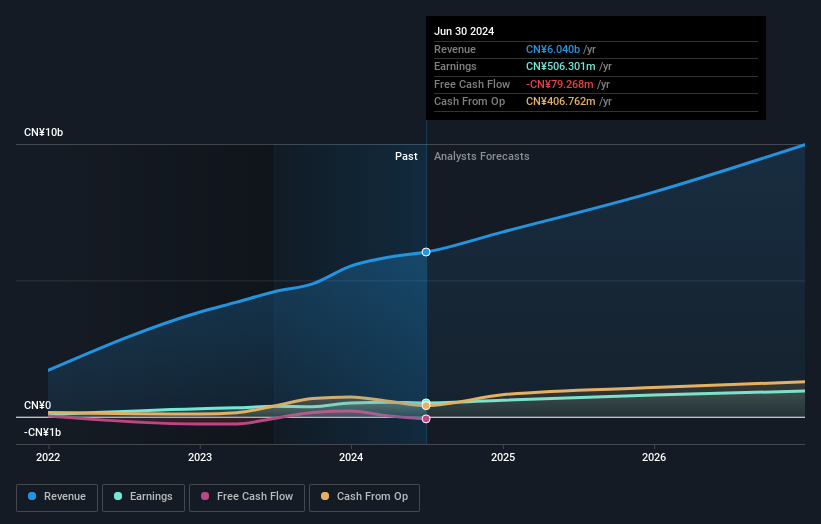

Overview: Shenzhen VMAX New Energy Co., Ltd. focuses on the research, development, production, and sale of power electronics and power transmission products both in China and internationally, with a market cap of CN¥10.43 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated CN¥6.29 billion.

Insider Ownership: 38.4%

Earnings Growth Forecast: 25.3% p.a.

Shenzhen VMAX New Energy's earnings are projected to grow significantly at 25.3% annually, surpassing the Chinese market average. The company trades at a favorable price-to-earnings ratio of 21.5x compared to the CN market's 34.9x, indicating good relative value within its industry. However, its dividend yield of 1.97% is not well covered by free cash flows, which could be a concern for income-focused investors amidst strong revenue growth forecasts of 21.9% per year.

- Unlock comprehensive insights into our analysis of Shenzhen VMAX New Energy stock in this growth report.

- Our valuation report here indicates Shenzhen VMAX New Energy may be undervalued.

Alnera Aluminium (SZSE:301613)

Simply Wall St Growth Rating: ★★★★★☆

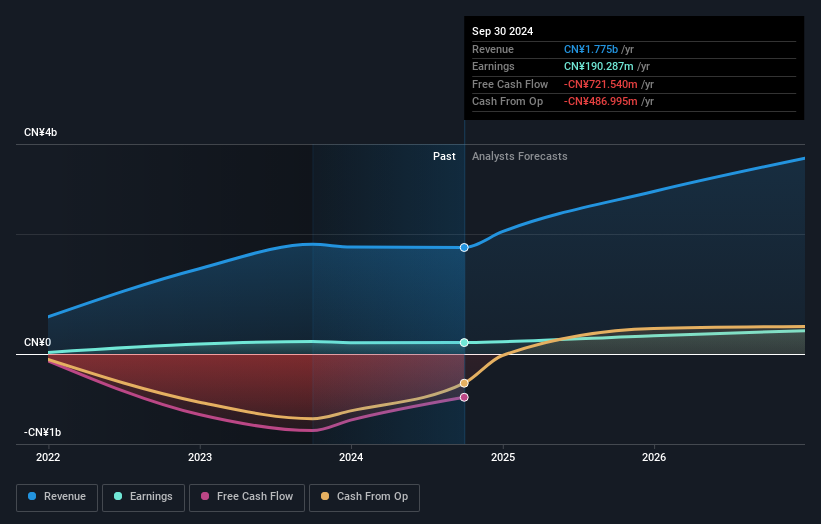

Overview: Alnera Aluminium Co., Ltd. focuses on the research, development, production, and sale of aluminum alloy parts for new energy vehicle battery systems and has a market cap of CN¥5.27 billion.

Operations: Alnera Aluminium Co., Ltd. generates revenue through its involvement in the research, development, production, and sale of aluminum alloy components specifically designed for battery systems in new energy vehicles.

Insider Ownership: 35.4%

Earnings Growth Forecast: 33.1% p.a.

Alnera Aluminium's revenue is forecast to grow at 26.6% annually, outpacing the Chinese market average of 13.5%, with earnings expected to rise significantly by 33.1% per year. Despite a low future return on equity of 17.4%, the stock offers relative value with a price-to-earnings ratio of 30.8x, below the market average of 34.9x. However, its debt coverage by operating cash flow is inadequate, and there has been no substantial insider trading activity recently.

- Click here to discover the nuances of Alnera Aluminium with our detailed analytical future growth report.

- The analysis detailed in our Alnera Aluminium valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Explore the 1478 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688035

Darbond Technology

Engages in the research and development, production, and sale of polymer engineering and interface materials in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives