Undiscovered Gems And 2 Other Promising Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape of accelerating inflation and fluctuating interest rates, major U.S. stock indexes like the Nasdaq Composite are nearing record highs, while small-cap stocks have lagged behind larger indices such as the S&P 500. In this environment, identifying promising opportunities within underexplored sectors can be crucial for enhancing portfolio diversity and potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.11% | -5.78% | ★★★★★★ |

| ELANTAS Beck India | NA | 15.21% | 25.05% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Invest Bank | 126.08% | 12.31% | 20.26% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Aerospace Intelligent Manufacturing Technology (SZSE:300446)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aerospace Intelligent Manufacturing Technology Co., Ltd. (SZSE:300446) specializes in the development and production of intelligent manufacturing systems for aerospace applications, with a market cap of CN¥14.40 billion.

Operations: Aerospace Intelligent Manufacturing Technology generates revenue primarily from its intelligent manufacturing systems tailored for the aerospace sector. The company's market capitalization is CN¥14.40 billion, reflecting its financial stature in the industry.

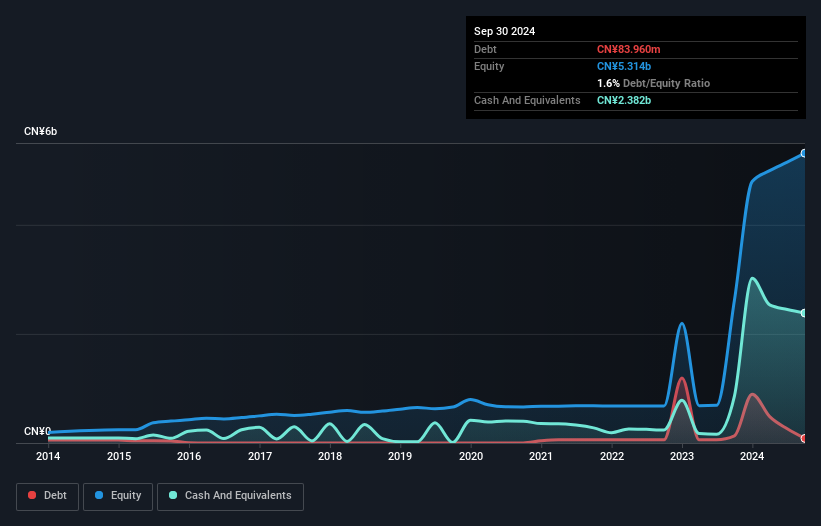

Aerospace Intelligent Manufacturing Technology, a small cap player, is making waves with its earnings surging by 127% over the past year, far outpacing the chemicals industry's -5.4%. The company has a favorable price-to-earnings ratio of 21.6x compared to the CN market's 36.5x, indicating potential value. Its debt management appears prudent with a debt-to-equity ratio rising to only 1.6% over five years and interest payments covered 117 times by EBIT, reflecting strong financial health. A recent shareholders meeting discussed a connected transaction from public bidding by a subsidiary, hinting at strategic moves in its operational landscape.

- Get an in-depth perspective on Aerospace Intelligent Manufacturing Technology's performance by reading our health report here.

Learn about Aerospace Intelligent Manufacturing Technology's historical performance.

Ningbo Sinyuan Zm Technology (SZSE:301398)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Sinyuan Zm Technology Co., Ltd. specializes in the research, development, production, and sale of aluminum and magnesium die-casting products for OEM customers in China, with a market cap of CN¥4.08 billion.

Operations: The company's revenue is primarily derived from the sale of aluminum and magnesium die-casting products. It operates within the OEM market in China, focusing on providing specialized casting solutions. The net profit margin has shown notable fluctuations, reflecting changes in operational efficiency and cost management strategies.

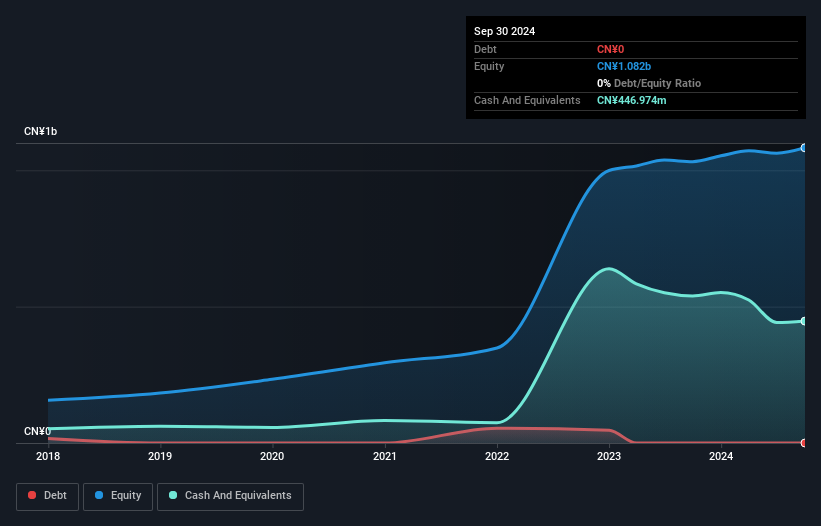

Ningbo Sinyuan Zm Technology stands out in the auto components sector with its debt-free status and an impressive 11% earnings growth over the past year, surpassing industry growth of 10.5%. Despite not being free cash flow positive, the company is profitable, indicating a solid financial footing. High levels of non-cash earnings suggest quality in reported profits. Recent events include a shareholders meeting to discuss cash management strategies and potential credit line applications, reflecting proactive financial planning. With no debt over five years and robust earnings performance, Ningbo Sinyuan seems poised for strategic maneuvers in its market space.

- Unlock comprehensive insights into our analysis of Ningbo Sinyuan Zm Technology stock in this health report.

Understand Ningbo Sinyuan Zm Technology's track record by examining our Past report.

Yankey Engineering (TWSE:6691)

Simply Wall St Value Rating: ★★★★★★

Overview: Yankey Engineering Co., Ltd. provides engineering services across Taiwan, China, and Thailand with a market capitalization of NT$46.69 billion.

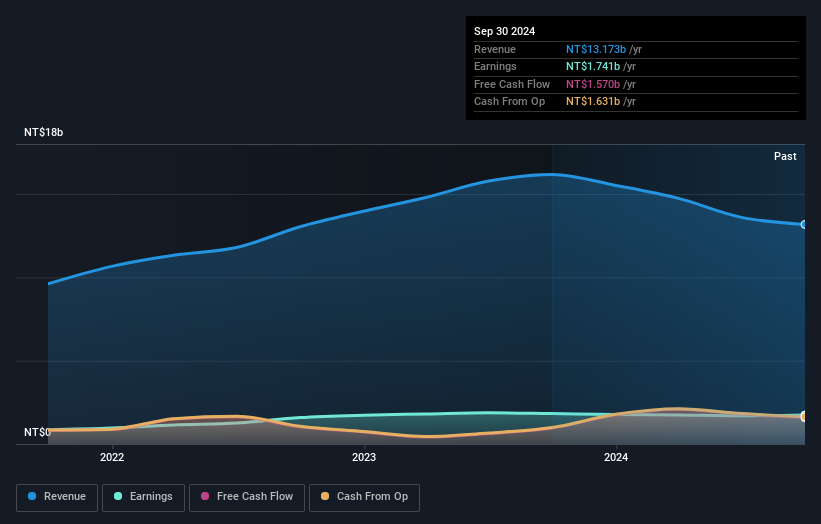

Operations: Yankey Engineering generates revenue primarily from building materials and HVAC equipment, totaling NT$13.17 billion. The company's market capitalization is NT$46.69 billion.

Yankey Engineering, a nimble player in the construction sector, stands out with its debt-free status and is trading slightly below its estimated fair value. Despite a challenging year with earnings growth at -4.6%, contrasting the industry average of 9.3%, it boasts high-quality past earnings and positive free cash flow, which was US$1.57 billion as of September 2024. The absence of debt now compared to a 10.4% debt-to-equity ratio five years ago suggests prudent financial management, enhancing its appeal as an investment prospect while positioning for potential future growth opportunities within the industry landscape.

- Navigate through the intricacies of Yankey Engineering with our comprehensive health report here.

Examine Yankey Engineering's past performance report to understand how it has performed in the past.

Summing It All Up

- Gain an insight into the universe of 4719 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300446

Aerospace Intelligent Manufacturing Technology

Aerospace Intelligent Manufacturing Technology Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives