- China

- /

- Auto Components

- /

- SZSE:002406

Undiscovered Gems And 2 Promising Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced increased pressure, with indices like the S&P 600 reflecting these broader market dynamics. In such an environment, identifying undiscovered gems becomes crucial for investors seeking to enhance their portfolios; these stocks often possess strong fundamentals and potential for growth despite current market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.64% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shantui Construction Machinery (SZSE:000680)

Simply Wall St Value Rating: ★★★★★★

Overview: Shantui Construction Machinery Co., Ltd. provides construction machinery products both domestically and internationally, with a market cap of CN¥12.36 billion.

Operations: Shantui Construction Machinery generates revenue primarily from the sale of construction machinery products in both domestic and international markets. The company has a market capitalization of CN¥12.36 billion.

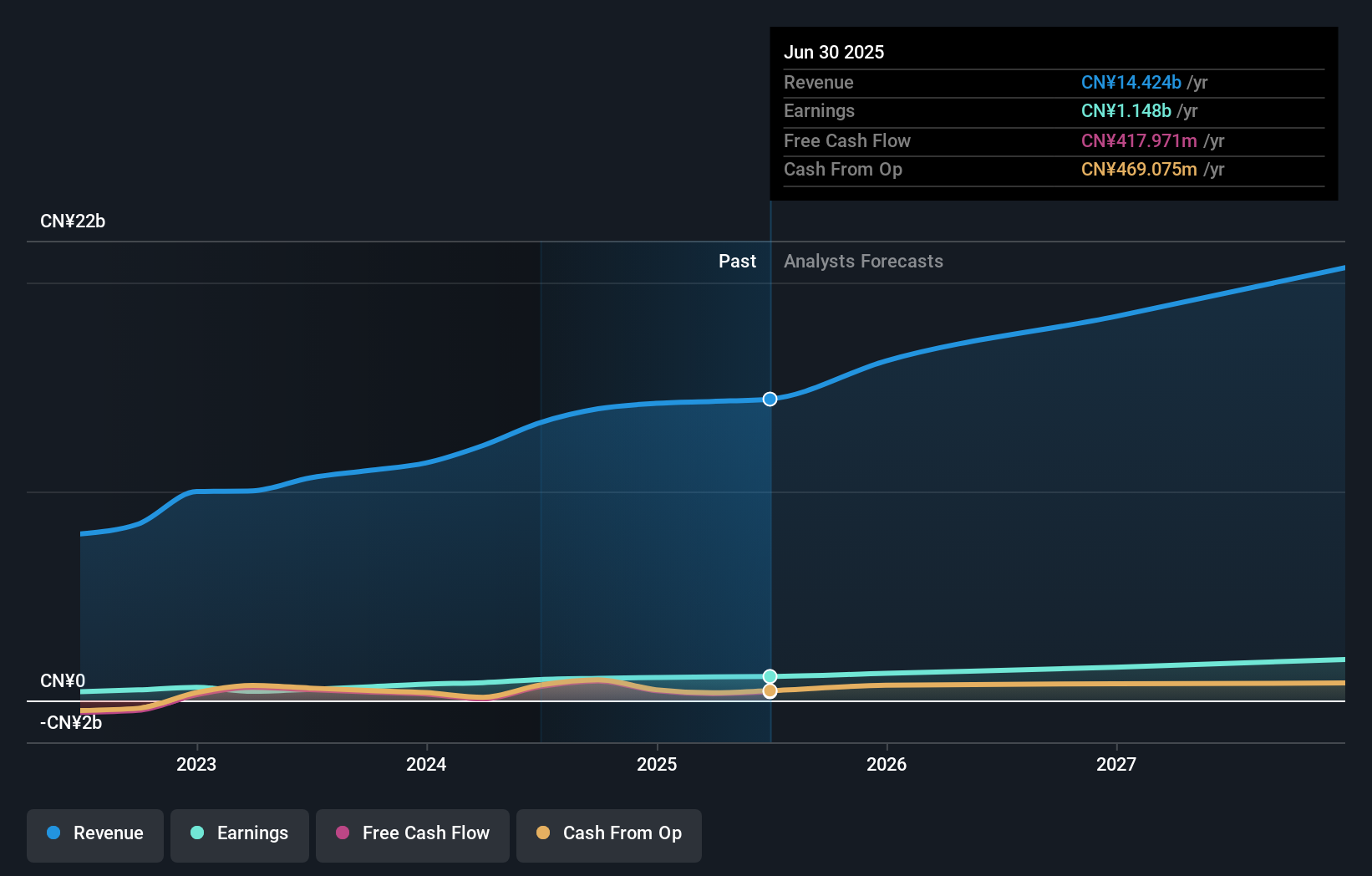

Shantui Construction Machinery, a player in the machinery sector, has shown impressive earnings growth of 65.7% over the past year, outpacing the industry average of -3.9%. The company's debt to equity ratio has significantly improved from 60.6% to 12.5% over five years, indicating stronger financial health. Recent earnings for half-year ended June 2024 saw sales rise to CNY 5.93 billion from CNY 4.39 billion and net income increased to CNY 418 million from CNY 302 million year-on-year, with basic earnings per share climbing to CNY 0.28 from CNY 0.20 previously.

