- China

- /

- Auto Components

- /

- SZSE:002510

Undiscovered Gems to Explore in November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts. In this environment of uncertainty and opportunity, identifying undiscovered gems requires a keen eye for companies with strong fundamentals that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricating oils, greases, and other derivatives for the automobile and industrial sectors in India with a market cap of ₹58.77 billion.

Operations: Gulf Oil Lubricants generates revenue primarily from its lubricants segment, totaling ₹33.83 billion. The company's net profit margin reflects its profitability dynamics within the competitive lubricant market in India.

Gulf Oil Lubricants India, a notable player in the lubricants sector, showcases strong financial health with more cash than its total debt and a debt-to-equity ratio reduced to 26.7% over five years. The company reported impressive earnings growth of 33% last year, outpacing the Chemicals industry average of 10.4%. Its price-to-earnings ratio stands at 18x, significantly lower than the Indian market's average of 33x, indicating good value. Recent executive changes include appointing Abhijit Kulkarni as Senior Management Personnel to drive strategic growth initiatives further enhancing its prospects in this competitive landscape.

Tianjin Motor DiesLtd (SZSE:002510)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tianjin Motor Dies Co., Ltd. specializes in the research, design, production, and sale of automobile body panel molds and related products both in China and internationally, with a market capitalization of CN¥4.77 billion.

Operations: The company's revenue is primarily derived from the sale of automobile body panel molds and supporting products. It operates both domestically in China and internationally.

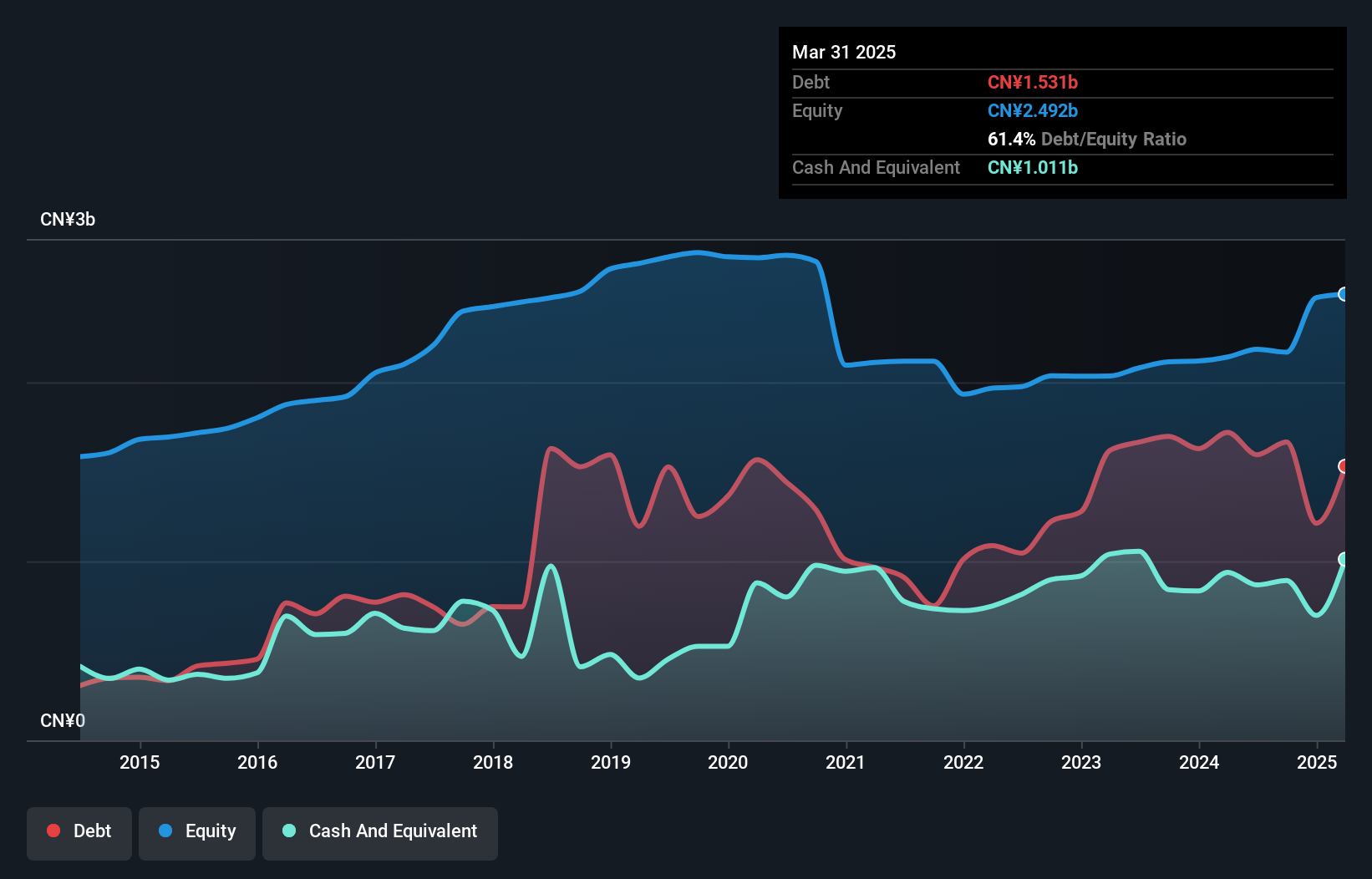

Tianjin Motor Dies, a nimble player in the auto components sector, has shown promising growth with earnings surging 50% over the past year, outpacing industry averages. The company's sales for the nine months ending September 2024 reached CNY 1.92 billion, up from CNY 1.66 billion a year earlier, while net income was CNY 90.4 million compared to CNY 87.77 million previously. Despite an increase in its debt-to-equity ratio from 45.9% to a still satisfactory 76.9%, Tianjin Motor Dies maintains high-quality earnings and comfortably covers its interest obligations, suggesting robust financial health amidst expansion efforts.

- Navigate through the intricacies of Tianjin Motor DiesLtd with our comprehensive health report here.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Value Rating: ★★★★★★

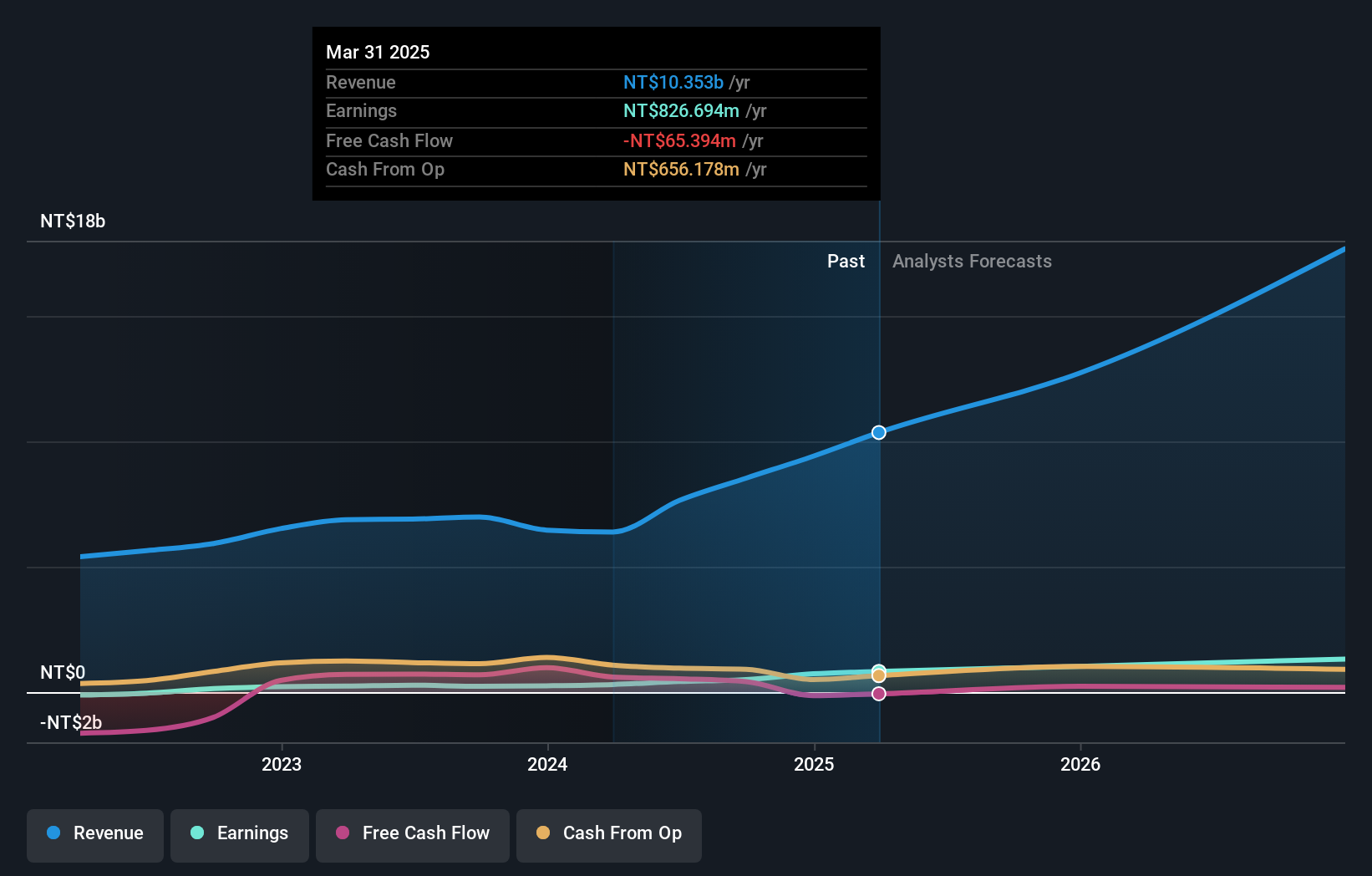

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and globally with a market cap of NT$32.57 billion.

Operations: Chenming Electronic Tech. generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$7.64 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into profitability trends over time.

Chenming Electronic Tech has seen its debt-to-equity ratio improve significantly, dropping from 25.3% to 15.8% over five years, indicating better financial health. Despite recent share price volatility, the company is trading at a substantial discount of 58.7% below its estimated fair value, which might catch the eye of value seekers. Its earnings growth outpaced the tech industry average last year with a robust increase of 52.1%. Although shareholders faced dilution recently, Chenming remains free cash flow positive and holds more cash than total debt, suggesting solid financial footing amidst market fluctuations.

- Click here to discover the nuances of Chenming Electronic Tech with our detailed analytical health report.

Gain insights into Chenming Electronic Tech's past trends and performance with our Past report.

Key Takeaways

- Get an in-depth perspective on all 4731 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Motor DiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002510

Tianjin Motor DiesLtd

Tianjin Motor Dies Co., Ltd. engages in the research and development, design, production, and sale of automobile body panel molds and supporting products in China and internationally.

Mediocre balance sheet unattractive dividend payer.

Market Insights

Community Narratives