- China

- /

- Auto Components

- /

- SZSE:300969

NINGBO HENGSHUAI Co., LTD. (SZSE:300969) Not Flying Under The Radar

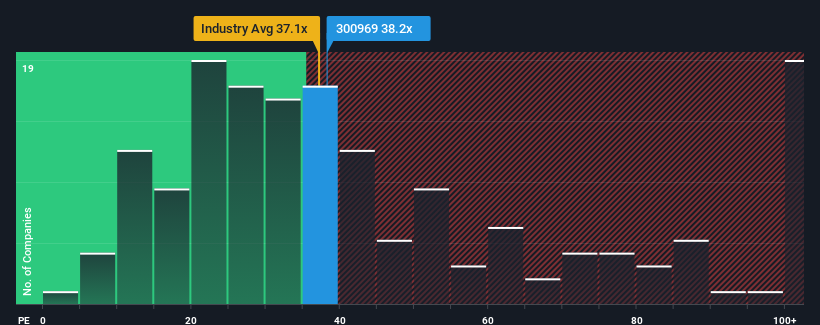

There wouldn't be many who think NINGBO HENGSHUAI Co., LTD.'s (SZSE:300969) price-to-earnings (or "P/E") ratio of 38.2x is worth a mention when the median P/E in China is similar at about 38x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for NINGBO HENGSHUAI as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for NINGBO HENGSHUAI

How Is NINGBO HENGSHUAI's Growth Trending?

In order to justify its P/E ratio, NINGBO HENGSHUAI would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. This was backed up an excellent period prior to see EPS up by 60% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 40% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is not materially different.

With this information, we can see why NINGBO HENGSHUAI is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From NINGBO HENGSHUAI's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of NINGBO HENGSHUAI's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for NINGBO HENGSHUAI with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than NINGBO HENGSHUAI. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NINGBO HENGSHUAI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300969

NINGBO HENGSHUAI

Ningbo Hengshuai Co., Ltd. manufactures and sells automotive micro-motors and components worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives