- China

- /

- Auto Components

- /

- SZSE:002765

Lacklustre Performance Is Driving Landai Technology Group Corp., Ltd.'s (SZSE:002765) 26% Price Drop

Landai Technology Group Corp., Ltd. (SZSE:002765) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 26% in the last year.

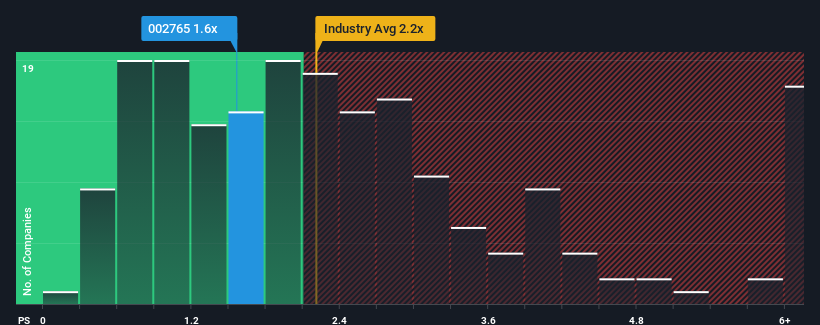

Following the heavy fall in price, when close to half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider Landai Technology Group as an enticing stock to check out with its 1.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Landai Technology Group

What Does Landai Technology Group's Recent Performance Look Like?

Landai Technology Group's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Landai Technology Group will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Landai Technology Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Landai Technology Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. As a result, it also grew revenue by 11% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 24% growth forecast for the broader industry.

In light of this, it's understandable that Landai Technology Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Landai Technology Group's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Landai Technology Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 1 warning sign for Landai Technology Group that you need to take into consideration.

If these risks are making you reconsider your opinion on Landai Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002765

Landai Technology Group

Engages in the research and development, manufacture, and sale of power transmission assemblies, transmission parts, and casting products for the automotive, textile machinery, and general machinery industries in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives