- China

- /

- Auto Components

- /

- SZSE:300432

Mianyang Fulin Precision Co.,Ltd.'s (SZSE:300432) Prospects Need A Boost To Lift Shares

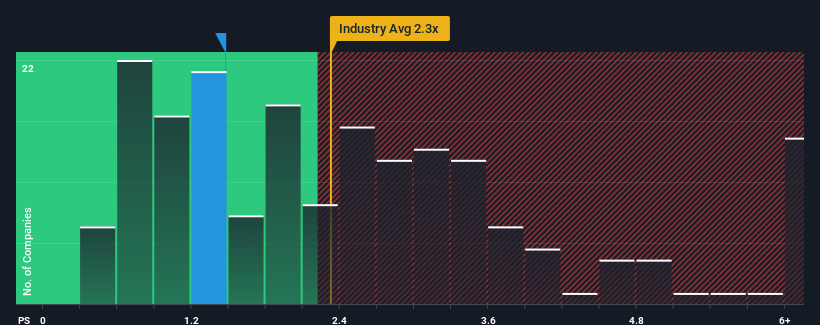

When you see that almost half of the companies in the Auto Components industry in China have price-to-sales ratios (or "P/S") above 2.3x, Mianyang Fulin Precision Co.,Ltd. (SZSE:300432) looks to be giving off some buy signals with its 1.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mianyang Fulin PrecisionLtd

What Does Mianyang Fulin PrecisionLtd's Recent Performance Look Like?

Mianyang Fulin PrecisionLtd's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Mianyang Fulin PrecisionLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Mianyang Fulin PrecisionLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.4% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Mianyang Fulin PrecisionLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Mianyang Fulin PrecisionLtd's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Mianyang Fulin PrecisionLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Mianyang Fulin PrecisionLtd has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives