- China

- /

- Auto Components

- /

- SZSE:002715

Huaiji Dengyun Auto-parts (Holding) Co.,Ltd. (SZSE:002715) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Huaiji Dengyun Auto-parts (Holding)Ltd (SZSE:002715) has had a great run on the share market with its stock up by a significant 37% over the last month. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Particularly, we will be paying attention to Huaiji Dengyun Auto-parts (Holding)Ltd's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Huaiji Dengyun Auto-parts (Holding)Ltd

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Huaiji Dengyun Auto-parts (Holding)Ltd is:

6.9% = CN¥29m ÷ CN¥425m (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.07.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Huaiji Dengyun Auto-parts (Holding)Ltd's Earnings Growth And 6.9% ROE

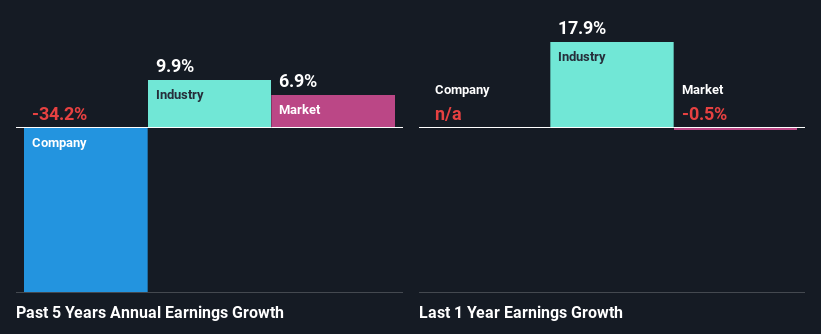

At first glance, Huaiji Dengyun Auto-parts (Holding)Ltd's ROE doesn't look very promising. However, its ROE is similar to the industry average of 8.5%, so we won't completely dismiss the company. But then again, Huaiji Dengyun Auto-parts (Holding)Ltd's five year net income shrunk at a rate of 34%. Bear in mind, the company does have a slightly low ROE. Therefore, the decline in earnings could also be the result of this.

However, when we compared Huaiji Dengyun Auto-parts (Holding)Ltd's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 9.9% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Huaiji Dengyun Auto-parts (Holding)Ltd is trading on a high P/E or a low P/E, relative to its industry.

Is Huaiji Dengyun Auto-parts (Holding)Ltd Efficiently Re-investing Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a regular dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

On the whole, we feel that the performance shown by Huaiji Dengyun Auto-parts (Holding)Ltd can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 1 risk we have identified for Huaiji Dengyun Auto-parts (Holding)Ltd by visiting our risks dashboard for free on our platform here.

Valuation is complex, but we're here to simplify it.

Discover if Huaiji Dengyun Auto-parts (Holding)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002715

Huaiji Dengyun Auto-parts (Holding)Ltd

Huaiji Dengyun Auto-parts (Holding) Co.,Ltd.

Mediocre balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026