- Saudi Arabia

- /

- Food

- /

- SASE:2286

Discovering Undiscovered Gems with Potential In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced particular challenges, underperforming their large-cap counterparts amid broader market volatility. Amidst this backdrop, identifying undiscovered gems—stocks with strong fundamentals and growth potential—becomes crucial for investors seeking opportunities in an uncertain environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.21% | 50.35% | 68.60% | ★★★★★☆ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Fourth Milling (SASE:2286)

Simply Wall St Value Rating: ★★★★★☆

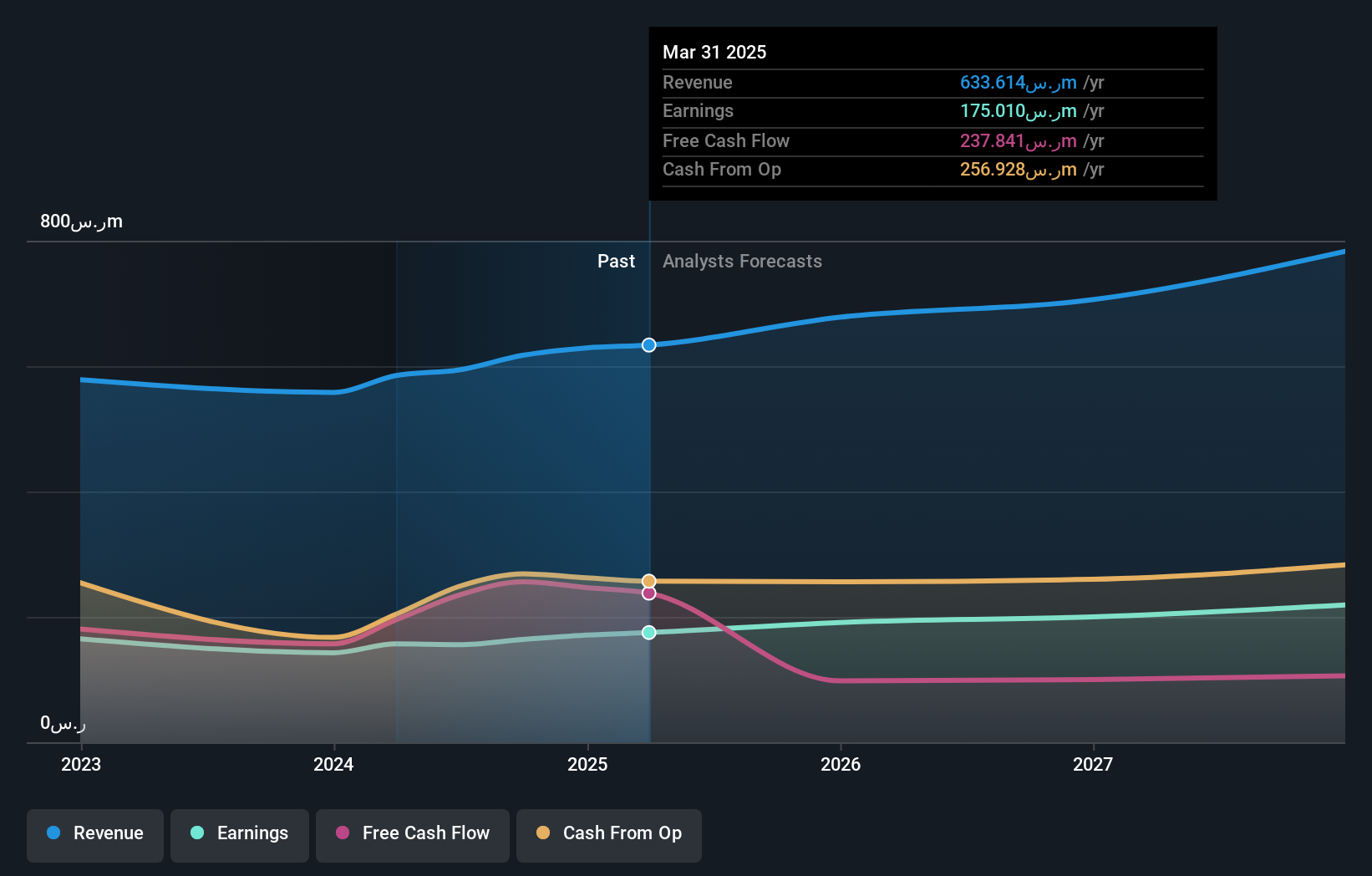

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour and its byproducts, as well as animal feed and bran products, with a market cap of SAR 2.86 billion.

Operations: The company generates revenue primarily from its food processing segment, amounting to SAR 596.89 million.

Fourth Milling has been making strides with a recent IPO raising SAR 858.6 million, offering 162 million shares at SAR 5.3 each. This small player in the food industry boasts a debt-free status and high-quality earnings, although its earnings growth of 1.1% over the past year lags behind the industry's robust 20.8%. Over five years, however, it has achieved an impressive annual growth rate of 29%, positioning it as potentially undervalued by trading at about 56% below estimated fair value. Despite its illiquid shares, Fourth Milling seems to offer solid fundamentals for potential investors exploring niche opportunities in the market.

- Click here and access our complete health analysis report to understand the dynamics of Fourth Milling.

Gain insights into Fourth Milling's historical performance by reviewing our past performance report.

