- China

- /

- Auto Components

- /

- SZSE:300680

After Leaping 34% Wuxi Longsheng Technology Co.,Ltd (SZSE:300680) Shares Are Not Flying Under The Radar

Despite an already strong run, Wuxi Longsheng Technology Co.,Ltd (SZSE:300680) shares have been powering on, with a gain of 34% in the last thirty days. The last month tops off a massive increase of 173% in the last year.

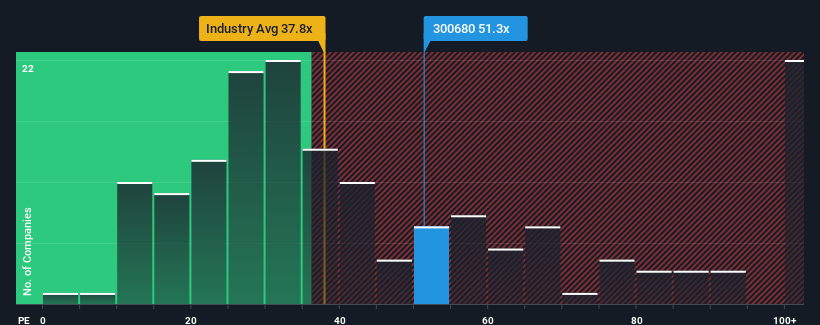

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 39x, you may consider Wuxi Longsheng TechnologyLtd as a stock to potentially avoid with its 51.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Wuxi Longsheng TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Wuxi Longsheng TechnologyLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Wuxi Longsheng TechnologyLtd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 91% gain to the company's bottom line. Pleasingly, EPS has also lifted 77% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 43% over the next year. That's shaping up to be materially higher than the 37% growth forecast for the broader market.

With this information, we can see why Wuxi Longsheng TechnologyLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Wuxi Longsheng TechnologyLtd shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wuxi Longsheng TechnologyLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Wuxi Longsheng TechnologyLtd, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the research and development, production, sales, and service of automotive parts products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026