- China

- /

- Construction

- /

- SHSE:600133

Discovering Undiscovered Gems in Asia for October 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by U.S. economic uncertainties and shifting monetary policies, the Asian markets present intriguing opportunities for investors seeking growth potential. With small-cap stocks in Asia potentially benefiting from lower interest rates and consumer-driven sectors showing resilience, identifying promising companies requires a keen understanding of market dynamics and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Woori Technology Investment | NA | 11.06% | -3.63% | ★★★★★★ |

| CYMECHS | 8.28% | -3.30% | -18.05% | ★★★★★★ |

| Anapass | 9.88% | 18.10% | 57.00% | ★★★★★★ |

| BIO-FD&CLtd | 0.15% | 2.82% | 18.20% | ★★★★★★ |

| Myung In Pharmaceutical | NA | 9.70% | 9.38% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 34.33% | 7.40% | 2.05% | ★★★★★☆ |

| Messe eSangLtd | 0.21% | 35.18% | 96.55% | ★★★★★☆ |

| Chinyang Holdings | 31.14% | 7.30% | -20.39% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| BIOBIJOULtd | 0.07% | 45.63% | 49.17% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Wuhan East Lake High Technology Group (SHSE:600133)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuhan East Lake High Technology Group Co., Ltd. operates in various sectors including technology and high-tech industries, with a market capitalization of CN¥10.85 billion.

Operations: Wuhan East Lake High Technology Group generates revenue primarily from its technology and high-tech industry operations. The company has a market capitalization of CN¥10.85 billion.

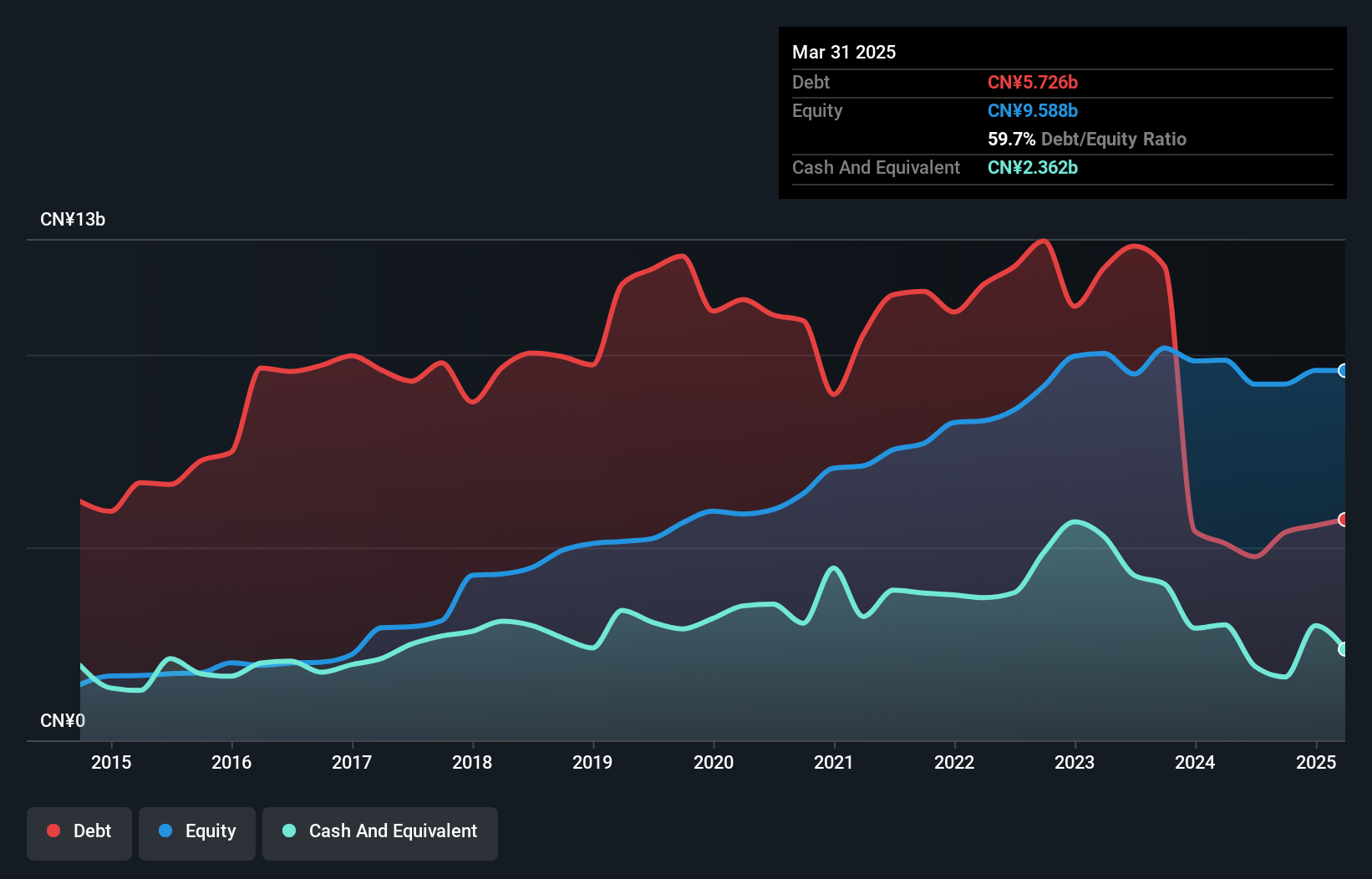

Wuhan East Lake High Technology Group, a smaller player in the tech space, has seen its debt to equity ratio improve significantly from 184.5% to 59.6% over five years, indicating better financial management. Despite high-quality past earnings and a satisfactory net debt to equity ratio of 38.2%, recent performance shows challenges with earnings growth down by -53.3%. The P/E ratio stands at 21.9x, lower than the CN market average of 45.5x, suggesting potential value for investors seeking bargains in the sector. However, net income for the first half of 2025 was CNY 49 million compared to CNY 82 million last year, highlighting some operational hurdles ahead.

Darbond Technology (SHSE:688035)

Simply Wall St Value Rating: ★★★★★★

Overview: Darbond Technology Co., Ltd focuses on the research, development, production, and sale of polymer engineering and interface materials in China with a market capitalization of CN¥8.69 billion.

Operations: Darbond Technology generates revenue primarily from the sale of polymer engineering and interface materials. The company's financial performance is reflected in its market capitalization of CN¥8.69 billion.

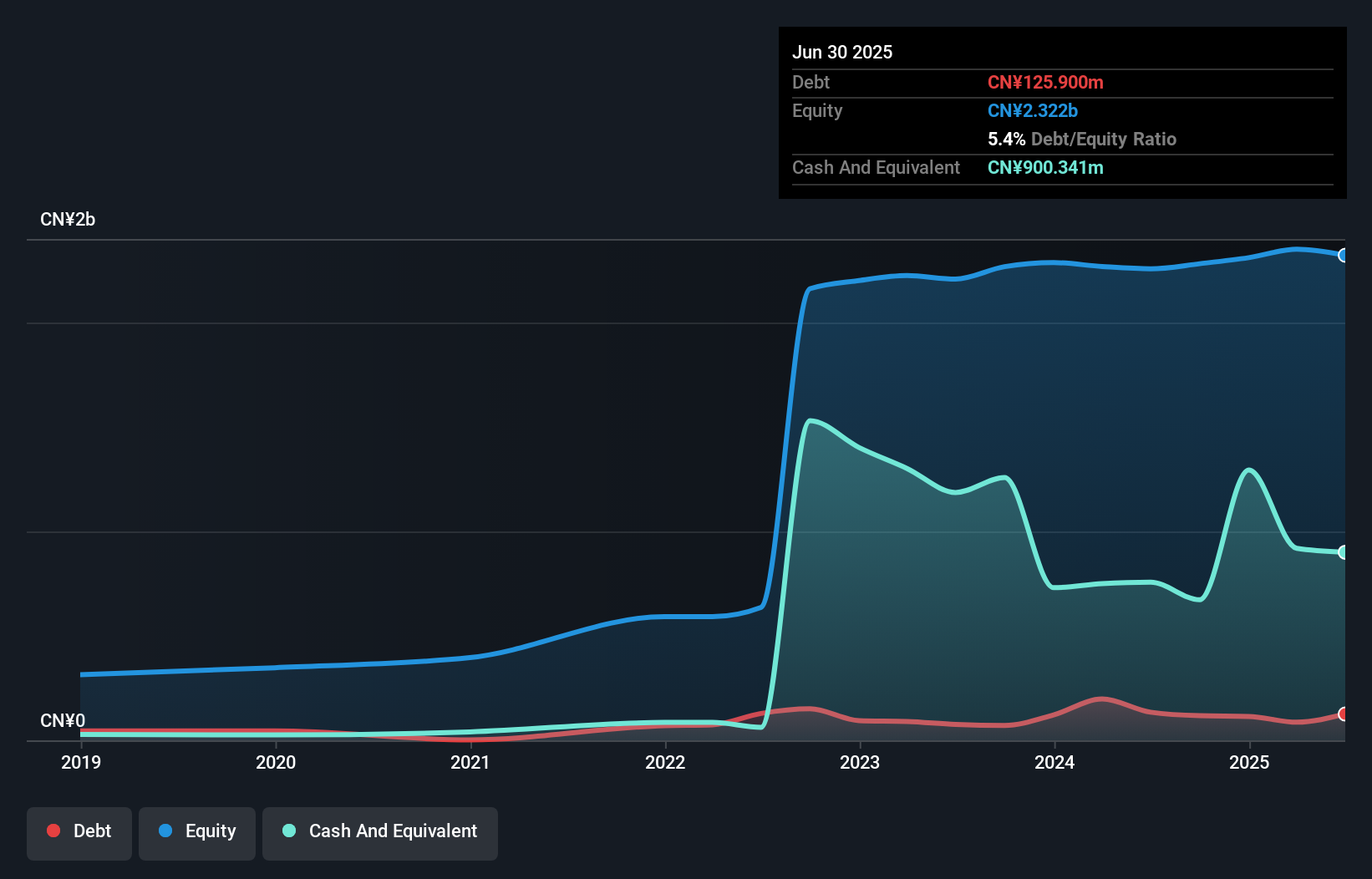

Darbond Technology, a nimble player in the chemicals sector, showcases impressive earnings growth of 26.8% over the past year, outpacing the industry average of 1.6%. The company's recent half-year results reveal revenue climbing to CNY 689.94 million from CNY 462.98 million a year prior, with net income reaching CNY 45.57 million compared to CNY 33.71 million previously. Despite its volatile share price and negative free cash flow in recent quarters, Darbond's robust cash position surpasses its total debt while maintaining high-quality earnings and sufficient interest coverage for financial stability moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Darbond Technology.

Explore historical data to track Darbond Technology's performance over time in our Past section.

Zhejiang Meili High Technology (SZSE:300611)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Meili High Technology Co., Ltd. focuses on the research, development, production, and sale of high-end spring products and precision injection molded parts both in China and internationally, with a market cap of CN¥6.50 billion.

Operations: The company generates revenue primarily through the sale of high-end spring products and precision injection molded parts. It has a market capitalization of CN¥6.50 billion, reflecting its financial stature in the industry.

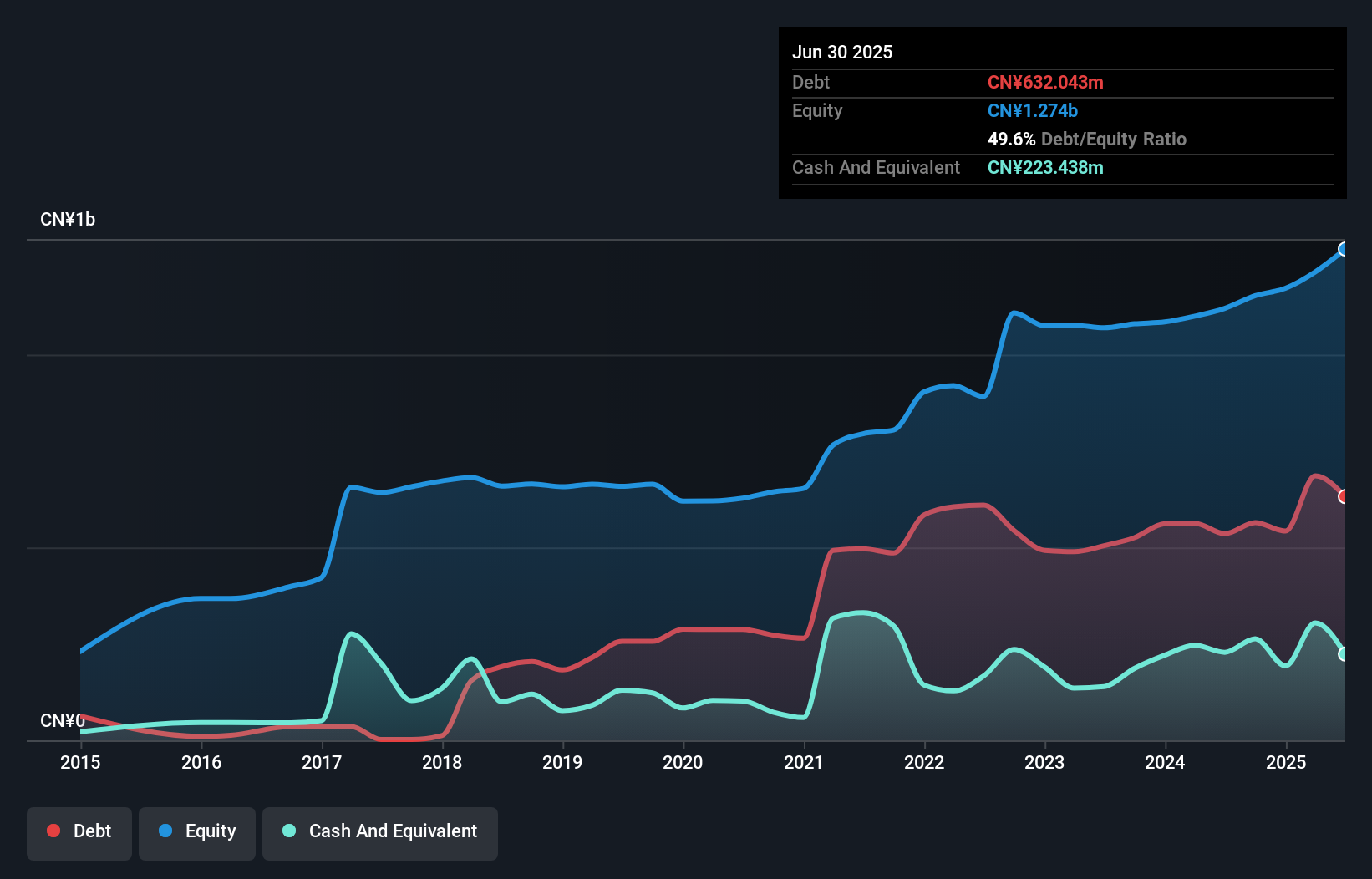

Zhejiang Meili High Technology, a vibrant player in the auto components sector, showcases impressive earnings growth of 105% over the past year, far outpacing the industry's 2.8%. The company trades at an attractive valuation, sitting 64.3% below its estimated fair value. Its net debt to equity ratio stands at a satisfactory 32.1%, indicating prudent financial management. Recent half-year results reveal sales climbing to CNY 889.39 million from CNY 696.42 million last year, with net income reaching CNY 80.4 million up from CNY 46.75 million, while basic earnings per share rose to CNY 0.38 from CNY 0.22 previously reported.

Taking Advantage

- Get an in-depth perspective on all 2369 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan East Lake High Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600133

Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group Co., Ltd.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success