Linkage Software (SHSE:688588)

Simply Wall St Value Rating: ★★★★★☆

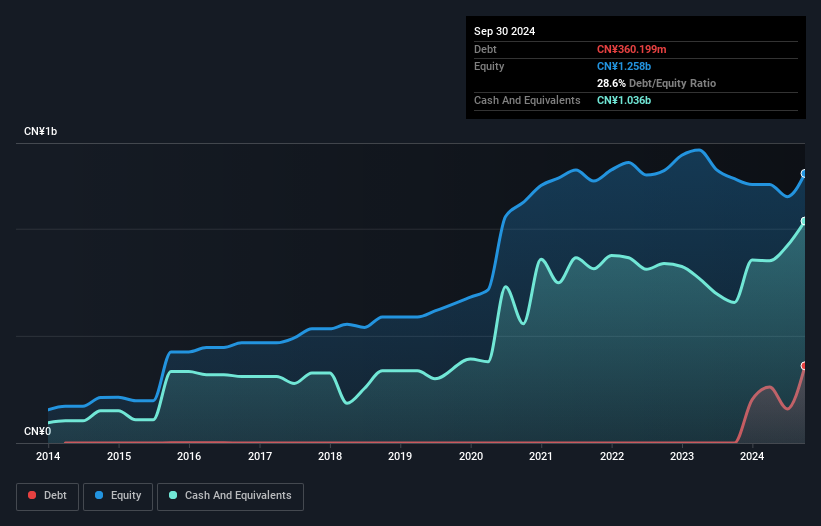

Overview: Linkage Software Co., LTD is a financial software company with a market cap of CN¥4.17 billion.

Operations: Linkage Software's revenue model is driven by its financial software offerings, contributing significantly to its overall income. The company has seen fluctuations in its gross profit margin, reflecting changes in cost management and pricing strategies over time.

Linkage Software, a smaller player in the tech sector, has shown impressive growth with earnings surging by 54.7% over the past year, outpacing the software industry's -13.9%. Their price-to-earnings ratio of 30.2x remains attractive compared to the broader CN market's 34.3x. Despite a debt-to-equity ratio increase to 28.6% over five years, they hold more cash than total debt and maintain positive free cash flow at CNY 139 million as of September 2024. Recent earnings reports highlight robust sales growth from CNY 491 million to CNY 808 million year-over-year, indicating strong operational performance and potential value for investors.

Zhejiang Taotao Vehicles (SZSE:301345)

Simply Wall St Value Rating: ★★★★★★

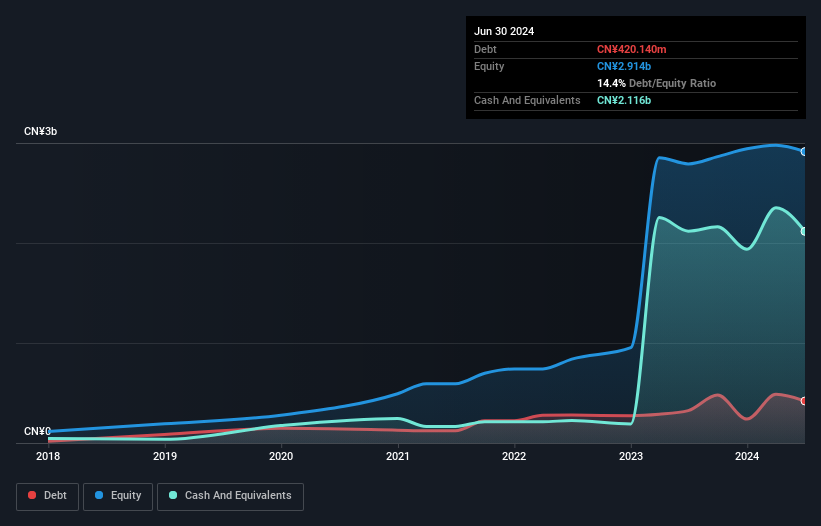

Overview: Zhejiang Taotao Vehicles Co., Ltd. is involved in the research, development, production, and sale of motorcycles, electric vehicles, and ATVs in China with a market cap of CN¥7.15 billion.

Operations: The company generates revenue primarily from the sale of motorcycles, electric vehicles, and ATVs. It has a market cap of CN¥7.15 billion.

Zhejiang Taotao Vehicles, a promising player in the auto sector, has shown robust financial performance with earnings growing by 37.6% over the past year, significantly outpacing the industry's modest 0.5% growth. The company reported sales of CNY 2.22 billion for the first nine months of 2024, up from CNY 1.35 billion a year ago, while net income climbed to CNY 301 million from CNY 204 million in the same period last year. With a price-to-earnings ratio of 19.2x below China's market average and reduced debt-to-equity ratio from 49.4% to just above14%, it seems well-positioned for future growth prospects amidst its ongoing share buyback program totaling CNY 63 million this year alone.

- Dive into the specifics of Zhejiang Taotao Vehicles here with our thorough health report.

Gain insights into Zhejiang Taotao Vehicles' past trends and performance with our Past report.

Make It Happen

- Reveal the 4742 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2286

Fourth Milling

Engages in the production, packaging, and sale of flour and its byproducts, animal feed, and bran products the Kingdom of Saudi Arabia.

Excellent balance sheet, good value and pays a dividend.