- Get an in-depth perspective on Shantui Construction Machinery's performance by reading our health report here.

Learn about Shantui Construction Machinery's historical performance.

Xuchang Yuandong Drive ShaftLtd (SZSE:002406)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuchang Yuandong Drive Shaft Co. Ltd specializes in the research, development, production, and sale of transmission drive shafts and related components in China with a market capitalization of approximately CN¥5.10 billion.

Operations: Yuandong Drive Shaft generates revenue primarily from automotive parts, amounting to CN¥1.28 billion.

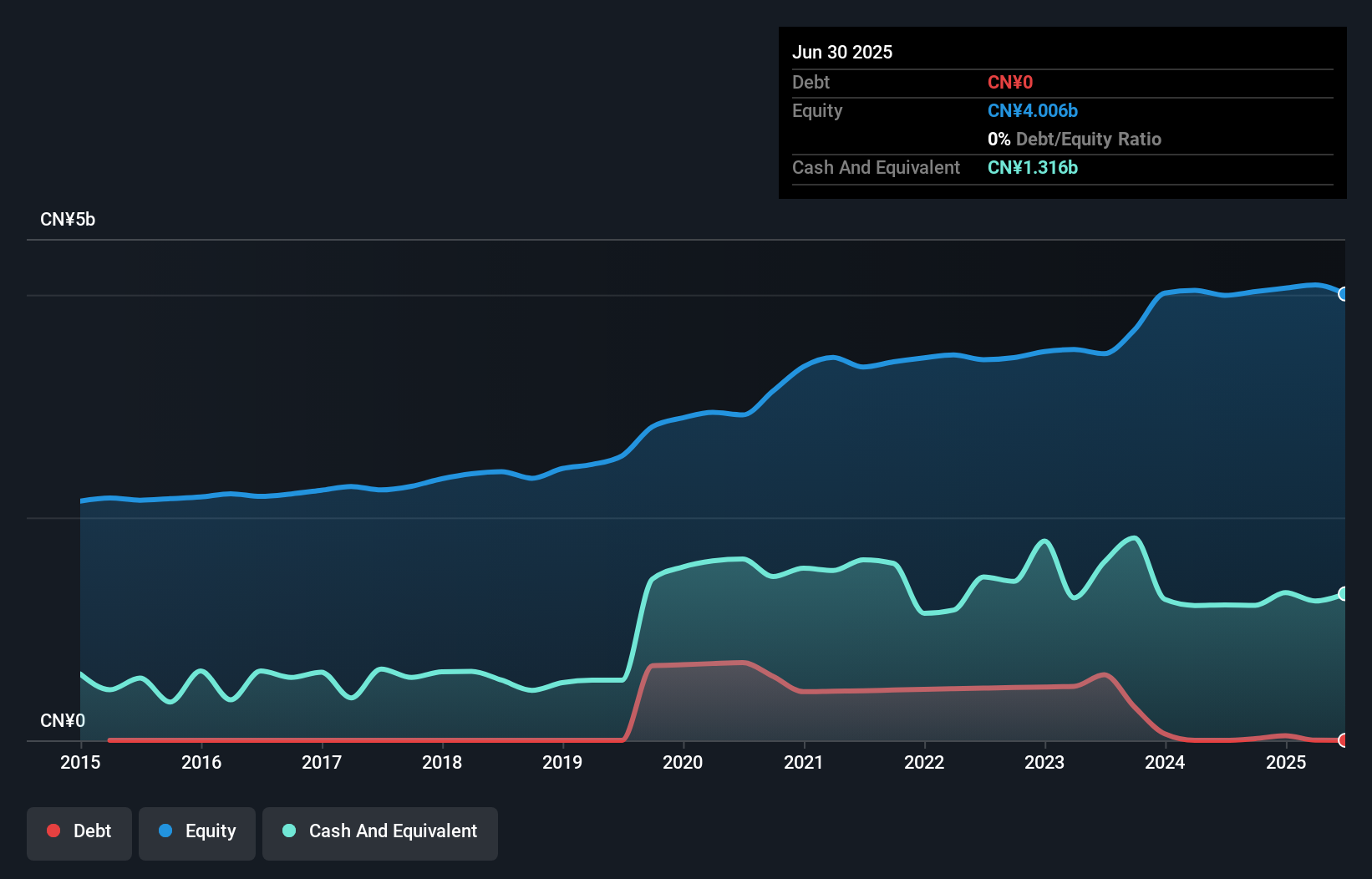

Yuandong Drive Shaft, a smaller player in the auto components sector, reported sales of CN¥649.08 million for the half-year ending June 2024, up from CN¥624.95 million the previous year. Their net income rose to CN¥53.14 million from CN¥42.76 million, indicating robust performance despite a significant one-off gain of CN¥34.3 million impacting recent results. The company boasts no debt and has seen earnings grow by 26% over the past year, outpacing industry growth rates of 16%. However, shareholders experienced some dilution recently which may concern potential investors looking at equity value stability.

Zhuhai Enpower ElectricLtd (SZSE:300681)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhuhai Enpower Electric Co., Ltd. focuses on the research, development, production, and sale of new energy vehicle power systems both in China and internationally, with a market cap of CN¥4.82 billion.

Operations: Zhuhai Enpower Electric Co., Ltd. generates revenue primarily from the sale of new energy vehicle power systems. The company has seen fluctuations in its gross profit margin, which was reported at 25% in the most recent financial period.

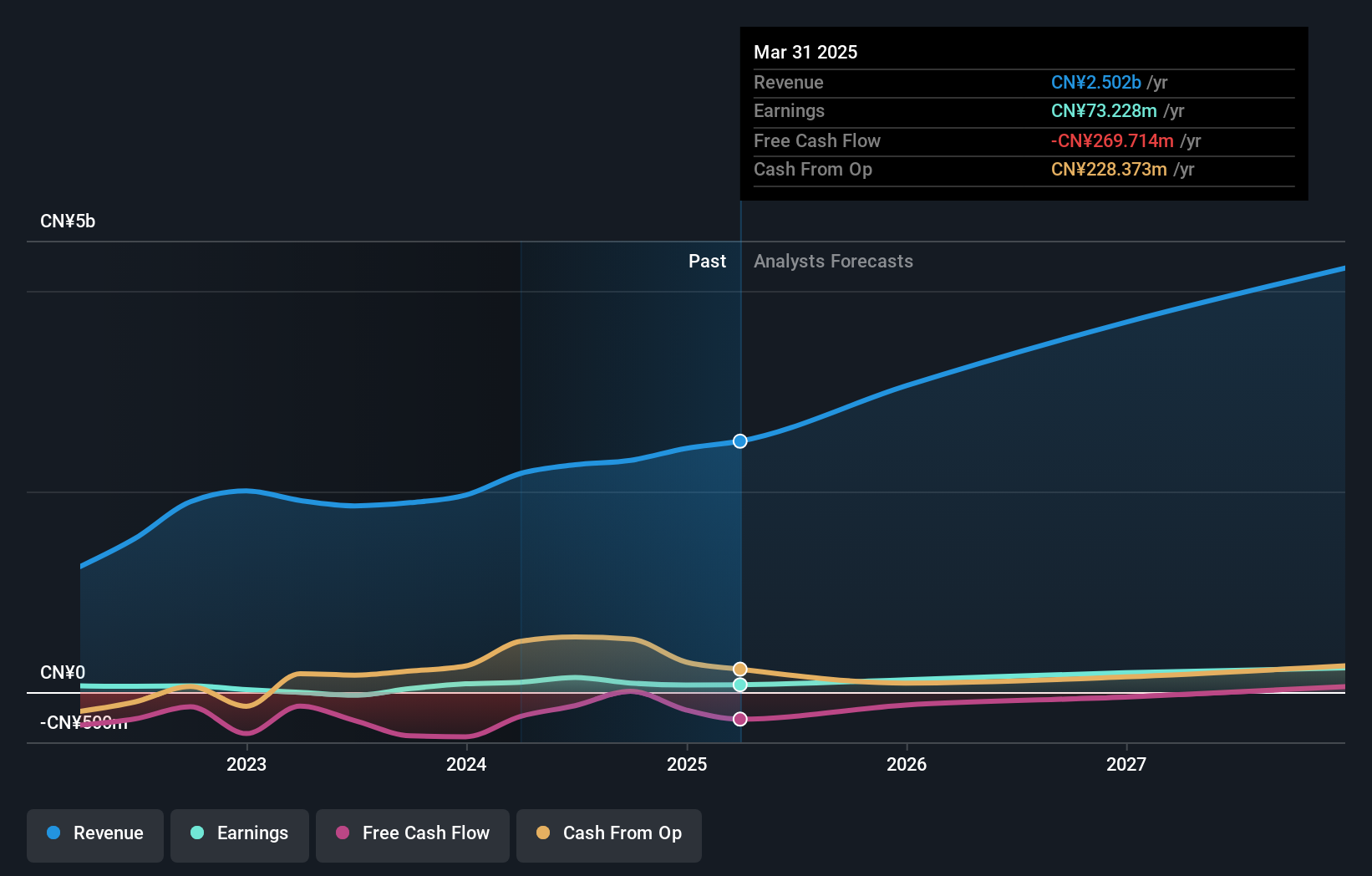

Zhuhai Enpower Electric, a smaller player in the auto components sector, reported notable earnings growth of 157.3% over the past year, outpacing the industry average of 16.4%. However, this performance was influenced by a non-recurring gain of CN¥28.5 million in its recent financial results. The company's debt-to-equity ratio has risen from 18% to 40.9% over five years, yet interest payments are well covered with EBIT at 6.3 times interest expenses. Recent earnings for nine months showed sales at CN¥1,607 million and net income at CN¥51 million compared to last year's figures of CN¥1,260 million and CN¥43 million respectively.

Key Takeaways

- Access the full spectrum of 4732 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002406

Xuchang Yuandong Drive ShaftLtd

Engages in the research, development, production, and sale of transmission drive shafts and related components in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives