- China

- /

- Auto Components

- /

- SZSE:300580

Wuxi Best Precision Machinery Co., Ltd.'s (SZSE:300580) 26% Jump Shows Its Popularity With Investors

Despite an already strong run, Wuxi Best Precision Machinery Co., Ltd. (SZSE:300580) shares have been powering on, with a gain of 26% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.7% over the last year.

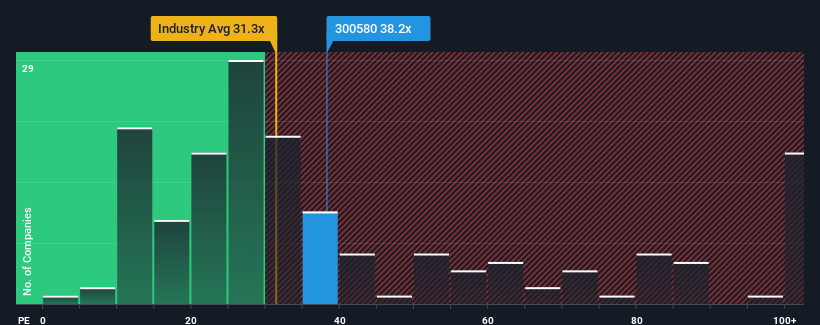

In spite of the firm bounce in price, it's still not a stretch to say that Wuxi Best Precision Machinery's price-to-earnings (or "P/E") ratio of 38.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 35x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Wuxi Best Precision Machinery as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Wuxi Best Precision Machinery

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Wuxi Best Precision Machinery's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 40% over the next year. With the market predicted to deliver 40% growth , the company is positioned for a comparable earnings result.

With this information, we can see why Wuxi Best Precision Machinery is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Wuxi Best Precision Machinery's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Wuxi Best Precision Machinery maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Wuxi Best Precision Machinery you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Best Precision Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300580

Wuxi Best Precision Machinery

Engages in the research, development, production, and sale of precision parts, intelligent equipment, and tooling products in China and internationally.

Flawless balance sheet with high growth potential.