- China

- /

- Auto Components

- /

- SZSE:300680

Top Growth Companies With Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing the performance of major indices such as the S&P 500, which recently experienced a slight decline amid these challenges. In this environment, growth companies with high insider ownership often attract attention due to their potential for alignment between management and shareholder interests, making them particularly appealing when market conditions are volatile.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 17.1% |

Let's explore several standout options from the results in the screener.

Jiangxi Rimag Group (SEHK:2522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Rimag Group Co., Ltd. operates medical imaging centers in China and has a market cap of HK$11.87 billion.

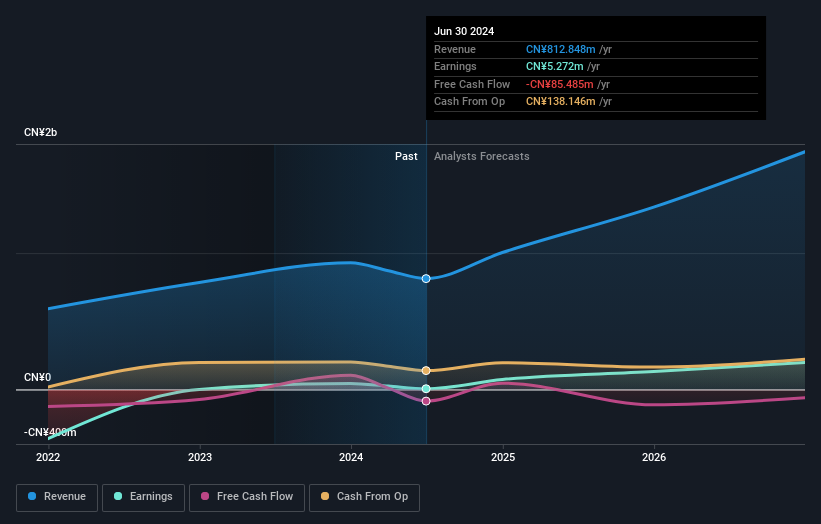

Operations: The company's revenue primarily comes from its Medical Labs & Research segment, generating CN¥812.85 million.

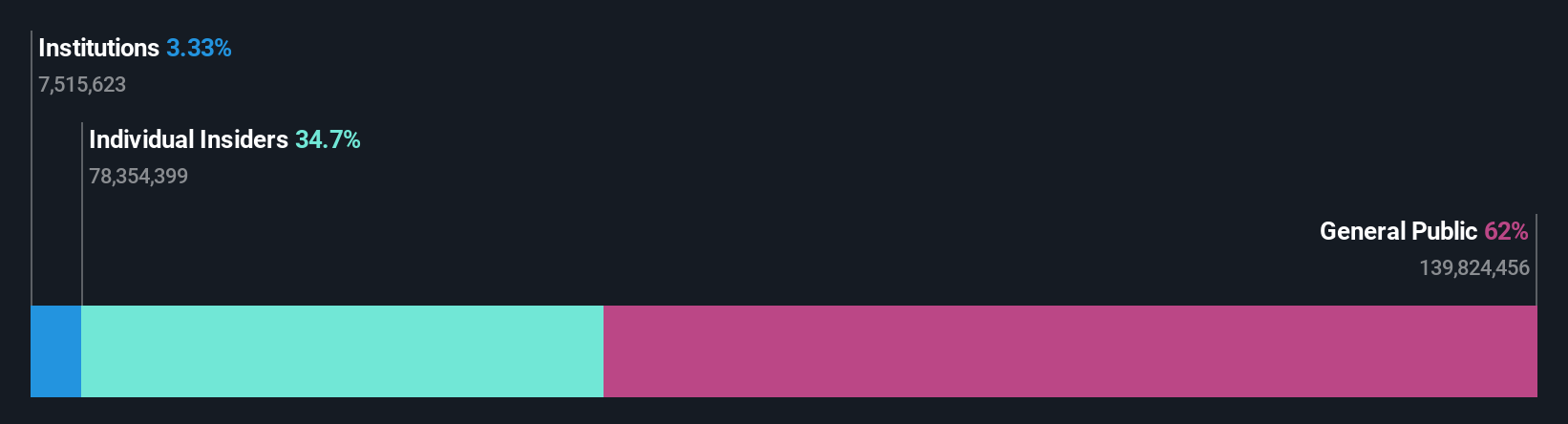

Insider Ownership: 24.3%

Earnings Growth Forecast: 71.8% p.a.

Jiangxi Rimag Group is poised for significant growth, with revenue projected to increase by 30% annually, surpassing the Hong Kong market's growth rate. Earnings are expected to grow substantially at 71.8% per year. Despite high volatility in its share price and a decline in profit margins from last year, the stock trades slightly below its estimated fair value. Recent proposed amendments to company bylaws may influence governance and strategic direction moving forward.

- Navigate through the intricacies of Jiangxi Rimag Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Jiangxi Rimag Group's share price might be too optimistic.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd is a Chinese company specializing in the manufacturing of auto parts, with a market cap of CN¥6.97 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue from its core business of manufacturing auto parts in China.

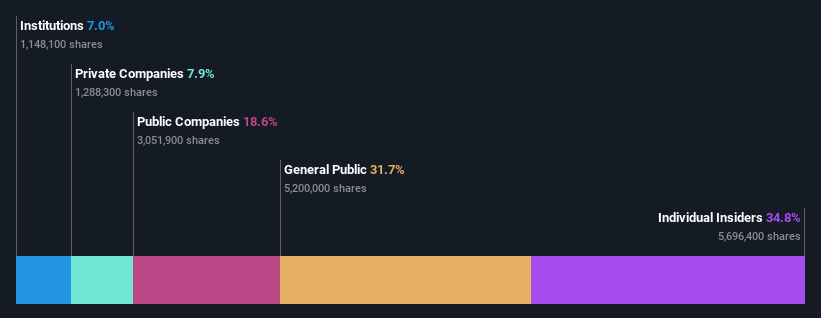

Insider Ownership: 34.8%

Earnings Growth Forecast: 31.7% p.a.

Wuxi Longsheng Technology is set for robust growth, with revenue forecasted to rise 26.8% annually, outpacing the Chinese market's 13.6%. Earnings are projected to grow significantly at 31.67% per year, exceeding market expectations. Despite a relatively low return on equity forecast of 15.6%, the company's buyback program worth up to CNY 200 million could enhance shareholder value by reducing registered capital and potentially increasing earnings per share over time.

- Take a closer look at Wuxi Longsheng TechnologyLtd's potential here in our earnings growth report.

- Our expertly prepared valuation report Wuxi Longsheng TechnologyLtd implies its share price may be too high.

note (TSE:5243)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Note Inc. operates in the media platform sector in Japan and has a market capitalization of ¥39.47 billion.

Operations: The company's revenue segments include the media platform business in Japan.

Insider Ownership: 34.8%

Earnings Growth Forecast: 42.9% p.a.

Note Inc. is positioned for substantial growth, with earnings projected to increase by 42.91% annually, surpassing the Japanese market's average of 7.7%. However, revenue growth at 17.5% per year lags behind the desired threshold but still outpaces the market's 4.2%. The company recently completed a private placement with Google International LLC, raising approximately ¥489 million net proceeds to support its expansion efforts and enhance financial flexibility amidst a volatile share price environment.

- Dive into the specifics of note here with our thorough growth forecast report.

- Our valuation report unveils the possibility note's shares may be trading at a premium.

Summing It All Up

- Click here to access our complete index of 1439 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the manufacturing of auto parts in China.

High growth potential with solid track record.

Market Insights

Community Narratives