- China

- /

- Auto Components

- /

- SZSE:300507

Jiangsu Olive Sensors High-Tech Co., Ltd.'s (SZSE:300507) Business Is Trailing The Market But Its Shares Aren't

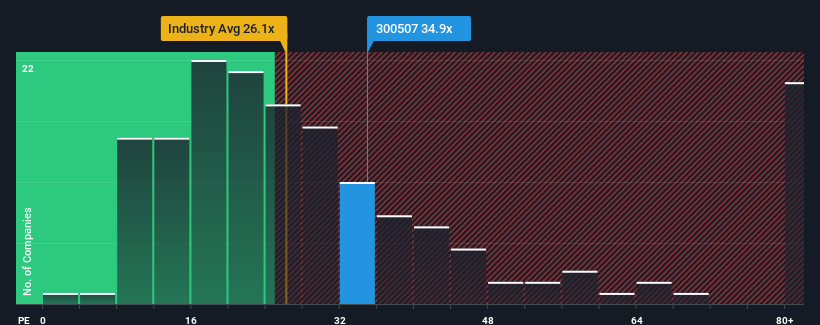

With a price-to-earnings (or "P/E") ratio of 34.9x Jiangsu Olive Sensors High-Tech Co., Ltd. (SZSE:300507) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Jiangsu Olive Sensors High-Tech over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Jiangsu Olive Sensors High-Tech

How Is Jiangsu Olive Sensors High-Tech's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Jiangsu Olive Sensors High-Tech's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 51%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 7.7% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Jiangsu Olive Sensors High-Tech's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jiangsu Olive Sensors High-Tech revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 3 warning signs we've spotted with Jiangsu Olive Sensors High-Tech (including 1 which is potentially serious).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300507

Jiangsu Olive Sensors High-Tech

Jiangsu Olive Sensors High-Tech Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026